FX options wrap - Beware more USD weakness igniting FX volatility

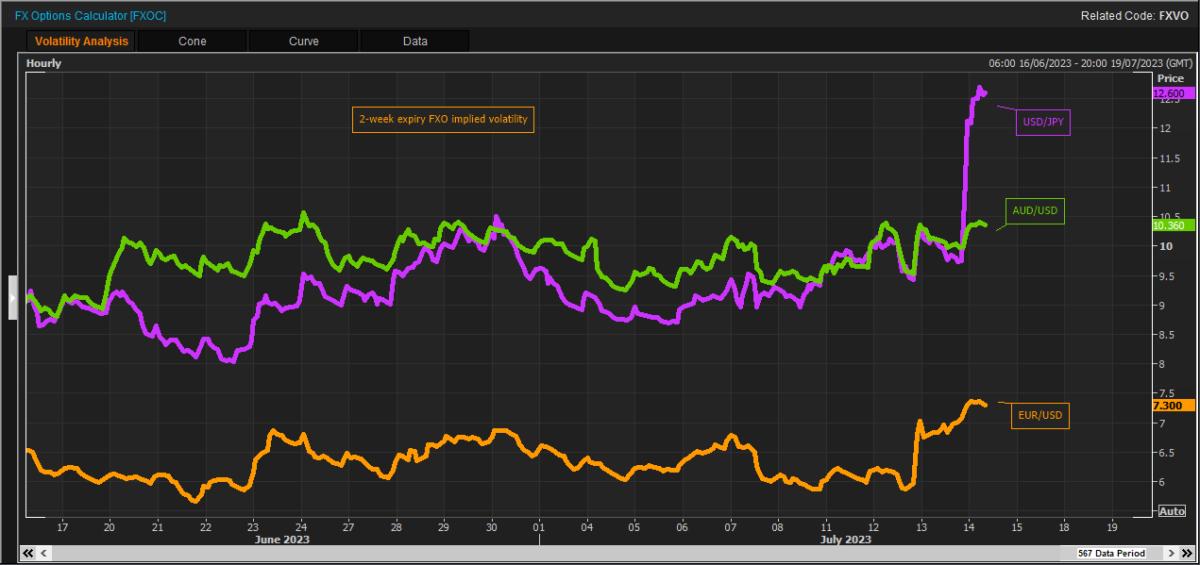

There has been a recent upward shift in FX volatility protection costs with a focus on USD puts that would benefit from further USD losses.

Sub-2-month expiry implied volatility has seen the bulk of demand, especially in EUR/USD, GBP/USD and USD/CHF, which have broken out of longer term ranges and forced short covering. A lack of existing option strikes in these pairings could help to fuel volatility if the USD extends recent losses.

There's been demand for EUR/USD topside strikes up to 1.1500 over a 3-month horizon since last weeks U.S. CPI, which has helped to erase the downside risk premium from sub 1-month risk reversals.

GBP/USD 1-month implied volatility eyes pre June BoE highs at 8.5 as markets look to Wednesday's UK CPI data to cement a 50bps hike on Aug. 3. USD/JPY focus is on the 2-week date since it included the Fed and BoJ - with the latter demanding the bulk of the risk premium.

AUD/USD and NZD/USD have not escaped demand for implied volatility and USD put strikes. Stand out G10 FX option strike expiries this week.

For more click on