TVS ELECTRONICS – Wave C Completion Zone Hit | Wave 5 Rally Setup Loading?

🧠 Market Structure & Wave Breakdown

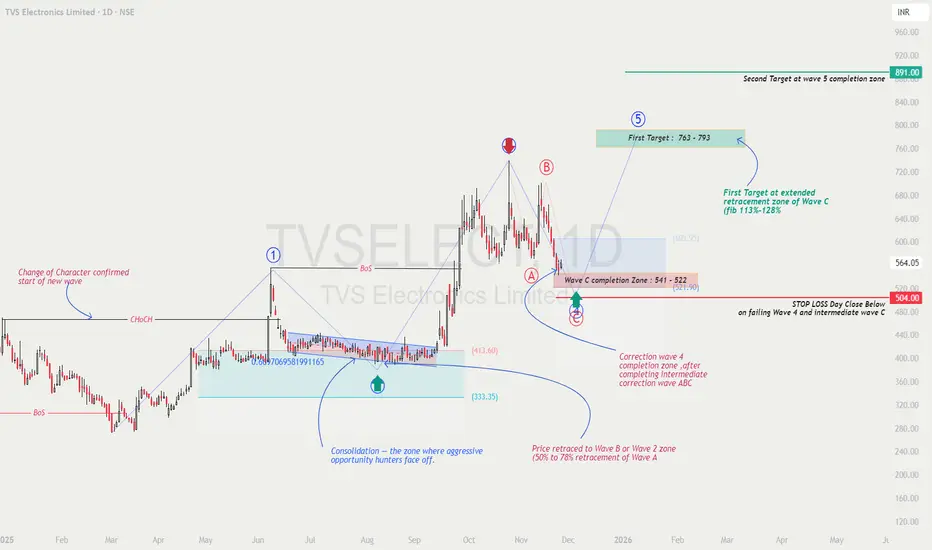

TVS Electronics is forming a textbook Elliott Wave structure.

After a powerful impulsive Wave 1, the price has completed a clean A–B–C corrective phase, and is now sitting inside the crucial Wave C completion zone (₹541–₹522) 🔥.

This zone aligns with:

50–78% retracement of Wave A (typical Wave B/2 retracement)

Demand + structure support from previous consolidation

Market psychology reset after an overextended Wave B

This is where the early reversal of Wave 5 typically begins 📈.

📚 Educational Insights

🎯 Prediction & Targets

If the price reverses from the ₹541–₹522 support and breaks structure upward:

🎯 First Target (Wave 5 Mid-Zone): ₹763 – ₹793

🎯 Second Target (Wave 5 Completion): ₹891

A break above ₹605.95 (previous micro-structure high) will confirm the bullish wave activation.

🛑 Stop Loss (Closing Basis): Below ₹504

This level invalidates the Wave 4 / Wave C completion structure.

💡 Trading Strategy (Educational Purpose Only)

🧩 Summary & Outlook

TVS Electronics has now entered the Wave C completion zone, a high-probability demand and reversal area.

If buyers step in here and structure flips bullish, a Wave 5 rally toward ₹763 → ₹891 could unfold.

This setup aligns perfectly with Elliott Wave principles, Fibonacci confluence, and structural demand. ⚡

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational purposes only — not financial advice.

🧠 Market Structure & Wave Breakdown

TVS Electronics is forming a textbook Elliott Wave structure.

After a powerful impulsive Wave 1, the price has completed a clean A–B–C corrective phase, and is now sitting inside the crucial Wave C completion zone (₹541–₹522) 🔥.

This zone aligns with:

50–78% retracement of Wave A (typical Wave B/2 retracement)

Demand + structure support from previous consolidation

Market psychology reset after an overextended Wave B

This is where the early reversal of Wave 5 typically begins 📈.

📚 Educational Insights

- 🔄 ChoCH – Change of Character:

The earlier breakout confirmed a structural shift, marking the start of the new Elliott Wave cycle.

When ChoCH appears again near lows, it often signals the end of corrections. - 📉 A–B–C Corrections Explained:

Price forms Wave A (sharp drop) → Wave B (retracement) → Wave C (final flush).

Wave C often completes at deeper zones like the 113–128% extension, which aligns with this chart. - 🌀 Wave C Completion Zone (541–522):

This zone marks exhaustion of sellers and transition to accumulation, especially when aligned with fibs AND structural support. - 🚀 Wave 5 Expectations:

Wave 5 is usually driven by renewed momentum, volume expansion, and trend continuation.

Targets come from fib extensions of Wave 4.

🎯 Prediction & Targets

If the price reverses from the ₹541–₹522 support and breaks structure upward:

🎯 First Target (Wave 5 Mid-Zone): ₹763 – ₹793

🎯 Second Target (Wave 5 Completion): ₹891

A break above ₹605.95 (previous micro-structure high) will confirm the bullish wave activation.

🛑 Stop Loss (Closing Basis): Below ₹504

This level invalidates the Wave 4 / Wave C completion structure.

💡 Trading Strategy (Educational Purpose Only)

- 🟢 Entry Zone: ₹541–₹522

Look for bullish reversal patterns → Hammer, Engulfing, Double Bottom, or ChoCH. - 📈 Confirmation Entry:

Break above ₹605.95 + retest → safer Wave 5 trend-following entry. - 🎯 Profit Booking:

• Partial at ₹763–₹793

• Final around ₹891 - ⚖️ Risk Management:

• Use SL below ₹504 (daily close).

• Risk max 1–2% of capital.

• Don’t chase candles — wait for clean structure break.

🧩 Summary & Outlook

TVS Electronics has now entered the Wave C completion zone, a high-probability demand and reversal area.

If buyers step in here and structure flips bullish, a Wave 5 rally toward ₹763 → ₹891 could unfold.

This setup aligns perfectly with Elliott Wave principles, Fibonacci confluence, and structural demand. ⚡

⚠️ Disclaimer

I am not a SEBI-registered analyst.

This analysis is for educational purposes only — not financial advice.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.