The Nifty 50 closed the week on a positive note, rising nearly 1%, supported by strong macro cues and sectoral gains.

RBI Policy Boost:

The Reserve Bank of India kept the repo rate unchanged at 5.50% for the second straight meeting while raising FY26 GDP growth to 6.8% and lowering the inflation forecast — a move that lifted overall market sentiment.

Sector Highlights:

Banking stocks led the rally, with Bank Nifty up over 2% as private lenders like Kotak Mahindra Bank and Axis Bank posted solid gains.

Metals also shined, with Nifty Metal up 1.85%, driven by optimism over potential Fed rate cuts and a weaker dollar.

Key Levels to Watch:

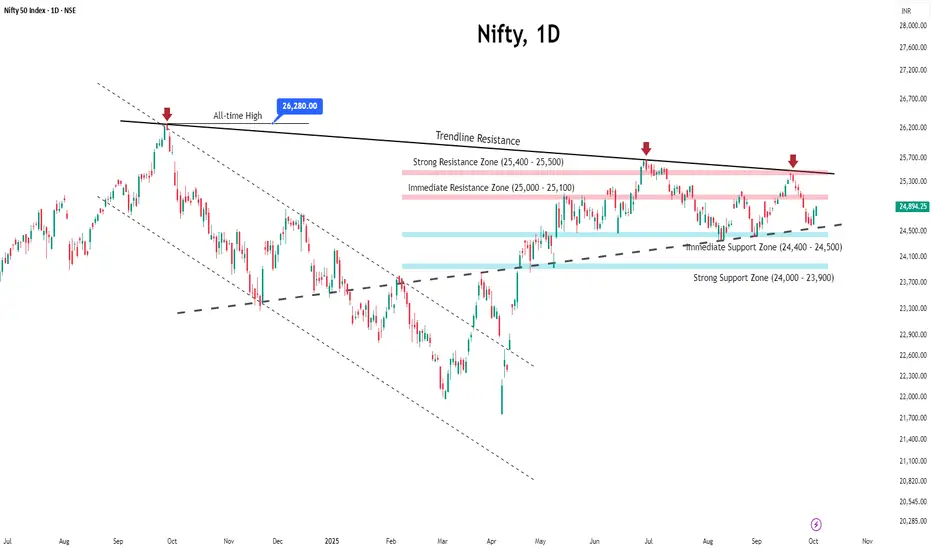

Resistance: 25,000–25,100 remains a tough barrier. A breakout above 25,100 could spark a rally toward 25,400.

Support: 24,400–24,500 is the key zone to hold. A dip below this may trigger renewed selling pressure

Outlook:

The market is expected to consolidate within the current range, with sector rotation likely to drive short-term moves. Overall sentiment remains constructive as long as Nifty holds above key support levels.

RBI Policy Boost:

The Reserve Bank of India kept the repo rate unchanged at 5.50% for the second straight meeting while raising FY26 GDP growth to 6.8% and lowering the inflation forecast — a move that lifted overall market sentiment.

Sector Highlights:

Banking stocks led the rally, with Bank Nifty up over 2% as private lenders like Kotak Mahindra Bank and Axis Bank posted solid gains.

Metals also shined, with Nifty Metal up 1.85%, driven by optimism over potential Fed rate cuts and a weaker dollar.

Key Levels to Watch:

Resistance: 25,000–25,100 remains a tough barrier. A breakout above 25,100 could spark a rally toward 25,400.

Support: 24,400–24,500 is the key zone to hold. A dip below this may trigger renewed selling pressure

Outlook:

The market is expected to consolidate within the current range, with sector rotation likely to drive short-term moves. Overall sentiment remains constructive as long as Nifty holds above key support levels.

🌐 goodluckcapital.com

🎖️ SEBI registered INH300006582

🎖️ CMT(usa) & CFTe(usa) chartered

🎖️ NSE certified professionals

📈 Trading and Investment Advice

t.me/GoodluckCapital

🤝 Contact Us

bio.link/GoodluckCapital

🎖️ SEBI registered INH300006582

🎖️ CMT(usa) & CFTe(usa) chartered

🎖️ NSE certified professionals

📈 Trading and Investment Advice

t.me/GoodluckCapital

🤝 Contact Us

bio.link/GoodluckCapital

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

🌐 goodluckcapital.com

🎖️ SEBI registered INH300006582

🎖️ CMT(usa) & CFTe(usa) chartered

🎖️ NSE certified professionals

📈 Trading and Investment Advice

t.me/GoodluckCapital

🤝 Contact Us

bio.link/GoodluckCapital

🎖️ SEBI registered INH300006582

🎖️ CMT(usa) & CFTe(usa) chartered

🎖️ NSE certified professionals

📈 Trading and Investment Advice

t.me/GoodluckCapital

🤝 Contact Us

bio.link/GoodluckCapital

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.