Why ASML Stock Didn’t Rise Hard Despite a Stellar Q3 2025

There are a number of factors behind this. Trend Analysis

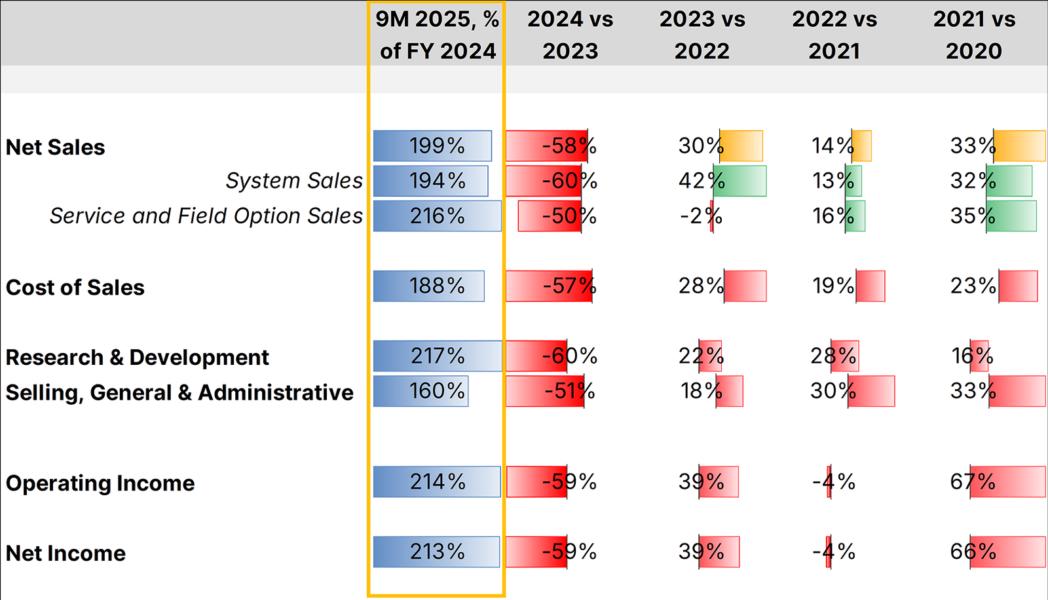

At first glance, the trends over the past nine months of FY 2025 are highly encouraging:

Source: Company Information; Leverage Shares analysis

If current trends continue, net sales will be around 133% higher than that in 2024 while net income will be about 150% higher. In comparison, cost of sales doesn't quite rise in tandem with increasing sales, thereby translating to higher passthroughs to net income.

In Q3 2025, the company initiated a strategic partnership with Mistral AI, a generative artificial intelligence company with a focus on software coding development via a EUR 1.3 billion investment in the latter's Series C funding round to secure a 11% stake and a seat in its Strategic Committee. ASML CFO Roger Dassen stated during the call that ASML expects to accelerate innovation, improve time-to-market and lower development costs for the solutions it offers its clients through this partnership. Mr. Dassen also stated that this partnership brings the company even closer to the AI ecosystem.

Meanwhile, R&D ("research and development") expenses have risen from the lull seen in 2024 and is now trending more towards the steady year-on-year rises witnessed since 2020. The company expects to add another EUR 1.2 billion in spending to the EUR 3.4 billion already spent so far in the FY. This sum would be thrice that spent in FY 2024.

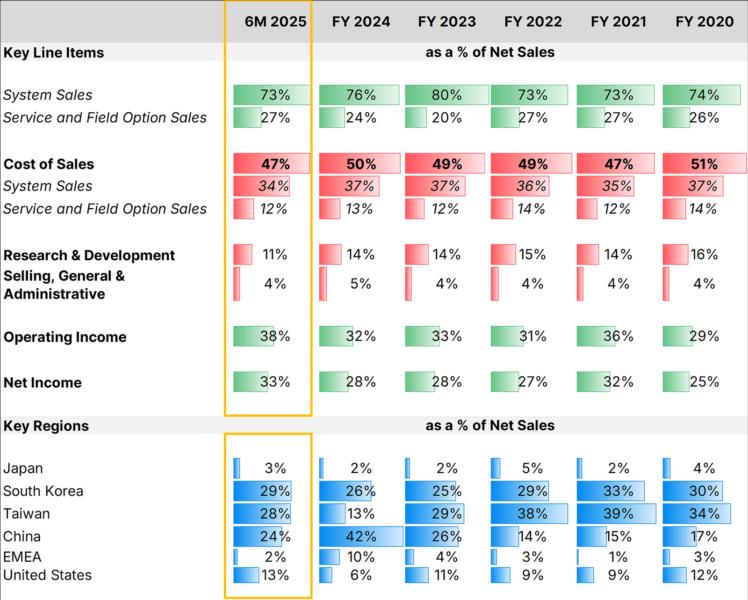

As evident in past years' results as well as the Interim Report for the first six months ("6M") of FY 2025, there is generally a steady relationship between key line items, including R&D expenses, net sales and net income.

Source: Company Information; Leverage Shares analysis

Given this relationship, the high R&D expense stands out: if the long-term balance between spending and sales were to hold going forward, this could be taken to mean that the company expects future sales to be substantially higher. The company reports this quarter that it continues to see progress in High-NA EUV ("high numerical aperture extreme ultraviolet") – the next generation of lithography technology needed to create more powerful and energy-efficient chips with fewer process steps. Towards this goal, it also announced the shipping of its first product serving Advanced Packaging, the TWINSCAN XT:260, through which customers can work on overcome the unique physical limitations of semiconductor material to enable the production of smaller, more powerful chips.What Could be Weighing Down the Stock

A two-fold increase in R&D over the previous year is a bold step is an unusual trend for the company. While necessary for the company, it remains questionable that this would translate to massive sales, given the capital-intensive nature of the semiconductor industry. ASML's advanced High-NA machines cost around1 $380 million each, with even older machines selling for over $180 million. Thus, there is a definite bottleneck on the total capacity for upgrades or replacements of equipment among chipmakers. While ASML might have attracted a high number of bookings, it remains to be seen if a large number of deliveries will be made.

Taiwan had, so far, been the largest destination for ASML's machines since 2020, except for 2024 when China alone accounted for nearly half of net sales. As of 6M 2024, China's share had effectively halved from that number - thus making the country responsible for nearly quarter of net sales.

In a report published on the 7th of October this year2, the bipartisan Select Committee on the Chinese Communist Party in the U.S. House of Representatives charged that revenues of ASML (among two others) "came, in significant part, from sales to China’s restricted entities". The Committee noted that nearly every toolmaker counted restricted companies with deep ties to the Chinese military among their top customers in China for a number of years now. The Committee contended that access to high-level technology by non-U.S. chip equipment manufacturers was made possible by inconsistencies in restrictions by Japanese, Dutch, U.S. and other allied governments and concluded by stating: "It is far past time that the Toolmakers start treating the CCP and its national champions as threats to their corporate longevity, rather than as valued customers."

The massive spurt in revenues in 2024 might be partially explicable that Chinese chipmakers might have been stockpiling equipment at least before such gaps are closed. ASML's CEO Christophe Fouquet quoted in the earnings' press release, "we expect China customer demand, and therefore our China total net sales in 2026 to decline significantly compared to our very strong business there in 2024 and 2025."

The timing of the Select Committee's release, along with the imposition of higher tariffs on Chinese exports to the U.S. along with China's increased limitations on the export of rare earth elements potentially strengthens the possibility that restrictions will come sooner rather than later. In Conclusion

Given that a large component of the conviction in the stock was borne on the likelihood of ASML continuing to sell in China, a large part of the conviction via an overall growth outlook that the stock enjoyed is currently under scrutiny by market participants. Simultaneously, while Mr. Fouquet contended in the earnings release that net sales in 2026 isn't expected to be lower than in 2025 regardless of restrictions of sales into China, this hinges on ASML's customers to sink substantial costs into new equipment with a more restricted field for reselling their legacy equipment.

ASML occupies an important position within the semiconductor industry. Strong sales outlook or not, it isn't likely to be supplanted from the global supply chain for semiconductor chips any time soon. Thus, investors looking for exposure to the semiconductor industry would be loathe to relinquish their holdings in the stock. In addition, the company does hand out modest dividends which is unlikely to cease any time soon.

On the other hand: regardless of assertions about sales figures going forward, there is a pretty strong likelihood of turbulence. Many growth-seeking investors might not find ample cause to double down on the stock which, in turn, could deflate convictions and valuations going forward.

Footnotes:

- "ASML High-NA EUV Twinscan EXE Machines Cost $380 Million, 10-20 Units Already Booked", TechPowerUp, 14 February 2024

- "Selling the Forges of the Future", Select Committee on the Chinese Communist Party, U.S. House of Representatives, 7 October 2025