🔒💎 XPT/USD (Platinum vs. U.S. Dollar) — Swing/Scalping Thief Plan

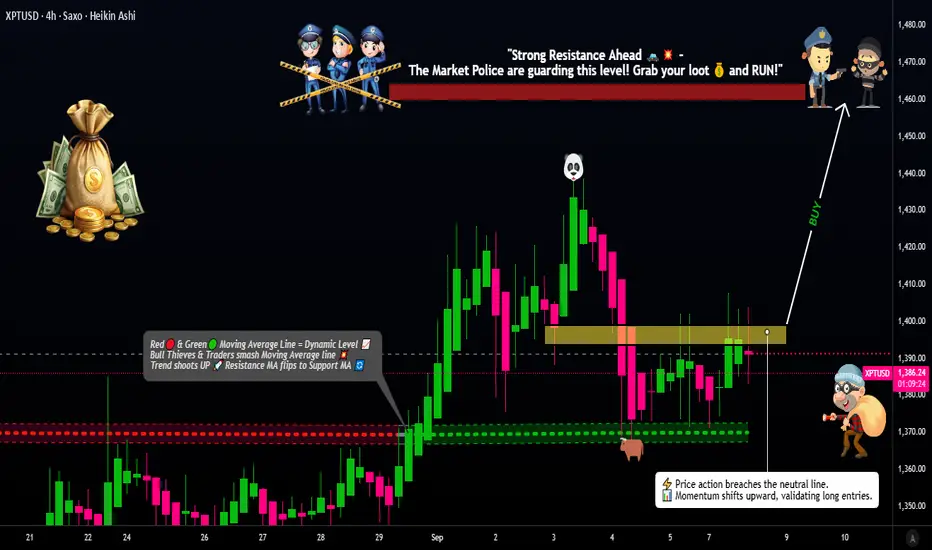

📌 Trade Plan (Bullish Setup)

Asset: XPT/USD (Platinum vs. U.S. Dollar)

Bias: Bullish (Pending Order Plan)

Breakout Entry: Watching $1400.00 ⚡ (Resistance Breakout)

Layered Buy Entries (Thief Strategy):

$1380 (Layer 1)

$1390 (Layer 2)

$1400 (Layer 3 / Breakout Confirm)

(You can increase/adjust layering based on your own risk strategy — set alerts on TradingView for breakout confirmation 📲)

Stop Loss (Thief SL): $1360.00 (after breakout confirmation).

Note: Adjust SL based on your own risk management — not a fixed recommendation.

Target (Escape Point): $1460.00 🎯

Resistance + Overbought + Trap Zone → exit with stolen money before the vault closes!

💡 Why This Thief Plan?

Combines Thief Layer Strategy (multiple buy limits around breakout) with macro, fundamental, and sentiment drivers.

Breakout level @ $1400 is technically + psychologically key.

Layering ensures better risk-adjusted entry & scaling opportunities.

Target chosen at resistance/overbought zone — escape before trap triggers.

📊 Real-Time Market Data (Sept 8, 2025)

Current Change: +5.39 (+0.39%)

Previous Close: $1,376.35

Day’s Range: $1,369.14 – $1,407.52

52-Week Range: $887.50 – $1,486.23

😰 Fear & Greed Sentiment

Index: 53 → Neutral 😊

Market is balanced, showing cautious optimism with no extreme fear/greed.

🧑🤝🧑 Sentiment Breakdown

Retail Traders: 55% Long 🐂 | 45% Short 🐻

Institutions: 60% Long 🐂 | 40% Short 🐻

Institutions lean bullish, supported by macroeconomic shifts & rate-cut optimism.

🌍 Fundamental & Macro Drivers

Fed Rate Cuts Expected → Weak labor data fuels precious metal demand.

Global Equity Breadth → Broadening bull market supports commodities.

China Deflation Battle → Bond yields ~1.8% → key for platinum demand.

Weak U.S. Labor Market → Only 22K jobs added in Aug → rate cut hopes rise.

Oil Price Decline → Brent at $65.50 → signals demand concerns, indirectly hitting industrial metals.

🐂📉 Market Outlook

Bullish Score: 65% ✅

Bearish Score: 35% ❌

Summary: Platinum supported by rate cut expectations, weak labor data, and institutional flows. Risks remain due to oil price volatility & broader economic uncertainty.

🔍 Related Pairs to Watch

XAUUSD (Gold)

XAUUSD (Gold)

XAGUSD (Silver)

XAGUSD (Silver)

$PALLUSD (Palladium)

DXY (U.S. Dollar Index)

DXY (U.S. Dollar Index)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Platinum #XPTUSD #Metals #SwingTrade #Scalping #LayerStrategy #Breakout #ThiefTrader #Commodities #TradingPlan #TechnicalAnalysis #MacroAnalysis

📌 Trade Plan (Bullish Setup)

Asset: XPT/USD (Platinum vs. U.S. Dollar)

Bias: Bullish (Pending Order Plan)

Breakout Entry: Watching $1400.00 ⚡ (Resistance Breakout)

Layered Buy Entries (Thief Strategy):

$1380 (Layer 1)

$1390 (Layer 2)

$1400 (Layer 3 / Breakout Confirm)

(You can increase/adjust layering based on your own risk strategy — set alerts on TradingView for breakout confirmation 📲)

Stop Loss (Thief SL): $1360.00 (after breakout confirmation).

Note: Adjust SL based on your own risk management — not a fixed recommendation.

Target (Escape Point): $1460.00 🎯

Resistance + Overbought + Trap Zone → exit with stolen money before the vault closes!

💡 Why This Thief Plan?

Combines Thief Layer Strategy (multiple buy limits around breakout) with macro, fundamental, and sentiment drivers.

Breakout level @ $1400 is technically + psychologically key.

Layering ensures better risk-adjusted entry & scaling opportunities.

Target chosen at resistance/overbought zone — escape before trap triggers.

📊 Real-Time Market Data (Sept 8, 2025)

Current Change: +5.39 (+0.39%)

Previous Close: $1,376.35

Day’s Range: $1,369.14 – $1,407.52

52-Week Range: $887.50 – $1,486.23

😰 Fear & Greed Sentiment

Index: 53 → Neutral 😊

Market is balanced, showing cautious optimism with no extreme fear/greed.

🧑🤝🧑 Sentiment Breakdown

Retail Traders: 55% Long 🐂 | 45% Short 🐻

Institutions: 60% Long 🐂 | 40% Short 🐻

Institutions lean bullish, supported by macroeconomic shifts & rate-cut optimism.

🌍 Fundamental & Macro Drivers

Fed Rate Cuts Expected → Weak labor data fuels precious metal demand.

Global Equity Breadth → Broadening bull market supports commodities.

China Deflation Battle → Bond yields ~1.8% → key for platinum demand.

Weak U.S. Labor Market → Only 22K jobs added in Aug → rate cut hopes rise.

Oil Price Decline → Brent at $65.50 → signals demand concerns, indirectly hitting industrial metals.

🐂📉 Market Outlook

Bullish Score: 65% ✅

Bearish Score: 35% ❌

Summary: Platinum supported by rate cut expectations, weak labor data, and institutional flows. Risks remain due to oil price volatility & broader economic uncertainty.

🔍 Related Pairs to Watch

$PALLUSD (Palladium)

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Platinum #XPTUSD #Metals #SwingTrade #Scalping #LayerStrategy #Breakout #ThiefTrader #Commodities #TradingPlan #TechnicalAnalysis #MacroAnalysis

עסקה סגורה: היעד הושג

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.