🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

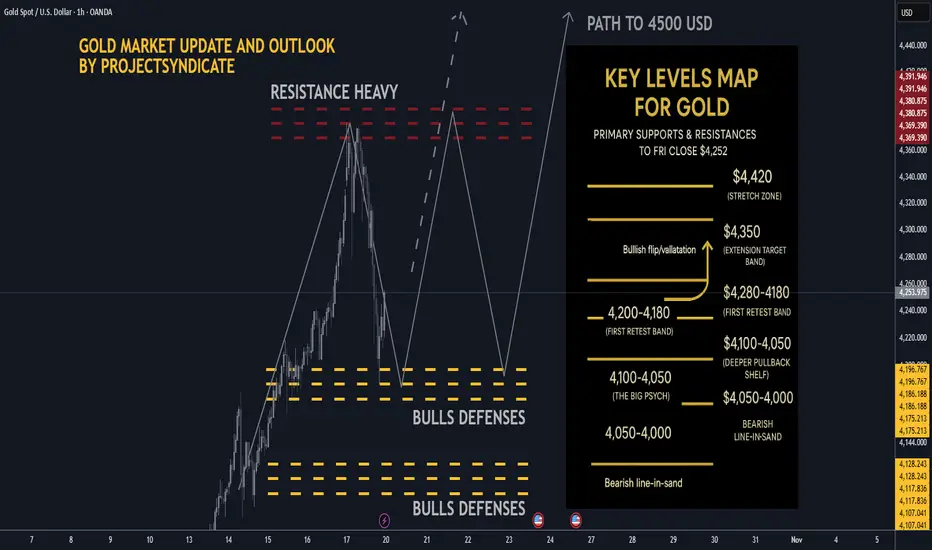

🏆 High/Close: $4,379 → ~$4,252 — higher close vs. last week’s pullback finish.

📈 Trend: Uptrend intact > $4,000; dip buyers continue to control rhythm.

🛡 Supports: $4,180–$4,140 → $4,100–$4,050 → $4,000 must hold.

🚧 Resistances: $4,260 / $4,300 / $4,350 → stretch $4,380–$4,420.

🧭 Bias next week: Buy-the-dip > $4,140–$4,200; momentum regain targets $4,300–$4,380+. Invalidation < $4,050 → risk $4,000/3,980.

🌍 Macro tailwinds:

• Fed: Markets lean to another cut into Oct 28–29; softer real yields buoy gold.

• FX: DXY under pressure = constructive backdrop.

• Flows: ETF interest & CB buying remain supportive on dips.

• Geopolitics: Tariff/trade and regional risks keep safe-haven bids live.

🎯 Street view: Several houses float $5,000/oz by 2026 scenarios on easing policy & reserve diversification narratives

________________________________________

🔝 Key Resistance Zones

• $4,260–$4,280 near-ATH supply / immediate ceiling from close

• $4,300–$4,350 extension target band

• $4,380–$4,420 stretch zone toward prior spike high and measured extensions

🛡 Support Zones

• $4,220–$4,200 first retest band just below close

• $4,180–$4,140

• $4,100–$4,050 deeper pullback shelf; $4,000 remains the big psych

________________________________________

⚖️ Base Case Scenario

Expect shallow pullbacks into $4,220–$4,140 to be bought, followed by rotation back into the $4,260–$4,300 resistance stack for an ATH retest.

🚀 Breakout Trigger

A sustained push/acceptance > ~$4,280 unlocks $4,300 → $4,350, with room toward $4,380–$4,420 if momentum persists.

💡 Market Drivers

• Fed cut expectations into late Oct(lower real yields = gold tailwind

• USD softness / DXY sub-100 tone supports metals

• Ongoing central-bank bullion demand; ETF inflows stabilizing

• Geopolitics & trade/tariff headlines keeping safety bids active

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,140–$4,200

• Bearish below: $4,100–$4,050 risk expands under $4,000

🧭 Strategy

Accumulate dips above $4,140–$4,200.

On breakout > $4,280, target $4,300–$4,350+. Maintain tight risk under stepped supports; invalidate momentum below $4,050–$4,000.

________________________________________

🏆 High/Close: $4,379 → ~$4,252 — higher close vs. last week’s pullback finish.

📈 Trend: Uptrend intact > $4,000; dip buyers continue to control rhythm.

🛡 Supports: $4,180–$4,140 → $4,100–$4,050 → $4,000 must hold.

🚧 Resistances: $4,260 / $4,300 / $4,350 → stretch $4,380–$4,420.

🧭 Bias next week: Buy-the-dip > $4,140–$4,200; momentum regain targets $4,300–$4,380+. Invalidation < $4,050 → risk $4,000/3,980.

🌍 Macro tailwinds:

• Fed: Markets lean to another cut into Oct 28–29; softer real yields buoy gold.

• FX: DXY under pressure = constructive backdrop.

• Flows: ETF interest & CB buying remain supportive on dips.

• Geopolitics: Tariff/trade and regional risks keep safe-haven bids live.

🎯 Street view: Several houses float $5,000/oz by 2026 scenarios on easing policy & reserve diversification narratives

________________________________________

🔝 Key Resistance Zones

• $4,260–$4,280 near-ATH supply / immediate ceiling from close

• $4,300–$4,350 extension target band

• $4,380–$4,420 stretch zone toward prior spike high and measured extensions

🛡 Support Zones

• $4,220–$4,200 first retest band just below close

• $4,180–$4,140

• $4,100–$4,050 deeper pullback shelf; $4,000 remains the big psych

________________________________________

⚖️ Base Case Scenario

Expect shallow pullbacks into $4,220–$4,140 to be bought, followed by rotation back into the $4,260–$4,300 resistance stack for an ATH retest.

🚀 Breakout Trigger

A sustained push/acceptance > ~$4,280 unlocks $4,300 → $4,350, with room toward $4,380–$4,420 if momentum persists.

💡 Market Drivers

• Fed cut expectations into late Oct(lower real yields = gold tailwind

• USD softness / DXY sub-100 tone supports metals

• Ongoing central-bank bullion demand; ETF inflows stabilizing

• Geopolitics & trade/tariff headlines keeping safety bids active

🔓 Bull / Bear Trigger Lines

• Bullish above: $4,140–$4,200

• Bearish below: $4,100–$4,050 risk expands under $4,000

🧭 Strategy

Accumulate dips above $4,140–$4,200.

On breakout > $4,280, target $4,300–$4,350+. Maintain tight risk under stepped supports; invalidate momentum below $4,050–$4,000.

________________________________________

הערה

🎁Please hit the like button and🎁Leave a comment to support our team!

הערה

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE💰 Close: $4,379 → $4,252 — higher close, trend still strong.

📈 Trend: Uptrend > $4,000; dip buyers still in charge.

🛡 Supports: $4,180 → $4,000 (key line to defend).

🚧 Resistances: $4,260 / $4,300 / $4,350 → stretch $4,420.

🧭 Next Week Bias: Buy dips $4,140–$4,200 → target $4,300–$4,380+.

🏦 Macro Tailwinds: Fed cut bets + weak USD + CB gold demand.

🌍 Geopolitics: Trade & regional risks = safe-haven flows.

🎯 Street View: $5,000/oz by 2026 in play.

🚀 Breakout: >$4,280 → opens path to $4,350–$4,420.

⚖️ Strategy: Accumulate dips; protect under $4,050–$4,000.

עסקה פעילה

עסקה סגורה: היעד הושג

BOTH TARGETS HIT ALREADY. CONGRATS IF YOU FOLLOWED. ANOTHER EPIC RUN BY PROJECTSYNDICATE.On breakout > $4,280, target $4,300–$4,35

הערה

PROJECTSYNDICATE: BESPOKE MARKET ANALYSIS AND INSIGHTS FOR REAL TRADERS.הערה

broke down below some support levels today. stay tuned for further updates over weekend.

for this week we are done all targets hit already.

הערה

5% down day so far today, could indicate a potential upcomingcorrection. stay tuned for further updates later this week.

הערה

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE🏆 High/Close: $4,380 → ~$4,100 — sharp weekly fade off resistance, closing near lows as momentum unwinds.

📈 Trend: Short-term overextended; medium-term uptrend tested but intact above $4,000 — structure still constructive, yet fading momentum warns of exhaustion.

🛡 Supports: $4,100 / $4,060 → $4,000 remains the battleground; break exposes $3,960–$3,920.

🚧 Resistances: $4,220 / $4,280 / $4,350 → key rejection zone $4,380–$4,400 capping rallies.

🧭 Bias next week: Neutral-to-soft; sellers in control below $4,220. Limited upside unless bulls reclaim $4,300. Expect choppy consolidation between $4,000–$4,250. Breakdown under $4,000 risks deeper flush toward $3,900.

🌍 Macro backdrop:

• Hotter U.S. data rekindles “higher-for-longer” fears; Fed messaging turns less dovish.

• Yields rebound, weighing on bullion sentiment.

• ETF inflows pause after three strong weeks — risk-on tone returns in equities.

• Central-bank bids remain a cushion but not enough to offset speculative unwinds.

🎯 Street view: Banks trim near-term forecasts; consensus shifts to consolidation before Q4 rebound. Range expected $3,950–$4,350 until next policy catalyst.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <5%

📕verified 1800%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.