🔎 Overview

____________________________________________________________

🛠 How to Use

____________________________________________________________

📊 Chart Explanation

____________________________________________________________

🔎 Observations & Conclusion

____________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

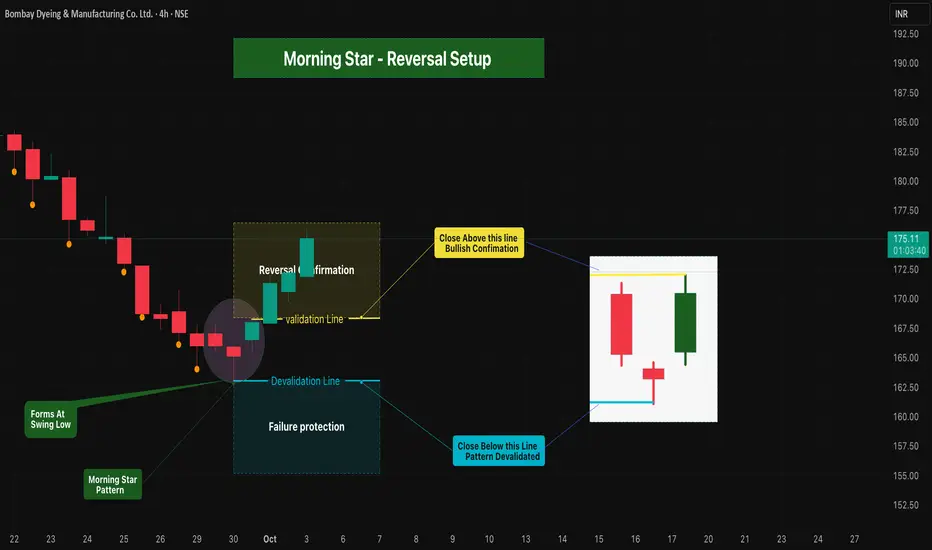

The Morning Star is a three-candle bullish reversal pattern that forms at a swing low after a downtrend.

• 1st Candle → Long bearish red candle (sellers in control).

• 2nd Candle → Small-bodied / Doji candle (indecision).

• 3rd Candle → Strong bullish green candle closing above the midpoint of the 1st red candle (buyers take control).

This structure signals a possible bullish reversal with clear validation & devalidation rule

____________________________________________________________

🛠 How to Use

• Validation Line → High of bullish candle = breakout confirmation level.

• Devalidation Line → Low of Doji candle = failure protection.

• Entry Rule → Candle close above Validation Line = Bullish Confirmation.

• Failure Rule → Candle close below Devalidation Line (before validation) = Pattern invalidated.

• Forms at swing low

• Protects against false signals & ensures structured risk management.

____________________________________________________________

📊 Chart Explanation

• Symbol →BOMDYEING Bombay Dyeing & Manufacturing Co. Ltd.

• Timeframe → 4H

• Pattern Confirmation → Morning Star identified & validated.

• Validation Level → 168.24

• Devalidation Level → 163.00

• On 1 Oct 2025, price closed above validation level, confirming the bullish reversel

____________________________________________________________

🔎 Observations & Conclusion

The Morning Star provides a reliable bullish reversal framework..

With validation & devalidation levels, it filters false signals and enables disciplined risk-reward setups

____________________________________________________________

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.