A Deep Value Play or a Value Trap?

A Deep Value Play or a Value Trap? Dissecting AutoNation's Contradictions

AutoNation Inc. (NYSE: AN) has grown EPS 17% year over year, yet its forward P/E of 10.5 lags the 11.6 industry averagesuggesting potential undervaluation. The sale of collision centers and pivot to digital retail has eroded AutoNation's tangible asset base, weakening its balance sheet as a source of collateral.

This amplifies dependence on steady cash flowan exposed position in a cyclical downturn. At the same time, the growth of AutoNation Finance introduces added credit and duration risk. Auto loans are particularly vulnerable to rising delinquency rates and widening interest spreads, especially in a higher-for-longer rate environment.? This article explores the forces shaping the outlook for AutoNation Inc., the nation's largest automotive retailer.

Sky-High ROE, But What's Fueling It?

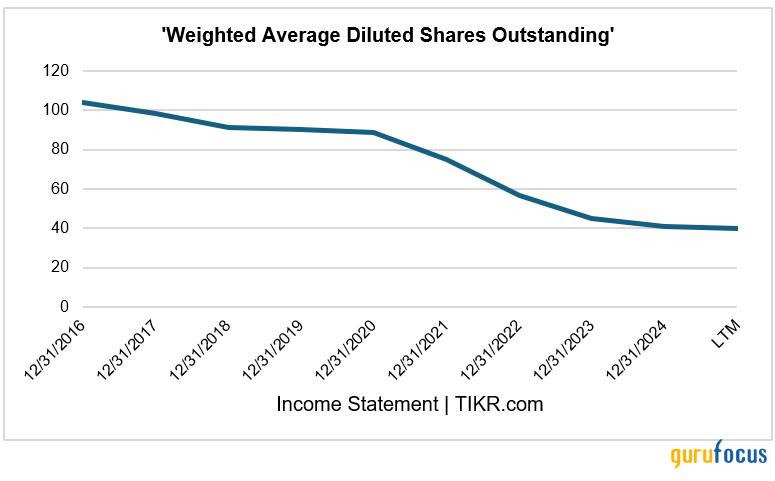

AutoNation's rising return on equity (ROE) may signal efficiency, but it's largely driven by financial engineeringnot stronger operations. Share repurchases have cut the share count by 42%, boosting ROE and EPS, yet without improving cash flow or margins. Meanwhile, tangible equity has fallen, increasing vulnerability to economic shocks.

Weighted Average Shares Outstanding

Growth has been debt-fueledthrough acquisitions and store expansionwithout a matching rise in return on invested capital (ROIC). The shift to asset-light models adds scalability but introduces valuation risk if margins slip.

Put simply, AutoNation's elevated ROE stems more from a shrinking equity base and increased leverage than from genuine value creation. A high ROE unsupported by strong returns on invested capital (ROIC) is a warning sign. The real test lies in sustainable ROIC, consistent free cash flow, and economic profitnot headline metrics.

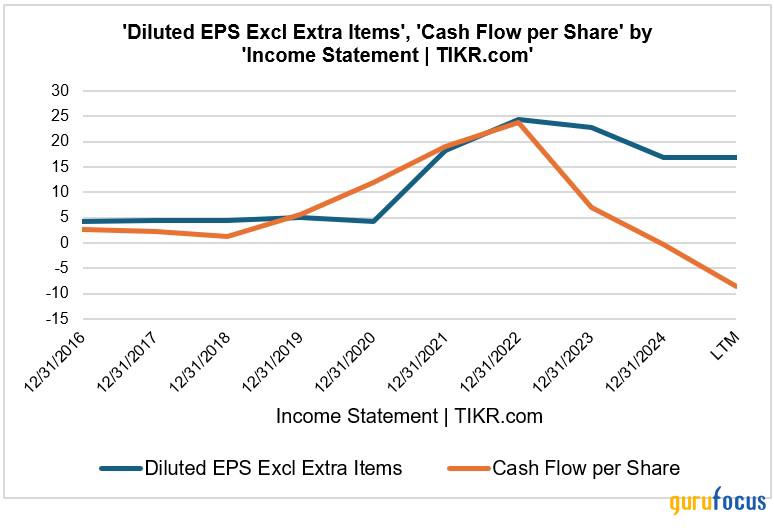

Cash Flow Illusions: Strong EPS, Weak FCF

AutoNation's EPS has surgedup over 50% at timesthanks to strong margins, buybacks, and finance growth. Yet free cash flow (FCF) has lagged or turned negative, revealing weaker earnings quality.

Diluted EPS Versus Cash Flow Per Share

Working capital swings, driven by inventory-heavy operations and floorplan financing, distort cash generation. Growth in receivables and AutoNation Finance further delays cash conversion while raising credit risk. At the same time, upfront CapEx for AutoNation USA stores suppresses FCF despite long-term potential.

The pattern is clear: accounting profits aren't translating into cash. That makes EPS-based valuations misleading, return metrics inflated, and liquidity risk elevatedespecially in downturns. For investors, strong earnings without real FCF could mean a capital treadmill, not a compounder.

Balance Sheet Risks: A Closer Look at Tangible Equity and Debt

AutoNation Inc. presents a balance sheet backed by an investment-grade credit rating, but one that has grown thinner and more exposed to cyclicality. Debt has climbed to $3.3 billion, while equity has shrunk from buybacks and a shift to an asset-light strategy.

AutoNation's sale of collision centers and shift toward digital retail has thinned its base of tangible assets, eroding balance sheet collateral and increasing reliance on stable cash flowan uncertain bet in a downturn.

At the same time, the expansion of AutoNation Finance adds exposure to credit and duration risk. Auto loans are highly sensitive to delinquencies and rate spreads, especially in a tightening cycle. With tangible book value already low, the company has little cushion if macro conditions sour.

Cheap for a Reason? Valuation Multiples Under the Microscope

AutoNation trades at just 6x forward earnings and ~5x EV/EBITDAwell below the S&P 500 and peers like Lithia Motors and CarMax. But low multiples often reflect risk.

Recent gains were buoyed by one-time tailwinds: tight supply, low rates, and cost leverage. As these fade, the market anticipates earnings reversion. Add to that structural concernsEV disruption, digital competition, and credit fragilityand skepticism over long-term earnings durability begins to look justified.

The valuation isn't being ignored. It's pricing in the risk that the peak is already past.

What Could Shift the Narrative?

To re-rate meaningfully, AutoNation must change investor perceptions around its earnings durability and strategic flexibility.

Scaling AutoNation Finance

Captive financing offers high-margin growth and customer retention benefits. But the market wants evidence of underwriting discipline, stable performance, and scalable profitabilityespecially in a higher-rate environment.

AutoNation USA Expansion

With over 130 stores targeted by 2026, success depends on proving strong unit economics and fast breakeven. Early wins need to scale for investors to revalue the platform.

Strategic Unlocks or Shareholder Pressure

A spin-off of AutoNation Finance or monetization of its digital platforms could unlock hidden value. Activist investors may also push for clearer capital allocation and a more streamlined operating structure.

Macro Tailwinds

Falling interest rates or a normalization in credit markets could improve affordability, ease delinquency pressures, and support higher valuation multiples. While outside management's control, these shifts would strengthen the impact of internal execution.

Bottom Line

Absent a clear catalyst or narrative reset, AutoNation's low multiple may prove stickynot because of market oversight, but because of unresolved questions around cash flow durability and long-term strategic coherence.

Final Take: Profitable Paradox or Peak Performance?

AutoNation is delivering strong headline results. EPS is rising, ROE is high, margins are solid, and the company is actively reshaping itselffrom financial services to digital channels to share repurchases. On paper, it resembles a compounder. The question is whether those gains are durable or front-loaded.

Yet the market remains skeptical.

Despite delivering strong results, AutoNation continues to trade more like a distressed cyclical than a category leader. Investors are split: is this a resilient operator with untapped growth leversor a short-term winner riding post-COVID tailwinds?

The bull case highlights efficient cost control, robust per-unit margins, and strategic capital flexibility. The bear case points to ROE inflated by buybacks, waning macro tailwinds, and long-term challenges from EV disruption and digital disintermediation.

This is what makes AutoNation a battleground stockstrong optics versus fragile conviction.

Ultimately, whether the stock re-rates may depend less on next quarter's results and more on whether management can reshape the narrativefrom past peak to still compounding. Until then, the market isn't just measuring valuationit's testing belief.