PROTECTED SOURCE SCRIPT

MTF-RISK [Module+]

Description

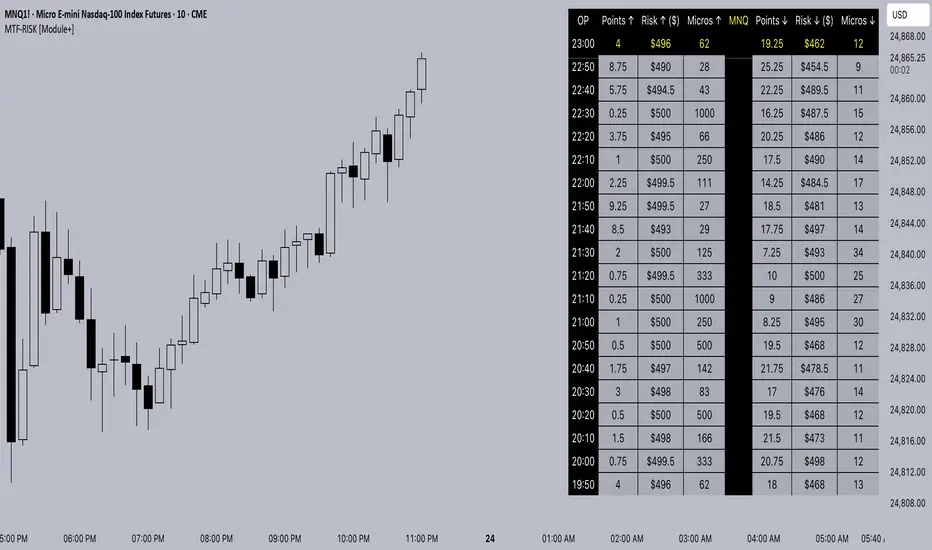

MTF-RISK [Module+] is a futures risk management tool that calculates standardized position sizing across multiple CME micro contracts, anchored to higher-timeframe structure. By combining multi-timeframe reference levels with a contract-based dollar-per-point model, it allows traders to maintain consistent risk across different futures markets.

Example:

User has selected the 1H timeframe for the risk table. Once an hourly candle closes, the high and low of that completed hour are locked as reference boundaries.

The risk table updates in real-time, showing the current stop distance, calculated contract size, and resulting risk in dollars for both upward and downward directions.

Benefit: Traders always maintain a fixed dollar risk, regardless of intraday price movement, while using HTF structure as the anchor for accurate and consistent position sizing.

1. Higher Timeframe Anchor

Use: Ensures all position sizing is tied to completed HTF structure, providing a consistent framework for intraday trades.

2. Risk Model Engine

Formula:

Contracts = Max Risk ÷ (Stop Distance × $TSE:VALUE per Point)

Use: Provides consistent dollar risk sizing across different futures contracts and multiple intraday timeframes.

3. Risk Table Overlay

Compact, real-time on-chart table with customizable styling.

Columns:

Custom features:

Use: Gives traders immediate insight into position sizing without leaving the chart.

Intended Use:

This is a risk visualization module, not a trade signal generator. Traders can use it to:

Limitations & Disclaimers:

MTF-RISK [Module+] is a futures risk management tool that calculates standardized position sizing across multiple CME micro contracts, anchored to higher-timeframe structure. By combining multi-timeframe reference levels with a contract-based dollar-per-point model, it allows traders to maintain consistent risk across different futures markets.

Example:

User has selected the 1H timeframe for the risk table. Once an hourly candle closes, the high and low of that completed hour are locked as reference boundaries.

- Lower timeframe candles (e.g., 1m, 5m, 15m) reference these established 1H boundaries to calculate:

- Distance in points from the current close to the HTF high or low.

- Corresponding dollar risk based on the user-defined Max Risk per Trade ($) setting.

The risk table updates in real-time, showing the current stop distance, calculated contract size, and resulting risk in dollars for both upward and downward directions.

Benefit: Traders always maintain a fixed dollar risk, regardless of intraday price movement, while using HTF structure as the anchor for accurate and consistent position sizing.

1. Higher Timeframe Anchor

- Always uses the last fully closed candle from the selected higher timeframe (default: 60m).

- Captures the prior HTF high and low as reference boundaries.

- Lower timeframe closers (e.g., 1m, 5m, 15m bars) reference these established HTF boundaries to measure stop distances and calculate risk.

Use: Ensures all position sizing is tied to completed HTF structure, providing a consistent framework for intraday trades.

2. Risk Model Engine

- Traders define maximum dollar risk per trade.

- The system calculates allowable micro contracts based on stop distance (current close → HTF high/low).

- Supported contracts and their point values:

- MNQ (Micro Nasdaq 100): $2.00 per point

- MES (Micro S&P 500): $5.00 per point

- MYM (Micro Dow Jones): $0.50 per point

- MGC (Micro Gold): $10.00 per point

Formula:

Contracts = Max Risk ÷ (Stop Distance × $TSE:VALUE per Point)

- Risk ↑: Based on distance to HTF high.

- Risk ↓: Based on distance to HTF low.

Use: Provides consistent dollar risk sizing across different futures contracts and multiple intraday timeframes.

3. Risk Table Overlay

Compact, real-time on-chart table with customizable styling.

Columns:

- OP: Operation time (adjusted by user’s timezone offset).

- Points ↑ / ↓: Stop distances in points relative to HTF boundaries.

- Risk ↑ / ↓ ($): Dollar exposure at those stops.

- Micros ↑ / ↓: Allowable contract count.

- Asset: Displays selected futures contract in the header.

Custom features:

- Independent text/background colors per column.

- Highlighted latest row for clarity.

- Adjustable outline, row colors, and text size.

Use: Gives traders immediate insight into position sizing without leaving the chart.

Intended Use:

This is a risk visualization module, not a trade signal generator. Traders can use it to:

- Standardize risk sizing across multiple CME micro futures.

- Quickly evaluate trade setups relative to HTF structure.

- Measure stop distances from lower timeframe closes while referencing HTF boundaries.

- Maintain consistency in risk management regardless of the instrument traded.

Limitations & Disclaimers:

- Calculations assume standard CME tick values for MNQ, MES, MYM, and MGC.

- Other markets may not align with these dollar-per-point values.

- This indicator does not predict direction, generate entries, or guarantee outcomes.

- For educational and informational purposes only.

- Trading involves risk; always use proper risk management.

- Closed-source (Protected): Logic is visible on charts, but source code is hidden.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.