TL;DR:

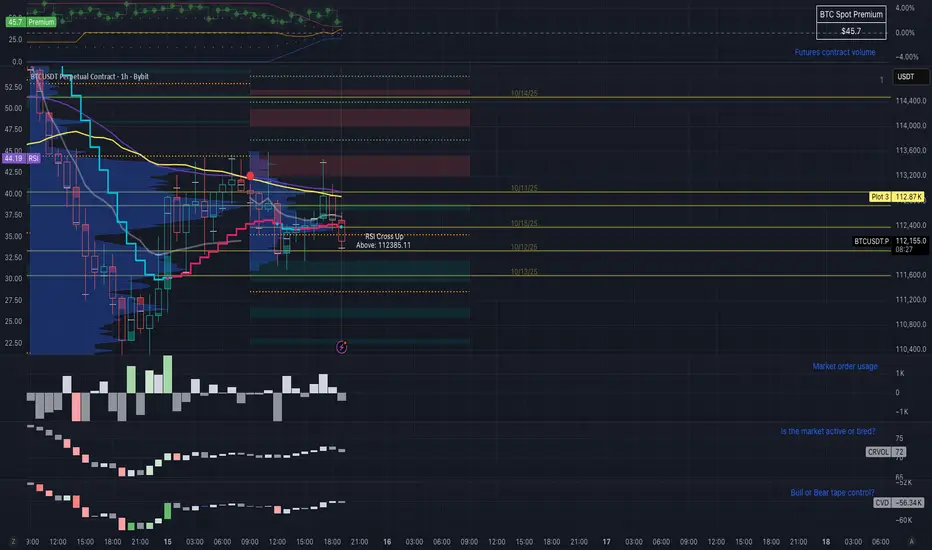

Bear HVN rejection, momentum rollover, C-leg targets 111 k–110 k.

Short bias intact while under 113.5 k.

⸻

🩻 Market Logic

This is a C-leg continuation play within a corrective structure, trading momentum + order-flow confluence:

• CVD down + CRVOL flat = liquidity fade.

• RSI breakdown = momentum confirmation.

• HVN rejection = structural trigger.

If 113.6 k gets reclaimed on strong volume → thesis invalidated; above that, next play is the L-BOR toward 116 k – 122 k.

After the liquidation flush and retrace, BTC printed a textbook A–B–C corrective structure inside the larger wave-5 on hourly charts.

The B-wave retraced ~0.93 of the prior drop — deep enough to trap late longs but shallow enough to preserve bearish symmetry.

🧠 Technical Context

• 1H HVN: 113.1k zone acting as supply shelf.

• RSI (10m): rolled under 50 → momentum shift confirmed.

• CVD: still negative (~–55k) — buyers not reclaiming control.

• CRVOL: >1.1× → active but fading = exhaustion, not expansion.

• Fib projections (C-wave):

• 1.0 × target → 111.55k

• 1.618 × extension → 110.38k

⚙️ Execution Plan

• Short Entry: 112.9 k – 113.2 k (bear HVN underside)

• Stop: 113.6 k (above 1 h wick)

• Targets:

• TP1 = 111.55 k

• TP2 = 110.38 k

• TP3 = 109.8 k (full C-leg completion)

• Bias: Bearish until hourly close > 113.48 k

Bear HVN rejection, momentum rollover, C-leg targets 111 k–110 k.

Short bias intact while under 113.5 k.

⸻

🩻 Market Logic

This is a C-leg continuation play within a corrective structure, trading momentum + order-flow confluence:

• CVD down + CRVOL flat = liquidity fade.

• RSI breakdown = momentum confirmation.

• HVN rejection = structural trigger.

If 113.6 k gets reclaimed on strong volume → thesis invalidated; above that, next play is the L-BOR toward 116 k – 122 k.

After the liquidation flush and retrace, BTC printed a textbook A–B–C corrective structure inside the larger wave-5 on hourly charts.

The B-wave retraced ~0.93 of the prior drop — deep enough to trap late longs but shallow enough to preserve bearish symmetry.

🧠 Technical Context

• 1H HVN: 113.1k zone acting as supply shelf.

• RSI (10m): rolled under 50 → momentum shift confirmed.

• CVD: still negative (~–55k) — buyers not reclaiming control.

• CRVOL: >1.1× → active but fading = exhaustion, not expansion.

• Fib projections (C-wave):

• 1.0 × target → 111.55k

• 1.618 × extension → 110.38k

⚙️ Execution Plan

• Short Entry: 112.9 k – 113.2 k (bear HVN underside)

• Stop: 113.6 k (above 1 h wick)

• Targets:

• TP1 = 111.55 k

• TP2 = 110.38 k

• TP3 = 109.8 k (full C-leg completion)

• Bias: Bearish until hourly close > 113.48 k

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.