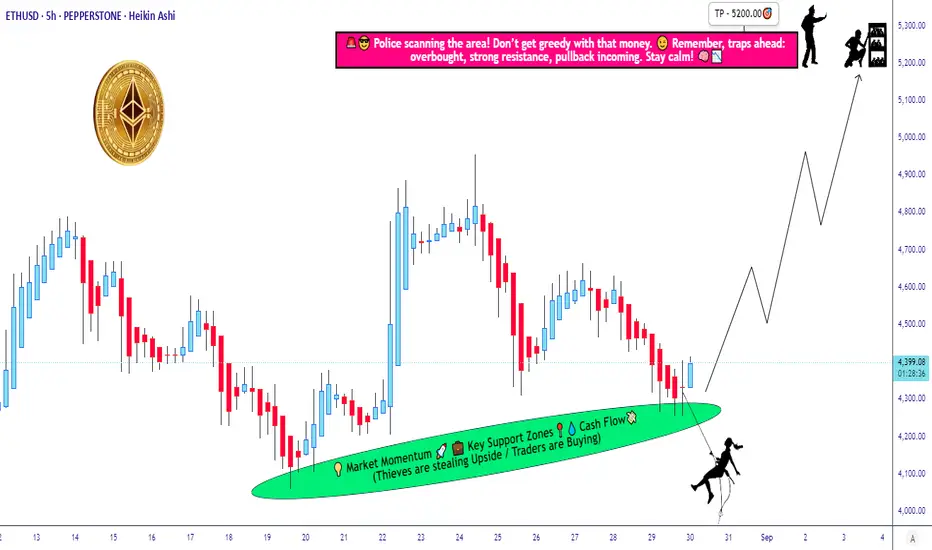

🔓💰 ETH/USD "Ethereum vs. Dollar" Money Heist Plan 💰🔓

🎯 Plan: Bullish Robbery | Swing/Day Trade

💎 Layered Entries | Precision Loot | Multi-Bag Grab

🚀 Target: 5200.00 | 🛑 Stop Loss: 4060.00

🚨👀 Attention Traders, Crypto Bandits & Market Looters! 👀🚨

The Ethereum vault is wide open – and Thief Trader is here with the LAYERED ENTRY STRATEGY. Stack those buy limits like gold bars in a secret vault. 🏦💎

💥 ENTRY: Any Price is a Good Price 💥

Thief style means we don’t chase – we LAYER.

⚔️ Multiple limit entries:

4400.00

4300.00

4200.00

(Add more layers if you’re savage enough.)

Every dip is a robbery opportunity – we’re not here to beg, we’re here to loot.

🔐 STOP LOSS: 4060.00 🔐

This is Thief’s SL Zone – where the cops show up.

OG Thieves know: adjust your SL to your own heist plan & risk appetite.

💸 TARGET: 5200.00 💸

That’s the police barricade – take the cash and escape before the sirens.

Secure the bag, don’t get greedy.

🧠 Thief Trader Secrets:

📊 Layered entries = survival + sniper precision.

⚡ Swing traders ride it, day traders loot it, investors just chill & count.

🔔 Trail your SL – don’t let profits get hijacked.

⚠️ HEIST PROTOCOL:

✅ No panic entries.

✅ Risk small, layer smart.

✅ Remember: patience = payday.

❤️🔥 Smash that 💥 BOOST BUTTON 💥 if you’re rolling with the Thief Squad.

Follow for the next Market Heist Plan – we rob, we layer, we escape with bags full. 💼💰

“Markets pay the disciplined thieves, not the desperate gamblers.” – Thief Trader

🤑📈🐂 #ETHUSD #CryptoHeist #ThiefTrader #EthereumHeist #LayeredEntries #CryptoTrading #RobTheMarket #MoneyHeistETH

🎯 Plan: Bullish Robbery | Swing/Day Trade

💎 Layered Entries | Precision Loot | Multi-Bag Grab

🚀 Target: 5200.00 | 🛑 Stop Loss: 4060.00

🚨👀 Attention Traders, Crypto Bandits & Market Looters! 👀🚨

The Ethereum vault is wide open – and Thief Trader is here with the LAYERED ENTRY STRATEGY. Stack those buy limits like gold bars in a secret vault. 🏦💎

💥 ENTRY: Any Price is a Good Price 💥

Thief style means we don’t chase – we LAYER.

⚔️ Multiple limit entries:

4400.00

4300.00

4200.00

(Add more layers if you’re savage enough.)

Every dip is a robbery opportunity – we’re not here to beg, we’re here to loot.

🔐 STOP LOSS: 4060.00 🔐

This is Thief’s SL Zone – where the cops show up.

OG Thieves know: adjust your SL to your own heist plan & risk appetite.

💸 TARGET: 5200.00 💸

That’s the police barricade – take the cash and escape before the sirens.

Secure the bag, don’t get greedy.

🧠 Thief Trader Secrets:

📊 Layered entries = survival + sniper precision.

⚡ Swing traders ride it, day traders loot it, investors just chill & count.

🔔 Trail your SL – don’t let profits get hijacked.

⚠️ HEIST PROTOCOL:

✅ No panic entries.

✅ Risk small, layer smart.

✅ Remember: patience = payday.

❤️🔥 Smash that 💥 BOOST BUTTON 💥 if you’re rolling with the Thief Squad.

Follow for the next Market Heist Plan – we rob, we layer, we escape with bags full. 💼💰

“Markets pay the disciplined thieves, not the desperate gamblers.” – Thief Trader

🤑📈🐂 #ETHUSD #CryptoHeist #ThiefTrader #EthereumHeist #LayeredEntries #CryptoTrading #RobTheMarket #MoneyHeistETH

עסקה פעילה

הערה

💰 Price Snapshot24-Hour Change: +0.18% 📈

24-Hour Trading Volume: $25.95B 💸

Market Cap: $536.11B 🏦

📊 Trader Sentiment Outlook

Retail Traders:

55% Bullish 🐂

25% Bearish 🐻

20% Neutral 😐

Institutional Traders:

60% Bullish 🐂

20% Bearish 🐻

20% Neutral 😐

😨 Fear & Greed Index

Score: 48 (Neutral) ⚖️

Scale: 0 (Extreme Fear) 😱 → 100 (Extreme Greed) 😍

Current Mood: Balanced, no extreme emotions driving the market.

🌟 Fundamental Score

Score: 82/100 ✅

Key Drivers:

🚀 Strong DeFi adoption

📥 Spot ETH ETF inflows

🔧 Ongoing network upgrades (e.g., Pectra)

📊 High staking participation

🌍 Macro Score

Score: 75/100 🌤️

Key Factors:

✅ Positive crypto regulatory sentiment

💧 Global liquidity growth

💵 Stable USD environment

🏦 Surge in institutional interest

📡 Overall Market Outlook

Bullish 🐂

Short-Term⏳

Moderate upward momentum.

Long-Term ⏳

Strong bullish trend 🌊

Driven by ETF demand and network scalability improvements.

📝 Key Takeaways

ETH holding strong above $4,400 with steady trading volume. 💪

Traders lean bullish, especially institutions, but no overheated greed.

Fundamentals remain robust thanks to DeFi and ETF inflows. 📥

Macro environment supportive with growing institutional adoption. 🌍

Bullish outlook dominates, but watch resistance near $5,000. 🚨

💡 Quick Tip

👉 Monitor ETF flows and USD strength for short-term price moves! ⚡

הערה

🚀 ETH/USD Market Snapshot - September 14, 2025Current Price: $4,661.77 USD 📊

(Slight dip of 0.14% today, but holding strong near recent highs)

😊 Investor Mood Breakdown

Retail Traders Sentiment: Bullish 69% 🟢

(Everyday investors are optimistic, driven by network growth and ETF buzz)

Institutional Traders Sentiment: Strongly Bullish 🏦

(Big players like funds are piling in with major buys and staking, showing long-term confidence)

📈 Fear & Greed Index

Score: 57 (Greed) 😎

(Market feels positive but not overheated – a good sign for steady climbs)

🔍 Fundamental & Macro Scores

Fundamental Score: 85/100 🟢

(Solid network upgrades, high DeFi activity, and growing adoption boost Ethereum's core strength)

Macro Score: 78/100 📈

(Supportive global liquidity and regulatory wins outweigh short-term economic jitters)

🎯 Overall Market Outlook

Bull (Long) 🚀

(Upward momentum looks set to continue with institutional inflows and tech improvements leading the way)

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.