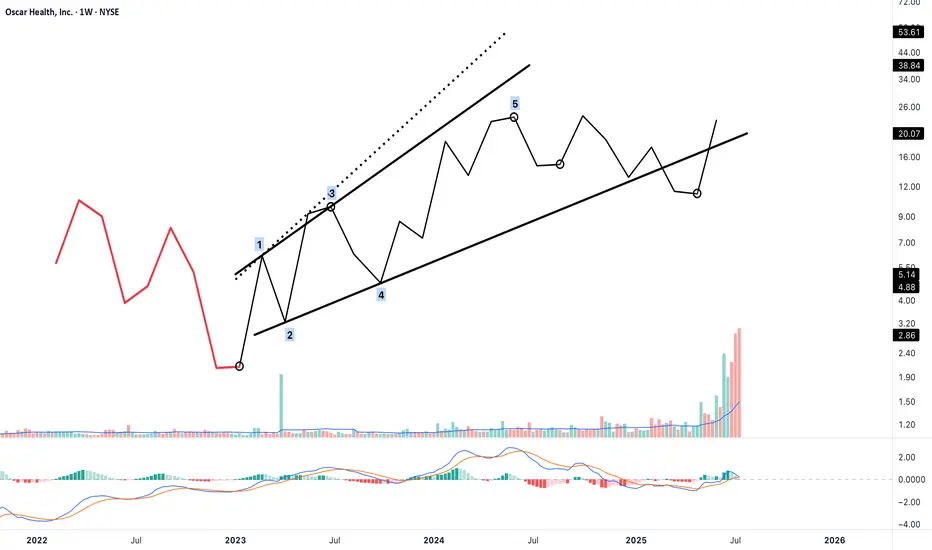

This chart presents a potential 5-wave terminal impulse structure — most likely a 5-extension terminal, where waves 1, 3, and 5 display impulsive character.

This move may represent the beginning of a new sequence — either as:

"Wave 1 of a larger motive structure"

"or Wave A of a corrective formation"

🔹 The wave is segmented using 12-bar intervals on a weekly chart.

🔹 Wave 3 and Wave 5 both meet the price extension and structural criteria of Neely’s Rule 4.

🔹 The final wave (5) reaches just above 141.4% of Wave 3, consistent with a 5-extension terminal.

🔹 Channel boundaries and post-terminal retracement suggest a completed structure.

According to NeoWave guidelines, the structure meets both:

Impulsive appearance, and

Overlap conditions required for a terminal.

The current focus shifts to analysing the post-terminal movement to determine whether it is part of a:

"2nd wave correction (if terminal was Wave 1)"

"or B wave retracement (if terminal was Wave A)"

🔍 Further bar-by-bar and structural analysis will be applied to this segment next, likely starting from m10 and beyond.

This move may represent the beginning of a new sequence — either as:

"Wave 1 of a larger motive structure"

"or Wave A of a corrective formation"

🔹 The wave is segmented using 12-bar intervals on a weekly chart.

🔹 Wave 3 and Wave 5 both meet the price extension and structural criteria of Neely’s Rule 4.

🔹 The final wave (5) reaches just above 141.4% of Wave 3, consistent with a 5-extension terminal.

🔹 Channel boundaries and post-terminal retracement suggest a completed structure.

According to NeoWave guidelines, the structure meets both:

Impulsive appearance, and

Overlap conditions required for a terminal.

The current focus shifts to analysing the post-terminal movement to determine whether it is part of a:

"2nd wave correction (if terminal was Wave 1)"

"or B wave retracement (if terminal was Wave A)"

🔍 Further bar-by-bar and structural analysis will be applied to this segment next, likely starting from m10 and beyond.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.