Chart Pattern Identification:

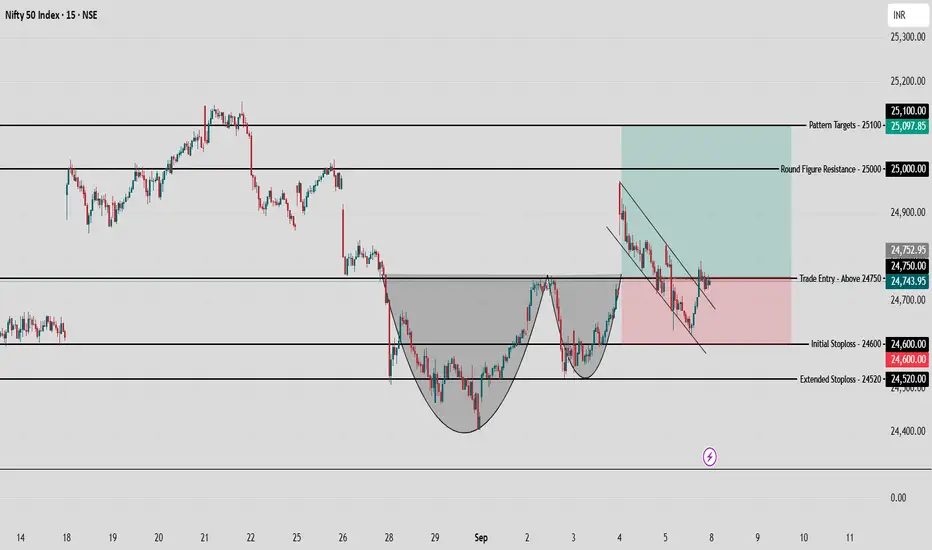

The chart illustrates a Cup & Handle pattern validated on the 15-minute Nifty 50 Index.

Pattern Validation: Pattern forms when price carves a rounded cup, retraces slightly to form the handle, and then breaks out above the neckline (24,750 zone here).

Pattern Invalidation: The setup fails if price closes and sustains below the handle low (around 24,600), indicating loss of bullish momentum and potential reversal.

Pattern Formation Conditions: Most reliable when occurring after a downtrend or consolidation, signaling accumulation and renewed bullish sentiment.

Significance: Indicates a shift from seller exhaustion to buyer strength, often leading to measured up-moves upon breakout.

How to Trade This Pattern

Entry: Take long positions only after a confirmed breakout and close above 24,750 (neckline). Avoid premature entries inside the handle.

Exit:

Initial Target: Watch for resistance near the psychological round figure of 25,000, where some profit booking and volatility are likely.

Ultimate Target: Projected pattern target is 25,100 as per the height of the cup extrapolated from breakout.

Stoploss:

Initial Stop: 24,600 (below handle low).

Extended Stop: 24,520 for extra volatility margin.

Risk-Reward: Entry at 24,750, Stop-loss at 24,600, Target at 25,100 gives a risk-reward ratio better than 1:2.5. For a strict 1:3 R:R setup, look for partial profit booking at 25,150–25,200.

Round Figure Psychology: Be vigilant as 25,000 is a major round number; expect increased order flow, resistance, and possible profit taking at this level.

Disclaimers

This content is for educational purposes only and reflects one approach to technical analysis. All trading carries risk. Backtest strategies, and never risk more than you can afford to lose. Individual results may vary; review market conditions and use appropriate position sizing.

👉 For more actionable setups and in-depth trading education, follow me!

The chart illustrates a Cup & Handle pattern validated on the 15-minute Nifty 50 Index.

Pattern Validation: Pattern forms when price carves a rounded cup, retraces slightly to form the handle, and then breaks out above the neckline (24,750 zone here).

Pattern Invalidation: The setup fails if price closes and sustains below the handle low (around 24,600), indicating loss of bullish momentum and potential reversal.

Pattern Formation Conditions: Most reliable when occurring after a downtrend or consolidation, signaling accumulation and renewed bullish sentiment.

Significance: Indicates a shift from seller exhaustion to buyer strength, often leading to measured up-moves upon breakout.

How to Trade This Pattern

Entry: Take long positions only after a confirmed breakout and close above 24,750 (neckline). Avoid premature entries inside the handle.

Exit:

Initial Target: Watch for resistance near the psychological round figure of 25,000, where some profit booking and volatility are likely.

Ultimate Target: Projected pattern target is 25,100 as per the height of the cup extrapolated from breakout.

Stoploss:

Initial Stop: 24,600 (below handle low).

Extended Stop: 24,520 for extra volatility margin.

Risk-Reward: Entry at 24,750, Stop-loss at 24,600, Target at 25,100 gives a risk-reward ratio better than 1:2.5. For a strict 1:3 R:R setup, look for partial profit booking at 25,150–25,200.

Round Figure Psychology: Be vigilant as 25,000 is a major round number; expect increased order flow, resistance, and possible profit taking at this level.

Disclaimers

This content is for educational purposes only and reflects one approach to technical analysis. All trading carries risk. Backtest strategies, and never risk more than you can afford to lose. Individual results may vary; review market conditions and use appropriate position sizing.

👉 For more actionable setups and in-depth trading education, follow me!

Years of disciplined charting in Indices, Commodities & Crypto.

Join Free Telegrams →for updates.

| NSE & MCX: t.me/ChartPathik

| US & Crypto: t.me/chartpathikglobal

| WhatsApp: +91-99293-91467

Join Free Telegrams →for updates.

| NSE & MCX: t.me/ChartPathik

| US & Crypto: t.me/chartpathikglobal

| WhatsApp: +91-99293-91467

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

Years of disciplined charting in Indices, Commodities & Crypto.

Join Free Telegrams →for updates.

| NSE & MCX: t.me/ChartPathik

| US & Crypto: t.me/chartpathikglobal

| WhatsApp: +91-99293-91467

Join Free Telegrams →for updates.

| NSE & MCX: t.me/ChartPathik

| US & Crypto: t.me/chartpathikglobal

| WhatsApp: +91-99293-91467

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.