OPEN-SOURCE SCRIPT

LSVR - Liquidity Sweep & Volume Reversal

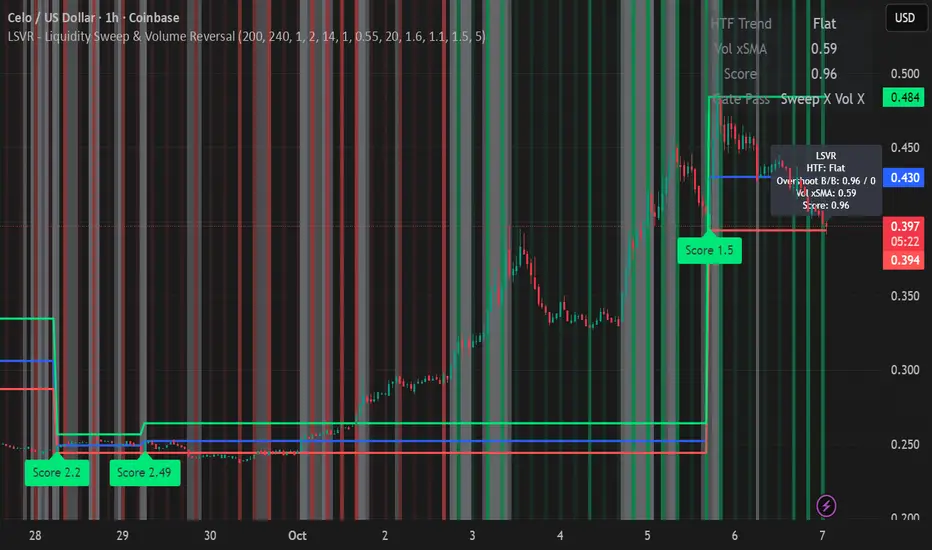

LSVR condenses a pro workflow into one visual overlay: Higher-Timeframe (HTF) Trend → Liquidity Sweep & Reclaim → Volume Confirmation. A signal only prints when all three gates align at bar close, and the chart shows everything you need—trend context, the sweep “trap” candle, and a projected Entry/SL/TP based on your chosen R multiple.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

How it works

HTF Trend Filter: Projects a smoothed KAMA/EMA from a higher timeframe to the chart using a safe, lookahead-off request. Long signals are considered only above the HTF line; shorts only below.

Liquidity Sweep & Reclaim: Finds confirmed swing highs/lows, then detects an ATR-scaled overshoot through that swing followed by a reclaim (close back inside a configurable % of the bar range).

Volume Confirmation: Requires either a volume spike over Volume SMA × multiplier or optional OBV divergence. No participation = no signal.

Score: Each setup is scored: trend (0/1) + overshoot strength (0..1.5) + conviction (0/1). Signals fire only when the score ≥ Min Signal Score.

What you see

HTF Ribbon (subtle green/red backdrop) for bias.

Sweep Box on the signal candle (green = long, red = short).

Signal markers (“L” / “S”) with a small score label.

Projected lines that persist until the next signal: Entry (close), Stop (beyond swept swing), Target (R multiple).

Heatmap that intensifies when the score crosses your threshold.

Dashboard (top-right): HTF direction, Volume×SMA, current Score, gate pass status.

Tooltip on the last bar with quick stats.

Quick start

Apply to any liquid symbol and set HTF to ~3–6× your chart timeframe (e.g., 15m chart → 1H–4H).

Trade with the HTF trend: take L signals above the HTF line and S signals below it.

Entry = signal bar close, SL = beyond the swept swing, TP = your Projected Take-Profit (R).

Tighten or loosen selectivity with Min Signal Score, Reclaim %, Overshoot (ATR×), and Cooldown.

Recommended presets

Choppy/crypto 15m: minScore 1.25, reclaimPct 0.60–0.65, overshootATR 1.0–1.2, useOBVDiv=false, cooldown 8.

FX 5m / session trend: minScore 1.0–1.1, reclaimPct 0.50–0.55, overshootATR 0.8–1.0, useOBVDiv=true, cooldown 5.

Indices 1m (RTH): minScore 1.2, reclaimPct 0.55–0.60, useOBVDiv=false, cooldown 10.

Non-repainting by design

HTF values use lookahead_off with realtime offset.

Swings are confirmed pivots (no “forming” pivots).

Signals print at bar close only.

Notes

OBV divergence can add sensitivity on liquid markets; keep it off for stricter filtering.

Use Cooldown to avoid clustered sweeps.

This is an overlay/analysis tool, not financial advice. Test settings in Replay/Paper Trading before using live.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.