1. Market Structure Overview

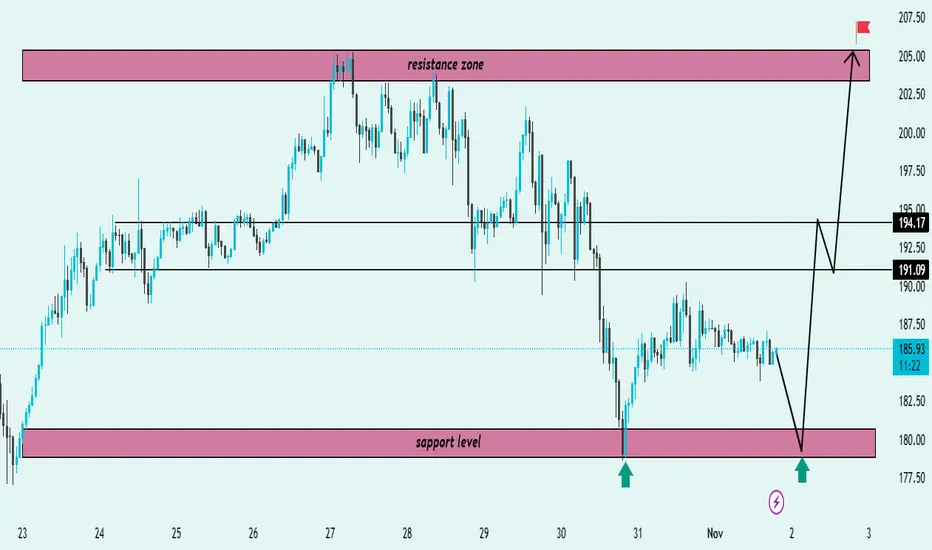

The chart shows Solana (SOL/USDT) trading within a well-defined range between a support level (~$179–$182) and a resistance zone (~$203–$207).

The price has recently tested the support zone multiple times (marked by green arrows), confirming its strength as a key demand area.

2. Key Technical Levels

Support Level: $179–$182 → Major demand zone where price has bounced twice.

Resistance Zone: $203–$207 → Supply area where previous rallies have reversed.

Mid-level Zones:

$191.09: Intermediate resistance (potential short-term reaction point).

$194.17: Secondary resistance before the upper target zone.

3. Price Action Insight

Price is currently consolidating around $185, showing indecision after a prior drop.

The black projection arrows suggest a potential liquidity sweep of the support zone before a bullish reversal.

Expected structure:

A final dip toward $180 to retest support.

A bullish reaction leading to a higher low formation.

A break above $191–$194, confirming bullish continuation.

A final push toward the resistance zone ($205) — the main target.

4. Trade Bias

Bias: Bullish from support

Confirmation Needed: Strong bullish candle or breakout from $191 resistance.

Invalidation: Daily close below $178 support.

5. Target Projection

Primary Target: $194

Final Target: $205 (resistance zone / flagged target)

Summary:

SOL/USDT is showing a potential bullish reversal setup from the $180 support zone. If price confirms strength with a bounce and breaks above $191–$194, the next rally could target the $205 resistance zone. A breakdown below $178 would invalidate the bullish scenario.

The chart shows Solana (SOL/USDT) trading within a well-defined range between a support level (~$179–$182) and a resistance zone (~$203–$207).

The price has recently tested the support zone multiple times (marked by green arrows), confirming its strength as a key demand area.

2. Key Technical Levels

Support Level: $179–$182 → Major demand zone where price has bounced twice.

Resistance Zone: $203–$207 → Supply area where previous rallies have reversed.

Mid-level Zones:

$191.09: Intermediate resistance (potential short-term reaction point).

$194.17: Secondary resistance before the upper target zone.

3. Price Action Insight

Price is currently consolidating around $185, showing indecision after a prior drop.

The black projection arrows suggest a potential liquidity sweep of the support zone before a bullish reversal.

Expected structure:

A final dip toward $180 to retest support.

A bullish reaction leading to a higher low formation.

A break above $191–$194, confirming bullish continuation.

A final push toward the resistance zone ($205) — the main target.

4. Trade Bias

Bias: Bullish from support

Confirmation Needed: Strong bullish candle or breakout from $191 resistance.

Invalidation: Daily close below $178 support.

5. Target Projection

Primary Target: $194

Final Target: $205 (resistance zone / flagged target)

Summary:

SOL/USDT is showing a potential bullish reversal setup from the $180 support zone. If price confirms strength with a bounce and breaks above $191–$194, the next rally could target the $205 resistance zone. A breakdown below $178 would invalidate the bullish scenario.

עסקה פעילה

JOIN MY TELEGRAM CHANNEL LINK 👇🏻

t.me/Classicallegendschool

t.me/Classicallegendschool

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

JOIN MY TELEGRAM CHANNEL LINK 👇🏻

t.me/Classicallegendschool

t.me/Classicallegendschool

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.