PINE LIBRARY

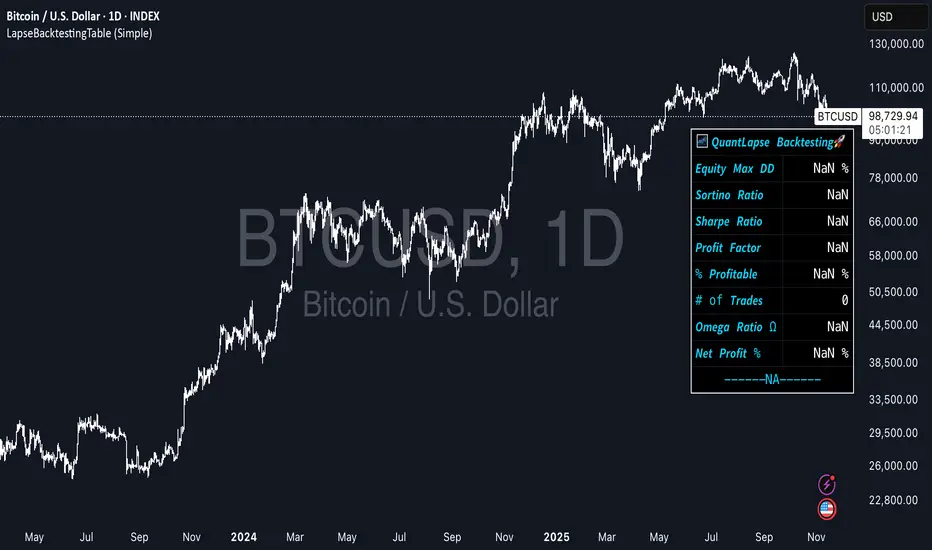

LapseBacktestingTable

Library "LapseBacktestingMetrics"

This library provides a robust set of quantitative backtesting and performance evaluation functions for Pine Script strategies. It’s designed to help traders, quants, and developers assess risk, return, and robustness through detailed statistical metrics — including Sharpe, Sortino, Omega, drawdowns, and trade efficiency.

Built to enhance any trading strategy’s evaluation framework, this library allows you to visualize performance with the quantlapseTable() function, producing an interactive on-chart performance table.

Credit to EliCobra and BikeLife76 for original concept inspiration.

curve(disp_ind)

Retrieves a selected performance curve of your strategy.

Parameters:

disp_ind (simple string): Type of curve to plot. Options include "Equity", "Open Profit", "Net Profit", "Gross Profit".

Returns: (float) Corresponding performance curve value.

cleaner(disp_ind, plot)

Filters and displays selected strategy plots for clean visualization.

Parameters:

disp_ind (simple string): Type of display.

plot (simple float): Strategy plot variable.

Returns: (float) Filtered plot value.

maxEquityDrawDown()

Calculates the maximum equity drawdown during the strategy’s lifecycle.

Returns: (float) Maximum equity drawdown percentage.

maxTradeDrawDown()

Computes the worst intra-trade drawdown among all closed trades.

Returns: (float) Maximum intra-trade drawdown percentage.

consecutive_wins()

Finds the highest number of consecutive winning trades.

Returns: (int) Maximum consecutive wins.

consecutive_losses()

Finds the highest number of consecutive losing trades.

Returns: (int) Maximum consecutive losses.

no_position()

Counts the maximum consecutive bars where no position was held.

Returns: (int) Maximum flat days count.

long_profit()

Calculates total profit generated by long positions as a percentage of initial capital.

Returns: (float) Total long profit %.

short_profit()

Calculates total profit generated by short positions as a percentage of initial capital.

Returns: (float) Total short profit %.

prev_month()

Measures the previous month’s profit or loss based on equity change.

Returns: (float) Monthly equity delta.

w_months()

Counts the number of profitable months in the backtest.

Returns: (int) Total winning months.

l_months()

Counts the number of losing months in the backtest.

Returns: (int) Total losing months.

checktf()

Returns the time-adjusted scaling factor used in Sharpe and Sortino ratio calculations based on chart timeframe.

Returns: (float) Annualization multiplier.

stat_calc()

Performs complete statistical computation including drawdowns, Sharpe, Sortino, Omega, trade stats, and profit ratios.

Returns: (array)

[equity_drawdown, intrade_drawdown, sharpe, sortino, omega, trades, profitable_percent, profit_factor, consecutive_win, consecutive_loss, total_winning_months, total_losing_months, net_profit_ls_ratio, netprofit].

f_colors(x, nv)

Generates a color gradient for performance values, supporting dynamic table visualization.

Parameters:

x (simple string): Metric label name.

nv (simple float): Metric numerical value.

Returns: (color) Gradient color value for table background.

quantlapseTable(option, position)

Displays an interactive Performance Table summarizing all major backtesting metrics.

Includes Sharpe, Sortino, Omega, Profit Factor, drawdowns, profitability %, and trade statistics.

Parameters:

option (simple string): Table type — "Full", "Simple", or "None".

position (simple string): Table position — "Top Left", "Middle Right", "Bottom Left", etc.

Returns: (table) On-chart performance visualization table.

This library empowers advanced quantitative evaluation directly within Pine Script®, ideal for strategy developers seeking deeper performance diagnostics and intuitive on-chart metrics.

This library provides a robust set of quantitative backtesting and performance evaluation functions for Pine Script strategies. It’s designed to help traders, quants, and developers assess risk, return, and robustness through detailed statistical metrics — including Sharpe, Sortino, Omega, drawdowns, and trade efficiency.

Built to enhance any trading strategy’s evaluation framework, this library allows you to visualize performance with the quantlapseTable() function, producing an interactive on-chart performance table.

Credit to EliCobra and BikeLife76 for original concept inspiration.

curve(disp_ind)

Retrieves a selected performance curve of your strategy.

Parameters:

disp_ind (simple string): Type of curve to plot. Options include "Equity", "Open Profit", "Net Profit", "Gross Profit".

Returns: (float) Corresponding performance curve value.

cleaner(disp_ind, plot)

Filters and displays selected strategy plots for clean visualization.

Parameters:

disp_ind (simple string): Type of display.

plot (simple float): Strategy plot variable.

Returns: (float) Filtered plot value.

maxEquityDrawDown()

Calculates the maximum equity drawdown during the strategy’s lifecycle.

Returns: (float) Maximum equity drawdown percentage.

maxTradeDrawDown()

Computes the worst intra-trade drawdown among all closed trades.

Returns: (float) Maximum intra-trade drawdown percentage.

consecutive_wins()

Finds the highest number of consecutive winning trades.

Returns: (int) Maximum consecutive wins.

consecutive_losses()

Finds the highest number of consecutive losing trades.

Returns: (int) Maximum consecutive losses.

no_position()

Counts the maximum consecutive bars where no position was held.

Returns: (int) Maximum flat days count.

long_profit()

Calculates total profit generated by long positions as a percentage of initial capital.

Returns: (float) Total long profit %.

short_profit()

Calculates total profit generated by short positions as a percentage of initial capital.

Returns: (float) Total short profit %.

prev_month()

Measures the previous month’s profit or loss based on equity change.

Returns: (float) Monthly equity delta.

w_months()

Counts the number of profitable months in the backtest.

Returns: (int) Total winning months.

l_months()

Counts the number of losing months in the backtest.

Returns: (int) Total losing months.

checktf()

Returns the time-adjusted scaling factor used in Sharpe and Sortino ratio calculations based on chart timeframe.

Returns: (float) Annualization multiplier.

stat_calc()

Performs complete statistical computation including drawdowns, Sharpe, Sortino, Omega, trade stats, and profit ratios.

Returns: (array)

[equity_drawdown, intrade_drawdown, sharpe, sortino, omega, trades, profitable_percent, profit_factor, consecutive_win, consecutive_loss, total_winning_months, total_losing_months, net_profit_ls_ratio, netprofit].

f_colors(x, nv)

Generates a color gradient for performance values, supporting dynamic table visualization.

Parameters:

x (simple string): Metric label name.

nv (simple float): Metric numerical value.

Returns: (color) Gradient color value for table background.

quantlapseTable(option, position)

Displays an interactive Performance Table summarizing all major backtesting metrics.

Includes Sharpe, Sortino, Omega, Profit Factor, drawdowns, profitability %, and trade statistics.

Parameters:

option (simple string): Table type — "Full", "Simple", or "None".

position (simple string): Table position — "Top Left", "Middle Right", "Bottom Left", etc.

Returns: (table) On-chart performance visualization table.

This library empowers advanced quantitative evaluation directly within Pine Script®, ideal for strategy developers seeking deeper performance diagnostics and intuitive on-chart metrics.

ספריית Pine

ברוח האמיתית של TradingView, המחבר לפרסם את הקוד של Pine הזה כספרייה בקוד פתוח, כך שמתכנתים אחרים בקהילתנו יעשו שימוש חוזר. כל הכבוד למחבר! ניתן להשתמש בספרייה הזו באופן פרטי או בומים בקוד פתוח, אך השימוש בחוזר בקוד הזה בפרסומים כפוף ל-כללי הבית.

⌛️ Get Invite-Only Access To Our World Class Systems ⬇️

whop.com/quantlapse-systems/

whop.com/quantlapse-systems/

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

ספריית Pine

ברוח האמיתית של TradingView, המחבר לפרסם את הקוד של Pine הזה כספרייה בקוד פתוח, כך שמתכנתים אחרים בקהילתנו יעשו שימוש חוזר. כל הכבוד למחבר! ניתן להשתמש בספרייה הזו באופן פרטי או בומים בקוד פתוח, אך השימוש בחוזר בקוד הזה בפרסומים כפוף ל-כללי הבית.

⌛️ Get Invite-Only Access To Our World Class Systems ⬇️

whop.com/quantlapse-systems/

whop.com/quantlapse-systems/

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.