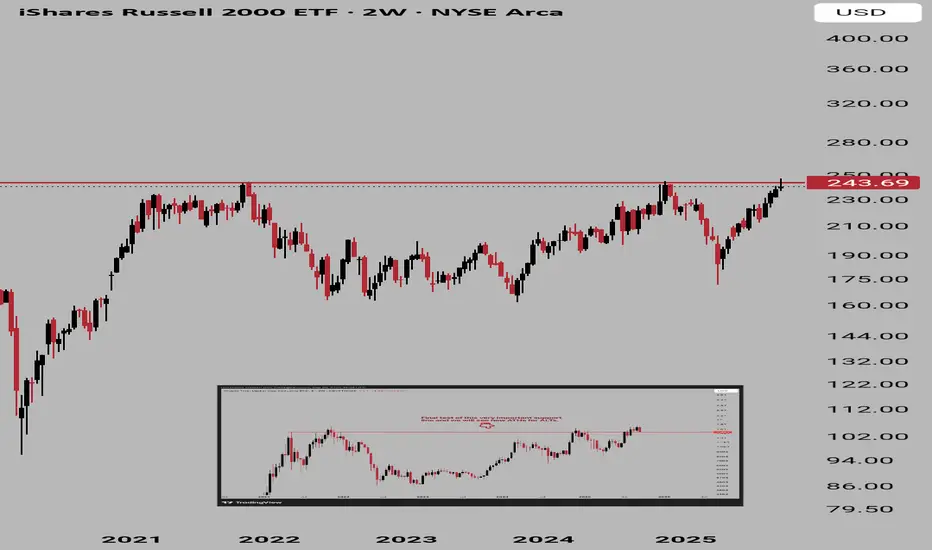

Risk-on vs risk-off assets → Both small-cap stocks (IWM) and altcoins (TOTAL2) are considered high-beta, speculative assets. They respond more aggressively to shifts in liquidity, interest rates, and risk appetite.

Liquidity sensitivity → When liquidity is abundant, both IWM and TOTAL2 rally harder than their large-cap counterparts (S&P 500 / Bitcoin). When liquidity tightens, they sell off harder too.

Market breadth / speculative phase → IWM is a gauge of U.S. market breadth (how smaller companies are doing), while TOTAL2 reflects risk-taking beyond Bitcoin. Both act as “speculative barometers.”

Macro correlation → In tightening cycles (higher rates, strong dollar), both tend to lag. In easing/liquidity cycles, they outperform and move almost in lockstep.

Liquidity sensitivity → When liquidity is abundant, both IWM and TOTAL2 rally harder than their large-cap counterparts (S&P 500 / Bitcoin). When liquidity tightens, they sell off harder too.

Market breadth / speculative phase → IWM is a gauge of U.S. market breadth (how smaller companies are doing), while TOTAL2 reflects risk-taking beyond Bitcoin. Both act as “speculative barometers.”

Macro correlation → In tightening cycles (higher rates, strong dollar), both tend to lag. In easing/liquidity cycles, they outperform and move almost in lockstep.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.