The correction in the crypto market continues, and it's now starting in the US stock market.

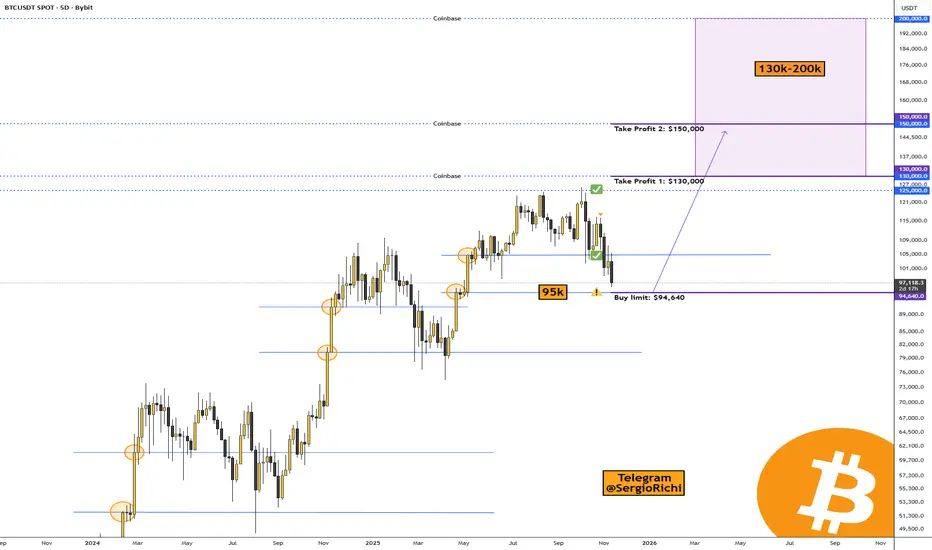

Bitcoin is nearing an important level on the 5-day timeframe—specifically $94,640.

That's where market makers and big players have placed limit buy orders, and I think we'll see some major trader liquidations there too. For those who trade Bitcoin exclusively, I've marked a buy level.

• Buy limit: $94,640.

• Take Profit 1: $130,000

• Take Profit 2: $150,000

The range for wrapping up Bitcoin's cycle is pretty wide, since there are large orders set up there for taking profits. It's tough to pinpoint exactly where the price peak will be—we can only go by the data we can see.

• Coinbase: $130,000, $150,000, and possibly $200,000.

• Binance: $130,000, $150,000, and likewise, it's unlikely but possible to climb to $200,000.

Based on Elliott waves, we're finishing the 5th upward wave, and I figure the peak will hit in 2026, followed by a straight drop.

Indicator for Bitcoin miners:

The cycle indicator on Bitcoin shows the peak hasn't been reached yet:

Samuel Benner's Cycle and the 2026 Peak

The "200-year farmer chart," often referred to as Samuel Benner's Cycle Chart, is a historical economic forecasting tool created in 1875 by Ohio farmer and self-taught economist Samuel Benner.

It's credited with a "90% success rate" in broad sentiment prediction, and modern applications extend to stocks, crypto, and even solar cycles correlating with recessions.

It's best used as a sentiment gauge, not a precise timer.

Implications for 2026

The chart marks 2026 as a "B" year—a cycle peak in "Good Times," signaling high prices and a time to sell before transitioning to panic and hard times from 2026-2032.

This suggests a potential bull run peak, followed by downturn risks amid global debt, inflation, and geopolitics. As of late 2025, we're in a growth phase approaching this apex, per the model's extensions.

Dear friends, it looks like 2026 will mark the end of the growth cycle for Bitcoin and altcoins, so we'll need to find exit points, bail out of the crypto market, stock up on supplies for 3-5 years, and get busy building bunkers 😀🔥.

הערה

The Crypto Fear and Greed Index is at an extreme fear level of 11.Chats and the X platform are buzzing with panic over Bitcoin's drop.

• The last time we saw numbers this low was February 26, 2025.

These are the times when the ideal entry point into Bitcoin takes shape—right when tons of folks are waiting for it to sink even lower or straight-up declaring that the bear market has kicked off and it's time to bail.

With Bitcoin, it's straightforward: now's the prime time to jump in.

But what about altcoins?

• I dug through the data on Coinbase and Binance and spotted that market makers and big players have set limit orders down below—some at -10%, others at -30% from current prices.

• This could mean Bitcoin's about to rally, its dominance will climb too, and they'll basically suck liquidity out of altcoins, pouring it right back into Bitcoin 😀🔥.

הערה

🚨 BREAKINGThe sentiment on Bitcoin is way too bearish right now.

Bitwise put together some intriguing stats on the average Bitcoin returns after the fear level drops below 20 points. After:

➖ 1 week: +5.2%

➖ 2 weeks: +9.3%

➖ 1 month: +19.9%

➖ 2 months: +44.2%

➖ 3 months: +62.4%

➖ 6 months: +48.5%

Today, the reading is at 9 points, which means we're in the final phase of Bitcoin's correction, and we could see a god candle in the near future.

הערה

As of November 19, 2025, there are massive buy orders queued up on Coinbase and Binance at $85,000 and $80,000.

Looks like we're gearing up for one last corrective dip across the crypto market and the S&P 500 index.

➖ The Crypto Fear & Greed Index is currently sitting at 16 points.

Snapshots:

הערה

🪙 Hey everyone.

Targets hit on Bitcoin, and I bet the panic level is through the roof.

➖ Even my brother—who couldn't care less about crypto—texted me saying Bitcoin's down to $80,000, what's going on? 😀🔥

➖ That's like an extra confirmation that the bottom might be in, or damn close to it.

The correction targets from the last update got nailed at • $80,000 and • $85,000.

If you're a Bitcoin-only trader, now's the time to think about adding it to your portfolio.

• Next stop: $96,000, where we'll see $10 billion in short liquidations.

• Medium-to-long term, we're eyeing $125,000 to $150,000; honestly, $200k still feels like a stretch right now—better to cash out at 125k-150k and then hunt for gains on altcoins as liquidity shifts over from Bitcoin.

Charts:

👉 If you sign up on a crypto exchange through my link, I'll kick back up to 50% of the trading commissions from your activity every week—pure win-win.

Trade US stocks (100x Leverage) ✅️

utex.io/?campaignId=FRIEND770205213

Binance

accounts.binance.com/register?ref=SERGIORICHI

Bybit

partner.bybit.com/b/sergiorichi

BingX

bingx.com/partner/sergiorichi/3wfPhC

utex.io/?campaignId=FRIEND770205213

Binance

accounts.binance.com/register?ref=SERGIORICHI

Bybit

partner.bybit.com/b/sergiorichi

BingX

bingx.com/partner/sergiorichi/3wfPhC

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

Trade US stocks (100x Leverage) ✅️

utex.io/?campaignId=FRIEND770205213

Binance

accounts.binance.com/register?ref=SERGIORICHI

Bybit

partner.bybit.com/b/sergiorichi

BingX

bingx.com/partner/sergiorichi/3wfPhC

utex.io/?campaignId=FRIEND770205213

Binance

accounts.binance.com/register?ref=SERGIORICHI

Bybit

partner.bybit.com/b/sergiorichi

BingX

bingx.com/partner/sergiorichi/3wfPhC

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.