OPEN-SOURCE SCRIPT

AVGO Advanced Day Trading Strategy

📈 Overview

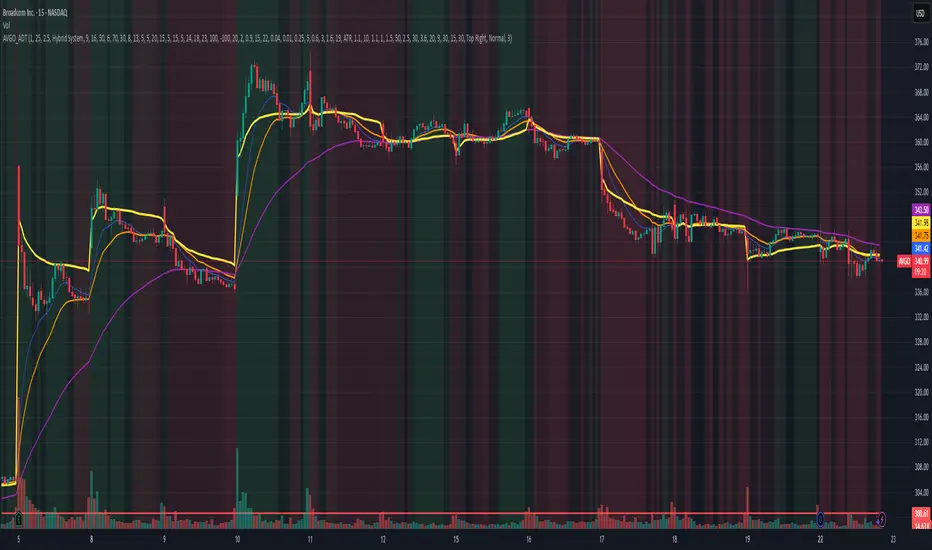

The AVGO Advanced Day Trading Strategy is a comprehensive, multi-timeframe trading system designed for active day traders seeking consistent performance with robust risk management. Originally optimized for AVGO (Broadcom), this strategy adapts well to other liquid stocks and can be customized for various trading styles.

🎯 Key Features

Multiple Entry Methods

Advanced Technical Arsenal

When enabled, the strategy analyzes 8+ additional indicators for confluence:

🛡️ Risk Management System

Position Sizing

Multiple Profit Targets

Stop Loss Protection

📊 Technical Specifications

Primary Indicators

Volume Confirmation

Market Structure Analysis

⏰ Trading Hours & Filters

Time Management

Market Condition Filters

📱 Visual Features

Information Dashboard

Real-time display of:

Chart Visualization

🔔 Alert System

Entry Alerts

Advanced Alerts

⚙️ Customization Options

Strategy Parameters

Visual Customization

📋 Default Settings

🎯 Best Use Cases

⚠️ Important Notes

🏆 Performance Features

This strategy is for educational purposes. Past performance does not guarantee future results. Always practice proper risk management and consider your financial situation before trading.

The AVGO Advanced Day Trading Strategy is a comprehensive, multi-timeframe trading system designed for active day traders seeking consistent performance with robust risk management. Originally optimized for AVGO (Broadcom), this strategy adapts well to other liquid stocks and can be customized for various trading styles.

🎯 Key Features

Multiple Entry Methods

- EMA Crossover: Classic trend-following signals using fast (9) and medium (16) EMAs

- MACD + RSI Confluence: Momentum-based entries combining MACD crossovers with RSI positioning

- Price Momentum: Consecutive price action patterns with EMA and RSI confirmation

- Hybrid System: Advanced multi-trigger approach combining all methodologies

Advanced Technical Arsenal

When enabled, the strategy analyzes 8+ additional indicators for confluence:

- Volume Price Trend (VPT): Measures volume-weighted price momentum

- On-Balance Volume (OBV): Tracks cumulative volume flow

- Accumulation/Distribution Line: Identifies institutional money flow

- Williams %R: Momentum oscillator for entry timing

- Rate of Change Suite: Multi-timeframe momentum analysis (5, 14, 18 periods)

- Commodity Channel Index (CCI): Cyclical turning points

- Average Directional Index (ADX): Trend strength measurement

- Parabolic SAR: Dynamic support/resistance levels

🛡️ Risk Management System

Position Sizing

- Risk-based position sizing (default 1% per trade)

- Maximum position limits (default 25% of equity)

- Daily loss limits with automatic position closure

Multiple Profit Targets

- Target 1: 1.5% gain (50% position exit)

- Target 2: 2.5% gain (30% position exit)

- Target 3: 3.6% gain (20% position exit)

- Configurable exit percentages and target levels

Stop Loss Protection

- ATR-based or percentage-based stop losses

- Optional trailing stops

- Dynamic stop adjustment based on market volatility

📊 Technical Specifications

Primary Indicators

- EMAs: 9 (Fast), 16 (Medium), 50 (Long)

- VWAP: Volume-weighted average price filter

- RSI: 6-period momentum oscillator

- MACD: 8/13/5 configuration for faster signals

Volume Confirmation

- Volume filter requiring 1.6x average volume

- 19-period volume moving average baseline

- Optional volume confirmation bypass

Market Structure Analysis

- Bollinger Bands (20-period, 2.0 multiplier)

- Squeeze detection for breakout opportunities

- Fractal and pivot point analysis

⏰ Trading Hours & Filters

Time Management

- Configurable trading hours (default: 9:30 AM - 3:30 PM EST)

- Weekend and holiday filtering

- Session-based trade management

Market Condition Filters

- Trend alignment requirements

- VWAP positioning filters

- Volatility-based entry conditions

📱 Visual Features

Information Dashboard

Real-time display of:

- Current entry method and signals

- Bullish/bearish signal counts

- RSI and MACD status

- Trend direction and strength

- Position status and P&L

- Volume and time filter status

Chart Visualization

- EMA plots with customizable colors

- Entry signal markers

- Target and stop level lines

- Background color coding for trends

- Optional Bollinger Bands and SAR display

🔔 Alert System

Entry Alerts

- Customizable alerts for long and short entries

- Method-specific alert messages

- Signal confluence notifications

Advanced Alerts

- Strong confluence threshold alerts

- Custom alert messages with signal counts

- Risk management alerts

⚙️ Customization Options

Strategy Parameters

- Enable/disable long or short trades

- Adjustable risk parameters

- Multiple entry method selection

- Advanced indicator on/off toggle

Visual Customization

- Color schemes for all indicators

- Dashboard position and size options

- Show/hide various chart elements

- Background color preferences

📋 Default Settings

- Initial Capital: $100,000

- Commission: 0.1%

- Default Position Size: 10% of equity

- Risk Per Trade: 1.0%

- RSI Length: 6 periods

- MACD: 8/13/5 configuration

- Stop Loss: 1.1% or ATR-based

🎯 Best Use Cases

- Day Trading: Designed for intraday opportunities

- Swing Trading: Adaptable for longer-term positions

- Momentum Trading: Excellent for trending markets

- Risk-Conscious Trading: Built-in risk management protocols

⚠️ Important Notes

- Paper Trading Recommended: Test thoroughly before live trading

- Market Conditions: Performance varies with market volatility

- Customization: Adjust parameters based on your risk tolerance

- Educational Purpose: Use as a learning tool and customize for your needs

🏆 Performance Features

- Detailed performance metrics

- Trade-by-trade analysis capability

- Customizable risk/reward ratios

- Comprehensive backtesting support

This strategy is for educational purposes. Past performance does not guarantee future results. Always practice proper risk management and consider your financial situation before trading.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.