ממוצע נע פשוט (SMA)

אינדיקטורים, אסטרטגיות וספריות

Description: The Impulse MACD Buy Indicator, developed by OwlPixel, is a powerful trading tool for traders using TradingView's Pine Script version 5. This indicator aims to provide valuable insights for identifying potential buy signals in the market using the popular MACD (Moving Average Convergence Divergence) oscillator. Key Features: MACD Analysis: The...

Trend Strategy #1 Indicators: 1. SMA 2. Pivot high/low functions derived from SMA 3. Step lines to plot support and resistance based on the pivot points 4. If the close is over the resistance line, green arrows plot above, and vice versa for red arrows below support. Strategy: 1. Long Only 2. Mutable 2% TP/1.5% SL 3. 0.01% commission 4. When the close is...

This puts away multiple moving averages. The moving average line that this draws is calculated from the closing price, but it uses a slightly different method to determine if the moving average line is heard, and if the closing price is between the high and low moving averages, it counts. The ratio of each count is calculated and the rate of change (variance) is...

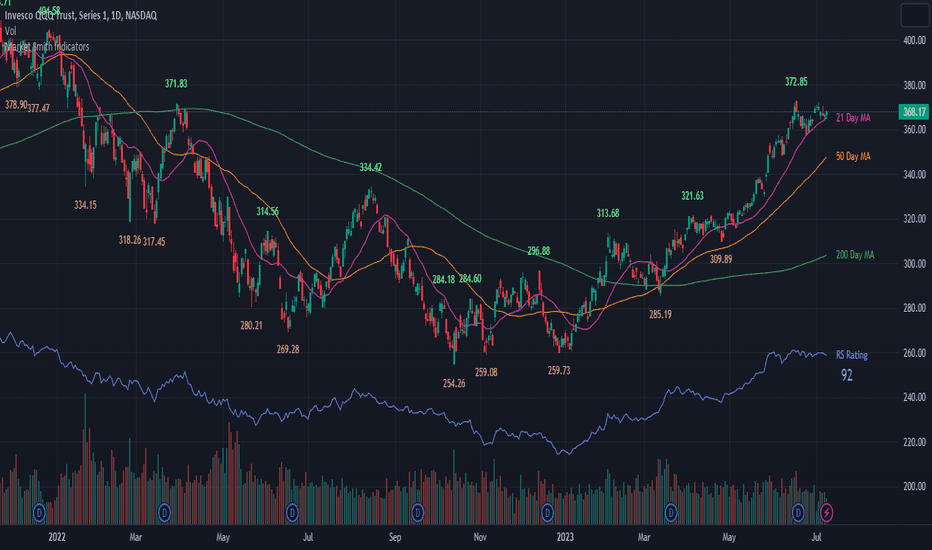

Market Smith has a collection of tools that are useful for identifying stocks. On their charts they have a 21/50/200 day moving averages, high and low pivot points, a relative strength line, and a relative strength rating. This script contains indicators for the following: 21/50/200 Day Moving Averages High and Low pivot points A Relative Strength line A...

The Indicator displays multiple exponential moving averages (EMAs) on the chart. The six available options will let you adjust and set ]exponential moving averages ( EMAS) as per your choice. Additionally I have added an Average ema which will calculate the average of all the emas that you have selected. This average ema works very strong and greatly to find...

Hello I would like to introduce a very simple strategy that uses a combination of 3 simple moving averages ( SMA 4 , SMA 9 , SMA 18 ) this is a classic combination showing the most probable trend directions Crosses were marked on the basis of the color of the candles (bulish cross - blue / bearish cross - maroon) ma 100 was used to determine the main trend,...

REVE Cohorts stands for Range Extensions Volume Expansions Cohorts. Volume is divided in four cohorts, these are depicted in the middle band with colors and histogram spikes. 0-80 percent i.e. low volumes; these get a green color and a narrow histogram bar 80-120 percent, normal volumes, these get a blue color and a narrow histogram bar 120-200 percent, high...

This Indicator is a combination of a standard BB indicator incorporated with a SSL Channel by ErwinBeckers which is Simple Moving average with a length of set at 10 (Default) and calculates the high and low set for the default 10 to form a Channel. The Settings for the Bollinger Band is the standard settings on a normal Bollinger Band - Length 20, source close...

The Pine Script "Planetary Tunings Moving Averages" is a unique tool that plots moving averages (MAs) on a chart, representing the wavelengths of different planets as derived from the book Quadrivium. These wavelengths, also referred to as 'planetary tunings', are related to the orbital resonance of each planet. Each planetary tuning value is first transformed...

The Wyckoff Range Strategy is a trading strategy that aims to identify potential accumulation and distribution phases in the market using the principles of Wyckoff analysis. It also incorporates the detection of spring and upthrust patterns. Here's a step-by-step explanation of how to use this strategy: Understanding Accumulation and Distribution...

The "Inverted Projection" indicator calculates the Simple Moving Average (SMA) and draws lines representing an inverted projection. The indicator swaps the highs and lows of the projection to provide a unique perspective on price movement. This indicator is a simple study that should not be taken seriously as a tool for predicting future price movements; it is...

The Crypto Trend Indicator is a trend-following indicator specifically designed to identify bullish and bearish trends in the price of Bitcoin, and other cryptocurrencies. This indicator doesn't provide explicit instructions on when to buy or sell, but rather offers an understanding of whether the trend is bullish or bearish. It's important to note that this...

This indicator provides dynamic range information to help traders identify when a value moves out of a certain zone. This can be useful in making trading decisions. When the value falls outside of the specified range, it may indicate a good time to enter or exit a trade

This script is a custom trading view indicator that helps to identify potential buy and sell signals based on the RSI (Relative Strength Index) and SMA (Simple Moving Average) indicators. The script also identifies potential reversals using a combination of RSI and price action. It plots buy, sell, and reversal signals on the chart along with an SMA line....

The strategy is designed to trade on the Stochastic RSI indicator crossover signals. Below are all of the trading conditions: -When the Stochastic RSI crosses above 30, a long position is entered. -When the Stochastic RSI crosses below 70, a short position is entered. -The strategy also includes two additional conditions for entry: -Long entries must have a...

The Conceptive Price Moving Average (CPMA) is a technical indicator designed to provide a more accurate moving average of the price by using the average of various price types, such as open, close, high, low, etc. The CPMA can help to smooth out the noise and provide a clearer picture of the overall trend by taking the average of the last 3 candles for each price...

The Simple Moving Average Slope indicator (SMAS) is a technical analysis tool designed to help traders detect the direction and strength of the current trend in the price of an asset. It is also a great tool for identifying sideways markets. The indicator plots the slope of a simple moving average (SMA) of the closing prices over a specified time period. The slope...

This Pine Script indicator is designed to provide traders with a visual representation of trade volume, moving average (MA) angle, and price velocity on a chart. The primary components of this indicator are: Trade Volume: The indicator compares the current bar's trade volume with the average volume over a user-defined lookback period. The volume is displayed as...

![twisted SMA strategy [4h] BTCUSD: twisted SMA strategy [4h]](https://s3.tradingview.com/v/vOPO3zto_mid.png)

![Conceptive Price Moving Average [CSM] BANKNIFTY: Conceptive Price Moving Average [CSM]](https://s3.tradingview.com/y/YUsTSSsF_mid.png)

![Simple Moving Average Slope [AstrideUnicorn] ETHUSDT: Simple Moving Average Slope [AstrideUnicorn]](https://s3.tradingview.com/c/CMitPGXF_mid.png)