📊 BANK NIFTY INTRADAY TRADING PLAN – 16-Jul-2025

Based on 15-Min Chart Observation | 200+ Point Gap Considered Significant

📍 IMPORTANT LEVELS TO WATCH

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,164) 📈

📊 SCENARIO 2: FLAT OPENING (Between 56,932 – 57,164) 🔄

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,711) ⚠️

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📌 SUMMARY & CONCLUSION

Based on 15-Min Chart Observation | 200+ Point Gap Considered Significant

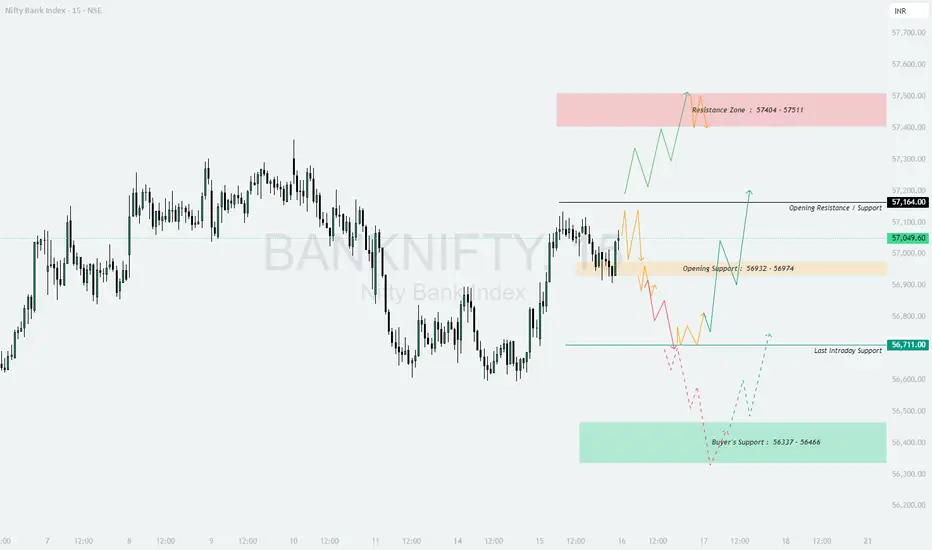

📍 IMPORTANT LEVELS TO WATCH

- []🟥 Resistance Zone: 57,404 – 57,511

[]⚫️ Opening Resistance / Support: 57,164

[]🟧 Opening Support Zone: 56,932 – 56,974

[]🟩 Last Intraday Support: 56,711 - 🟩 Buyer’s Support Zone: 56,337 – 56,466

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,164) 📈

- []If BANK NIFTY opens above 57,164 with a gap of 200+ points, expect a continuation toward the Resistance Zone 57,404 – 57,511.

[]Aggressive buying should only be considered after a 15-min candle close above 57,164 to confirm strength.

[]If prices enter the Resistance Zone, avoid fresh longs and look for profit booking opportunities.

[]Options Tip: Focus on ATM or ITM Call Options. Avoid far OTM options on gap-up days to minimize theta loss.

📊 SCENARIO 2: FLAT OPENING (Between 56,932 – 57,164) 🔄

- []This range is marked as a mixed zone: Opening Resistance / Support Zone. Price behavior here will set the day’s tone.

[]If BANK NIFTY sustains above 57,164, move towards the bullish setup targeting the upper Resistance Zone.

[]If BANK NIFTY breaks below 56,932, expect a decline toward Last Intraday Support 56,711.

[]Options Tip: Consider Straddle or Strangle setups for premium decay if prices stay sideways between 56,932 – 57,164. Exit quickly if volatility spikes.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,711) ⚠️

- []A gap-down below 56,711 signals bearish momentum. Initial downside target would be the Buyer’s Support Zone: 56,337 – 56,466.

[]Wait for the first 15-minute candle close below 56,711 before shorting to confirm strength.

[]If prices bounce from Buyer’s Support Zone, observe for reversal signals and manage trailing stop-loss.

[]Options Tip: Favor ATM or ITM Put Options. On gap-downs, avoid naked far OTM positions—use Bear Put Spreads for balanced risk-reward.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

- []📏 Risk only 1–2% of your trading capital per trade.

[]⏳ Avoid impulsive entries in the first 15–30 minutes of market opening.

[]⚖️ Always mark your Stop-Loss based on candle close, not just price spikes.

[]📈 Choose ATM or ITM options—they offer better Delta and lesser time decay. - 💼 Reduce position size when markets open with large gaps to avoid slippage risks.

📌 SUMMARY & CONCLUSION

- []Bullish Scenario: Above 57,164 → Target 57,404 – 57,511

[]Range-Bound Scenario: Between 56,932 – 57,164 → Watch closely for breakouts

[]Bearish Scenario: Below 56,711 → Target 56,337 – 56,466

[]Stay disciplined and patient. Let the market come to your planned levels instead of chasing moves.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please do your own research or consult a certified financial advisor before making trading decisions.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.