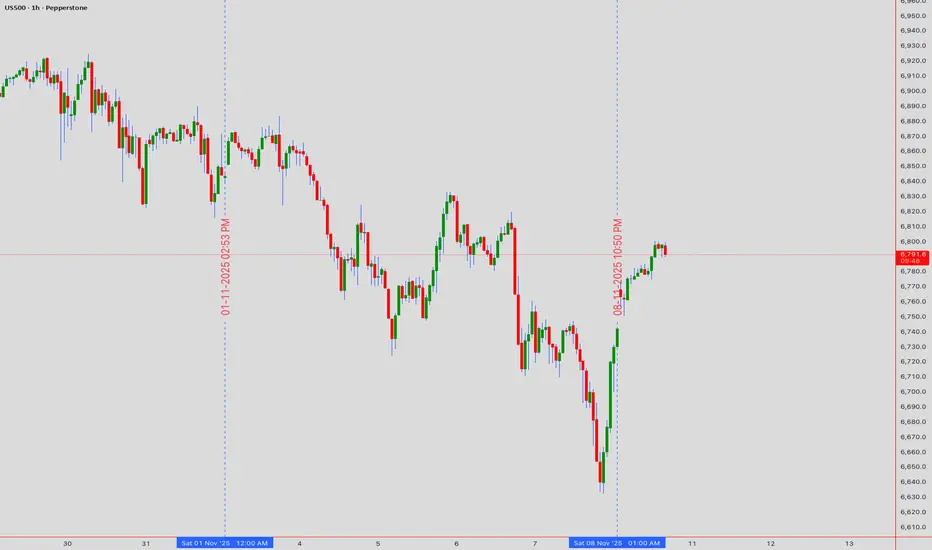

📊 US500 Intraday Technical Analysis - 10 Nov 2025

S&P 500 at 6,792 (4:45 PM UTC+4) — Major breakout setup with confluence

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 MARKET STRUCTURE

🔸 Wyckoff Phase D re-accumulation; Dow Theory primary uptrend intact

🔸 Gann Square-of-9 targets: 6,950 (resistance) / 6,650 (support)

🔸 Elliott Wave (3) extension in progress toward 6,950-7,050

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 TIMEFRAME MATRIX

Daily (1D): Rising channel 6,700-6,900; RSI 62 (bullish); Ichimoku cloud support 6,550

4H: Broadening wedge 6,750-6,900; EMA21>EMA50>EMA200 (golden cross); VWAP 6,680

1H: Cup-and-handle pattern; BB expanding; VWAP slope bullish

30M: Symmetrical triangle 6,780-6,850; hidden bull divergence on RSI; volume contracting

15M: Bull flag above 6,790; Tenkan>Kijun bullish; stochastic reset ready

5M: Falling wedge retest 6,800; hammer shows demand; watch false breakout

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 PRIMARY LONG (HIGH PROBABILITY)

⚡ MOMENTUM SCALP

Add above 6,950 ONLY if RSI >65 + volume surge; trail stop 6,920

🔻 REVERSAL SHORT

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🚨 BREAKOUT ALERTS

✅ BULL: 1H close >6,950 confirms breakout → target 7,150; move SL to BE+25

✅ BEAR: 1H close <6,780 with volume → retest 6,650 cloud support

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 INDICATOR SNAPSHOT

BB Squeeze (30M) expanding | MACD histogram positive | VWAP slope up | EMA21 = trigger line | Hidden bull divergence confirmed on RSI

⚠️ PATTERN RECOGNITION

Harmonic Bat PRZ: 7,050 | Rising Wedge failure <6,790 = Wyckoff spring | H&S risk if 6,700 breaks | Bull trap risk above 6,950 without volume

📈 TIMING & VOLATILITY

Gann 90° window 21:00 UTC (US close) | ATR(14) ≈100 pts | Earnings whispers elevate risk | Risk ≤1% per setup; lock TP1; avoid chasing sub-avg volume

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

S&P 500 at 6,792 (4:45 PM UTC+4) — Major breakout setup with confluence

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🔍 MARKET STRUCTURE

🔸 Wyckoff Phase D re-accumulation; Dow Theory primary uptrend intact

🔸 Gann Square-of-9 targets: 6,950 (resistance) / 6,650 (support)

🔸 Elliott Wave (3) extension in progress toward 6,950-7,050

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📈 TIMEFRAME MATRIX

Daily (1D): Rising channel 6,700-6,900; RSI 62 (bullish); Ichimoku cloud support 6,550

4H: Broadening wedge 6,750-6,900; EMA21>EMA50>EMA200 (golden cross); VWAP 6,680

1H: Cup-and-handle pattern; BB expanding; VWAP slope bullish

30M: Symmetrical triangle 6,780-6,850; hidden bull divergence on RSI; volume contracting

15M: Bull flag above 6,790; Tenkan>Kijun bullish; stochastic reset ready

5M: Falling wedge retest 6,800; hammer shows demand; watch false breakout

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 PRIMARY LONG (HIGH PROBABILITY)

- Entry: 6,790-6,820 (flag support + VWAP confluence)

- SL: 6,750 (below triangle base)

- TP1: 6,880 (+90 pips)

- TP2: 6,950 (+160 pips — channel resistance)

- TP3: 7,050 (+260 pips — harmonic extension)

- Confirmation: RSI >55, volume +20%, VWAP holding

⚡ MOMENTUM SCALP

Add above 6,950 ONLY if RSI >65 + volume surge; trail stop 6,920

🔻 REVERSAL SHORT

- Entry: 6,950-7,000 (supply resistance)

- SL: 7,050 (above wedge)

- Targets: 6,900 → 6,820 → 6,750 (Gann support)

- Trigger: Bearish engulfing + RSI divergence on 5M/15M

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🚨 BREAKOUT ALERTS

✅ BULL: 1H close >6,950 confirms breakout → target 7,150; move SL to BE+25

✅ BEAR: 1H close <6,780 with volume → retest 6,650 cloud support

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 INDICATOR SNAPSHOT

BB Squeeze (30M) expanding | MACD histogram positive | VWAP slope up | EMA21 = trigger line | Hidden bull divergence confirmed on RSI

⚠️ PATTERN RECOGNITION

Harmonic Bat PRZ: 7,050 | Rising Wedge failure <6,790 = Wyckoff spring | H&S risk if 6,700 breaks | Bull trap risk above 6,950 without volume

📈 TIMING & VOLATILITY

Gann 90° window 21:00 UTC (US close) | ATR(14) ≈100 pts | Earnings whispers elevate risk | Risk ≤1% per setup; lock TP1; avoid chasing sub-avg volume

Educational analysis only. Follow your plan, manage risk, adapt to live price action.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

I am nothing @shunya.trade

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

I am nothing @shunya.trade

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.