Meta and Google: Revenue Growth Concerns, Costly AI Spends

But when diving deeper into segments and key line item trends, however, there are substantial differences that underscore rumblings in their most important markets: the United States and the Western Hemisphere. Trend Analysis

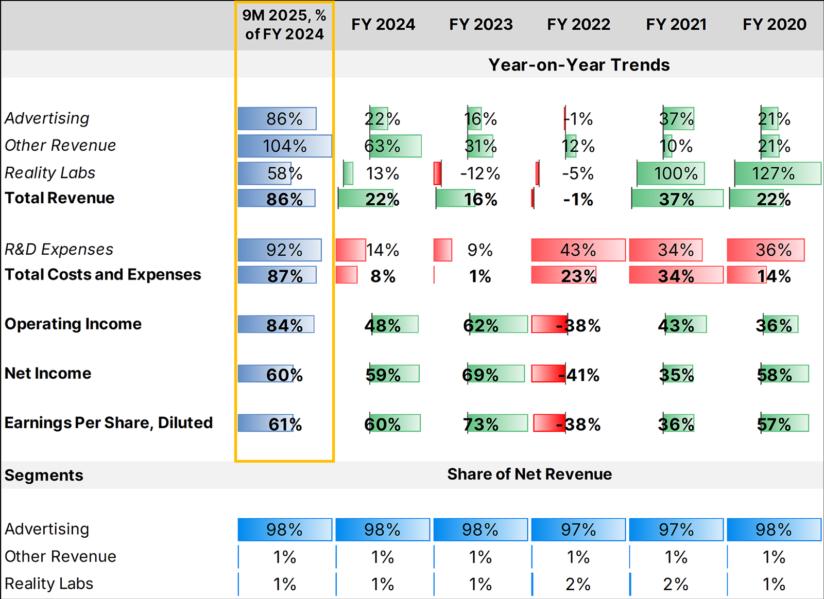

At first glance, Meta's top and bottom lines show outperformance relative to the previous FY:

Source: Company Information; Leverage Shares analysis

If trends over 9M 2025 continue, total revenue will be around 15% higher than that in FY 2024 but earnings per share will be around 19% lower. Revenues from advertising remains, by far, the biggest source of revenues with both "Other Revenue" – representing its WhatsApp Business platform, Meta Verified subscriptions and developer fees – and "Reality Labs" – representing its VR headsets and glasses – being relatively insignificant and consistently under 2% since FY 2020.

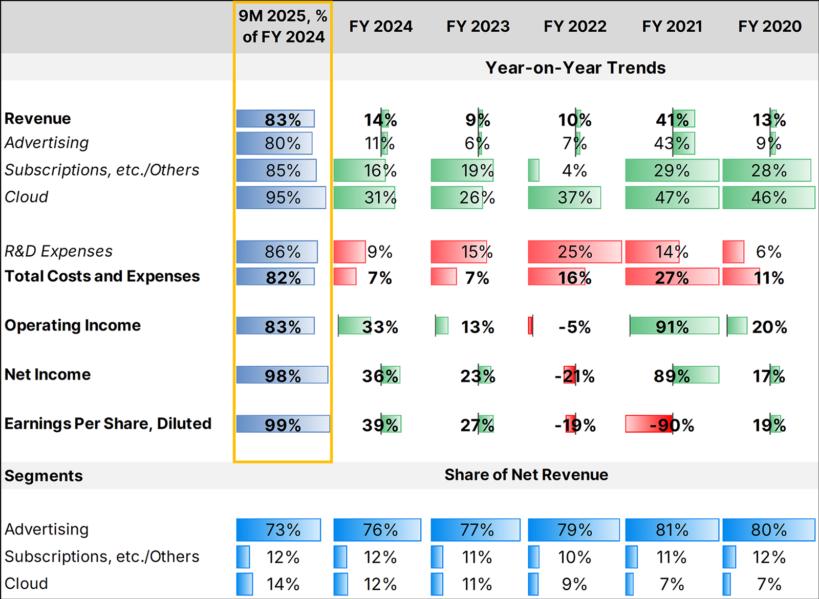

Interestingly, Google's top line results are almost exactly aligned with that of Meta's.

Source: Company Information; Leverage Shares analysis

If trends over 9M 2025 continue, total revenue will be around 11% higher than that in FY 2024. Unlike with Meta, however, the bottom line trend is different: earnings per share are already running par with that of the entirety of FY 2024. If trends continue, earnings per share for the full year will be 25% higher.

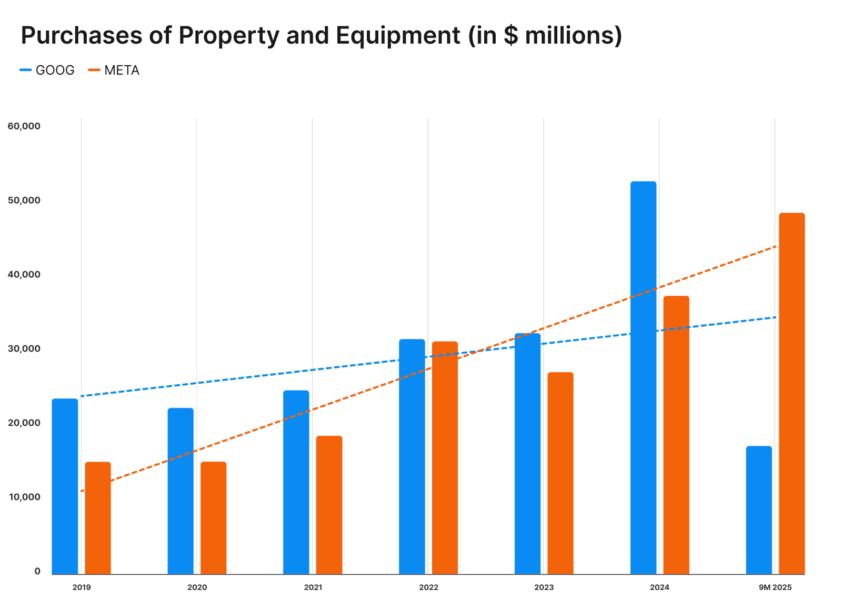

Meta’s relative underperformance in the bottom line can be predominantly attributable to increasing expenditure in compute infrastructure: at $48.3 billion so far this year, purchases of property and equipment were 216% that in the same period in the same period in the previous FY. Meanwhile, Google’s purchases of plant and property is 166% that in the same period in the previous FY.

Source: Company Information; Leverage Shares analysis

In forward guidance, Meta states that capital expenditure in 2026 will be higher than in 2025 as it continues to expand infrastructure aggressively by both building its own capacity and contracting with third parties. In a similar tone, Google CFO Anat Ashkenazi stated during the earnings call that the company estimates capital expenditure to be in the $91-93 billion range for FY 2025, with a substantial increase beyond this amount in 2026.

Both companies are consolidating and strengthening their bid to remain square within a trending theme that has dominated the language emanating from key American companies for some time now: AI. Behind the “Circular AI Deal Machine”

As per reports1, investing in AI now accounts for at least 40% share of US GDP ("Gross Domestic Product") growth this year and AI companies are estimated to have accounted for 80% of the gains in the U.S. market so far this year. The driving narrative that essentially makes the entire US economy one big bet on AI is the notion that it would deliver a significant boost to productivity growth by delivering cost savings in the long term by requiring fewer workers - who are already among the most productive in the world on average.

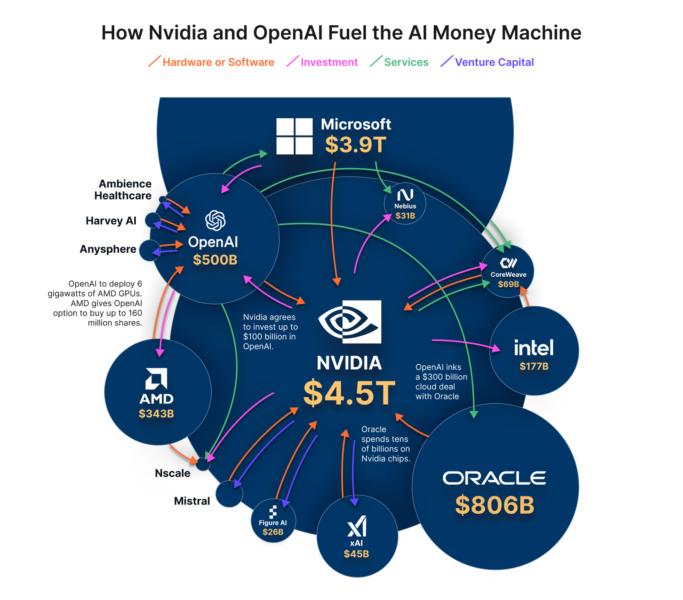

This long-running notion has led to the creation of a massive network of "circular deals"2 worth several trillions of dollars predominantly around Nvidia and OpenAI – which typically sees a pattern of purchases of products and services following an investment. This serial money machine is now nearly-inextricably linked to every major American tech firm and leading AI startup.

Source: Bloomberg News; Image redesign by Leverage Shares

While Google hasn't been a substantial part of this cyclical "deal machine", it isn't altogether out of it: earlier in June, it reportedly signed a deal3 (with significant details as yet unavailable) with OpenAI that provides the latter with additional computing capacity to help OpenAI train and run its AI models while CoreWeave is set to sell some capacity4 to Google, which will then sell to OpenAI. In some respects, it could be argued that Google is now being woven into the cyclical "deal machine".

Meanwhile, Google has been running its own set of deals outside of the cyclical machine: over the years, it has progressively invested greater sums5 into OpenAI's rival Anthropic while also developing and deploying its own "Gemini" family of Large Language Models. Some reports estimate6 that Google now holds around a 13% market share relative to ChatGPT's 71%, although it's left unclear if this is because of Gemini's integration into the company's existing Search, YouTube and email offerings. Both CEO Sundar Pichai and CFO Ashkenazi extolled the inroads made by the company into the AI market. CEO Pichai stated that Gemini now has 650 million monthly active users7 and that the latest model Gemini 3 slated to be released later this year. CFO Ashkenazi stated that the company is also using AI internally, with nearly half of the company's code now being generated by AI. Since 2023, Meta has been releasing iterations of its own large language models (LLMs) under the name "Llama" to developers around the world, with Facebook and WhatsApp using the Llama 3 model8 in some regions. With an open-weight configuration under a Community License and self-hosted deployment features, the Llama family was conceived for developers, startups, and organizations requiring self-hosting and deep control.

Earlier in April this year, Meta launched Llama 4 which had a somewhat lukewarm reception, with developers comparing it unfavourably9 to broad models such as OpenAI's GPT-40 and DeepSeek's R1. In specialized tasks, it was deemed to have fallen behind specialist LLMs.

With its LLMs unable to gain significant traction – much to the dissatisfaction of CEO Mark Zuckerberg10 – Meta has been enacting corrective measures under its chief AI officer Alexandr Wang, who was hired in June this year: 600 employees have been laid off from its bloated AI unit which is also being overhauled and restructured in order to compete with the likes of OpenAI in offering better AI models.

Over nine months ago, the company had inked a deal to build out a new datacenter in Louisiana (now called "Hyperion") to support its AI endeavour, which has ballooned from being worth $10 billion to $27 billion11 as of October. This 5 Gigawatt (GW) datacenter has an interesting funding pattern with asset management firm Blue Owl Capital: in exchange for Blue Owl providing private credit, the datacenter would be a joint venture between the two in which Meta would hold only a 20% stake. Meta would then lease the center from the joint venture for at least four years.

The company states that this is for "long-term strategic flexibility". Considering how the "circular deal" machine is set up, this might be something akin to a hedge if the AI endeavour were to underperform. Also announced earlier in August12 was a $10 billion+ cloud deal with Google over a six-year horizon, which is an interesting wrinkle: Hyperion's ownership structure likely incentivizes using native capacity over third party's (which the Google deal is quite likely to be). While details are scarce about the structuring of the deal, it remains to be seen how this deal would pan out in terms of costs for Meta: it would be entirely logical for Google to expect a baseline payment in such an agreement. The Way Ahead

What makes the likes of Meta and Google "high conviction" stocks to most investors would be the capability to compound top line growth with strong bottom line growth. In both cases, however, matching the previous FY's growth seems exceedingly unlikely. Trends indicate that Meta's EPS growth would be 19% lower than in the previous FY, which had registered a 60% growth over the year prior - which is a massive shift from all periods since 2020 (with the exception of the pandemic years of 2021 and 2022).

Meanwhile, Google's trend of 25% growth is lower than in the previous FY's. Like with Meta, the years of 2021 and 2022 were bumps in the road. Unlike with Meta, the 25% level lies true within a trend in earnings growth of the 20+% level since 2020 (with FY 2024 being a positive outlier). The factor supporting Google's growth stability has been its Cloud segment. Through the years, it has continued to grow in revenue share and displays substantial pass-through efficiency towards bottom line contribution.

Advertising, on the other hand, remains the mainstay for both companies. In here, both companies show significant slowdowns. With a growth trend of 15%, Meta falls somewhat short of the 19% average established in FY terms since 2020. Meanwhile, Google's advertising revenue growth is trending at 7%, which is under half of the 15% average established since 2020 through 2024.

The drop in advertising growth is directly linked to the spending habits and trends therein within the U.S. and Western Europe. Neither inflationary trends nor trade tensions have subsided. With lower spending being projected, there will be lower ad spends.

Long-term observers draw parallels between the massive multi-trillion AI Hype and the dot-com bubble at the turn of the century. Unlike the dot-com bubble, though: while today’s AI firms have tangible products and customers, their spending outpaces monetization. With such aggressive buildout plans, the road to monetize away high capital expenditures becomes ever longer.

While Google's existing capacity and presence in AI gave its stock trajectory a slight bump on the day following the earnings release, the gloomy outlook on future ad spends would likely be a more pressing concern for both companies. The question over the continuing feasibility of such massive AI-relevant investments will likely be a recurrent theme in the conversation around these two stocks and will make future trajectories quite rocky.

Footnotes:

- "America is now one big bet on AI", Financial Times, 6 October 2025

- "OpenAI, Nvidia Fuel $1 Trillion AI Market With Web of Circular Deals", Bloomberg, 7 October 2025

- "Exclusive: OpenAI taps Google in unprecedented cloud deal despite AI rivalry, sources say", Reuters, 10 June 2025

- "CoreWeave to offer compute capacity in Google's new cloud deal with OpenAI, sources say", Reuters, 12 June 2025

- "Google invests further $1bn in OpenAI rival Anthropic", Financial Times, 22 January 2025

- "ChatGPT remains the most popular chatbot globally but Google's Gemini is catching up fast", Livemint, 19 October 2025

- "Google's Gemini now has over 650 million monthly active users, says CEO Sundar Pichai", Moneycontrol, 30 October 2025

- "Meta’s battle with ChatGPT begins now", TheVerge, 18 April 2025

- "Why Llama 4 is a Disaster", Codersera

- "Meta lays off 600 from ‘bloated’ AI unit as Wang cements leadership", CNBC, 22 October 2025

- "Meta to spend $27B on north Louisiana data center", Nola.com, 29 October 2025

- "Meta Signs $10 Billion-Plus Cloud Deal With Google", The Information, 21 August 2025