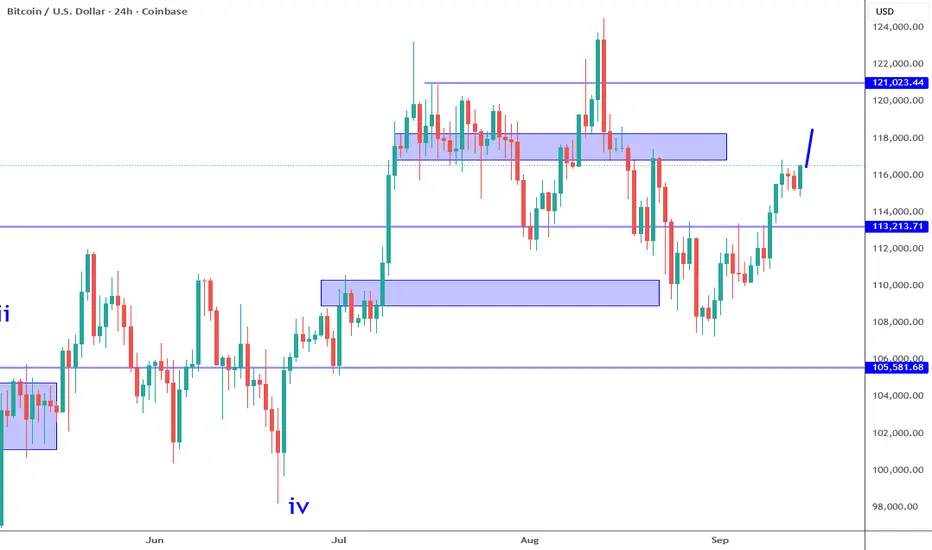

Bitcoin has formed a minor impulse structure and is currently showing a potential wave 4. The fact that it has initially rejected the 116K area resistance, but has barely retraced is a sign of strength. No wave 1, wave 4 overlap lap means a bullish wave 5 is more likely. A 5th wave can see price testing the 118 to 120K area this week. This puts my B wave scenario that I spoke about a week earlier into question which is the nature of subjective wave counts and why it is important to stay flexible.

This week we have the FOMC meeting where the FED is expected to cut interest rates by AT LEAST 25 basis points with an increasing possibility of a greater cut. Keep in mind the 25 point scenario is priced in. If they cut as expected, the focus will be on the press conference and how Powell responds to questions. This is where the market can fluctuate wildly depending on what hints he provides about future rate cuts, etc. Such a catalyst can be substantial enough to push Bitcoin into the 120K area, which will also move the other major markets dramatically as well.

What will invalidate the current bullish setup is a break back below the 113K support. IF this occurs as a result of the upcoming meeting, or any other reason, it will strengthen my B wave argument that I made the week earlier. So at this time, swing trade longs make sense, just be prepared for a dramatic change. IF for whatever reason price tests the 123Ks or higher, that will point to a potential run to the 130KS because it will confirm the current formation is still part of a broader wave 4. Yes it can be confusing, and when it is, focus more on the market structure itself.

Thank you for considering my analysis and perspective.

This week we have the FOMC meeting where the FED is expected to cut interest rates by AT LEAST 25 basis points with an increasing possibility of a greater cut. Keep in mind the 25 point scenario is priced in. If they cut as expected, the focus will be on the press conference and how Powell responds to questions. This is where the market can fluctuate wildly depending on what hints he provides about future rate cuts, etc. Such a catalyst can be substantial enough to push Bitcoin into the 120K area, which will also move the other major markets dramatically as well.

What will invalidate the current bullish setup is a break back below the 113K support. IF this occurs as a result of the upcoming meeting, or any other reason, it will strengthen my B wave argument that I made the week earlier. So at this time, swing trade longs make sense, just be prepared for a dramatic change. IF for whatever reason price tests the 123Ks or higher, that will point to a potential run to the 130KS because it will confirm the current formation is still part of a broader wave 4. Yes it can be confusing, and when it is, focus more on the market structure itself.

Thank you for considering my analysis and perspective.

I hosted ICTC 2025: whitebit.com/m/ICTC-2025

Try Trade Scanner Pro for FREE: bit.ly/TSCPRO

LIVE Day Trades: youtube.com/@marcpmarkets.signals

Watch Full Trade Scanner Pro Tutorial: youtu.be/fdFLhLnqM9A

Try Trade Scanner Pro for FREE: bit.ly/TSCPRO

LIVE Day Trades: youtube.com/@marcpmarkets.signals

Watch Full Trade Scanner Pro Tutorial: youtu.be/fdFLhLnqM9A

פרסומים קשורים

כתב ויתור

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

I hosted ICTC 2025: whitebit.com/m/ICTC-2025

Try Trade Scanner Pro for FREE: bit.ly/TSCPRO

LIVE Day Trades: youtube.com/@marcpmarkets.signals

Watch Full Trade Scanner Pro Tutorial: youtu.be/fdFLhLnqM9A

Try Trade Scanner Pro for FREE: bit.ly/TSCPRO

LIVE Day Trades: youtube.com/@marcpmarkets.signals

Watch Full Trade Scanner Pro Tutorial: youtu.be/fdFLhLnqM9A

פרסומים קשורים

כתב ויתור

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.