אינדיקטורים, אסטרטגיות וספריות

This is daytrade stock strategy, designed to take the best out of the daily gaps that are forming between the close of previous day and opening of present day. At the same time its logic has been adapted for SPY chart, in order to use correlation with the other stocks/assets/ etf which are linked with SP500 movement. Lastly it has been added 2 new confirmation...

Another indicator for you guys!!! This indicator consists of the 5 key Fibonacci retracement levels, plotted automatically to user input settings. I also have included an auto support/resistance trend line generator. What is a Fibonacci retracement? 'Fibonacci retracement is a method of technical analysis for determining support and resistance levels. It is...

docs.cmtassociation.org In Paul F. Desmond's award winning paper in 2002 entitled "Identifying Bear Market Bottoms and New Bull Markets", he proposed an indicator for panic buying and selling that can be used to determine major market bottoms. The paper explains that in major bear markets, you should have at least one, or more than one multiple 90% down days....

MUNICH'S MOMENTUM WAVE VERSION 2 IS LIVE!!! There are a few big things to note with this one. I decided to upload this as an entirely new script due to the number of changes differing from the first version, but as the last one, this will still work on ANY TIMEFRAME, ANY ASSET CLASS, ANY PRICE! . This momentum wave indicator now will give you data for when...

MUNICH'S MOMENTUM WAVE: This momentum tracker has features sampled from Madrid's moving average ribbon but has differentiated many values, parameters, and usage of integers. It is derived using momentum and then creates moving averages and mean lengths to help support the strength of a move in price action, and also has the key mean length that helps determine...

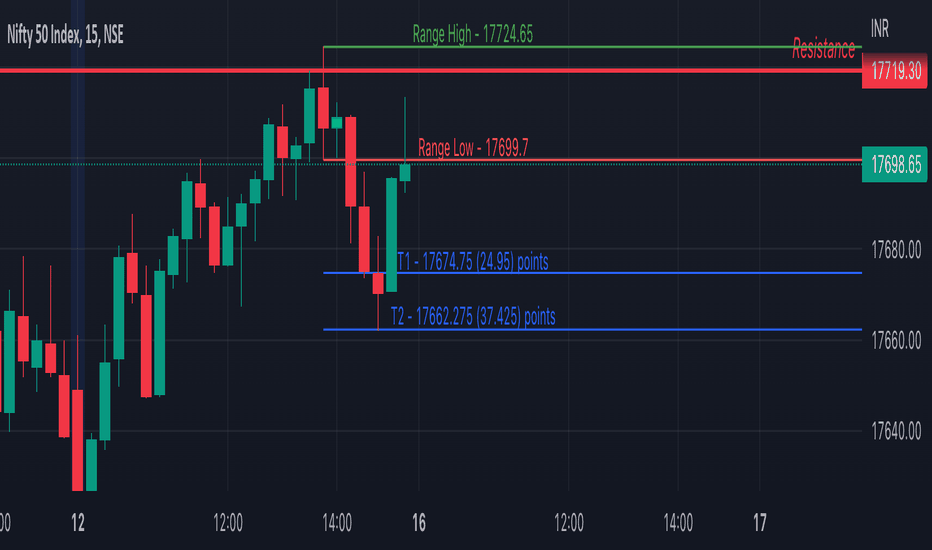

Script Details - This script plots Inside Bar for given day in selected time-frame (applicable only for Timeframes < Day) - Basis plotted inside bar, relevant targets are marked on the chart - Targets can be customised from script settings. Example, if range of mother candle is 10 points, then T1 is 10 * x above/below mother candle and T2 is 10 * y above/below...

This correlation tables idea is nothing new, many sites provides it. However, I couldn't find any simple correlation indicator on TradingView despite how simple this indicator is. This indicator works as its called. Calculating the correlation between 2 projects (can be used in stocks as well) using the 'ta.correlation' feature built into pinescript. When...

this indicator founded from easy combined 1.EMA 2.ATR/Supertrend 3.ADX/DI+DI- 4.MACD 5.Dochian 6.OBV and show by line label and background

This is a long timeframe script designed to benefit from the correlation with the Percentage of stocks Above 200 moving average from SPX At the same time with this percentage we are creating a weighted moving average to smooth its accuracy. The rules are simple : If the moving average is increasing its a long signal/short exit If the moving average is decreased...

The " Price of Volume Weighted Average Price " (PVWAP) indicator calculates the VWAP standard deviation of bar price. Features: 1. Ability to smooth the "Price of Volume Weighted Average Price" line. 2. Ability to choose the anchor period (timeframes). Let me know if you have any questions. Thanks.

This indicator helps monitoring QQE Mod and RMO of 20 tickers simultaneously. This indicator shows last 4/8 indicator results of particular ticker. Left side: 8 last colors of both indicator on current timeframe. Most left is older. Right side: 4 last colors of both indicator on selected higher timeframe. Most right is newer. Icon color is QQE Mod. Background...

This Table shows Quarterly Earning per share & Quarterly revenue of any stock .

>> How to use this indicator : 1. Set your teadingview theme to dark theme. 2. My indicator is valid for forex, stock and but more valid for crypto. 3. Use three timeframe for more validation (choose between those, that fit to your trading style) : - Timeframe 1m, 5m, and 15m for Scalping - Timeframe 30m, 1h and 4h for Intraday - Timeframe 4h, 1D and 1W for...

The Stockbee 4% Breakout script is a study tool for users who wants to do a deep dive on StockBee's 4% Breakout momentum burst method. This script will assist a specific group of traders who trade this method easily find historical momentum bursts. This script finds and colors red any candle body that meets the following criteria: 1. Volume of the candle is...

Fundamentals provide a method to set the financial value of a company, security, or currency. Included in fundamental analysis is basic qualitative and quantitative information that contributes to the asset's financial or economic well-being. Macroeconomic fundamentals include topics that affect an economy at large. Microeconomic fundamentals focus on the...

This is a scalper analysis movement designed around MACD and 200 EMA The rules are simple: For long we check if the close of the candle is above the ema200 and we have a crossover between macd and signal Once this happens we analyse the next candle, if its close higher than open , we can consider it a win and if its close lower than open we consider a lose. For...

Dynamic ADX by The Pine Guru What is the Dynamic ADX? The Dynamic ADX is an indicator created using the regular ADX, Line, and additional ADX Moving Average. This MA allows the script to calculate the ADX differently to the original ADX, providing greater input and accessibility to the user. As the ADX is a volatility indicator, it is communicates to trend...

This is a technical analysis study based on the most fit leading indicators for short timeframes like EMA and SMA. At the same time we have daily channel made from the last 2 weeks of ATR values, which will give us the daily top and bottom expected values(with 80%+ confidence) We have 3 groups of lengths for short length, medium length and a bigger length. At...

![Candle Level of VWAP [By MUQWISHI] QQQ: Candle Level of VWAP [By MUQWISHI]](https://s3.tradingview.com/y/yv3YPDLU_mid.png)

![Dynamic ADX - [The Pine Guru] AUDUSD: Dynamic ADX - [The Pine Guru]](https://s3.tradingview.com/j/JIuUQylr_mid.png)