PROTECTED SOURCE SCRIPT

מעודכן Pivot Volume Confluence

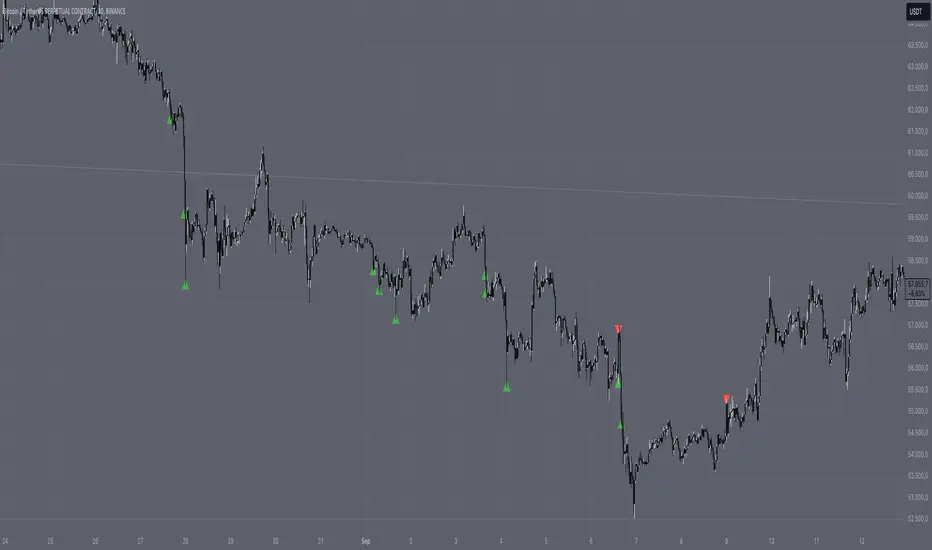

The Pivot Volume Confluence indicator is designed to help traders identify significant pivot points (local highs and lows) that are accompanied by increased trading volume. This combination can signal important market turning points and provides valuable insights into potential support and resistance areas.

Key Features:

• Pivot Point Identification: Automatically detects local highs and lows on the chart based on a customizable pivot length.

• Volume Analysis: Compares the volume at the pivot point with the average volume of the last N bars to recognize significant volume spikes.

• Timeframe-Based Adjustment: Automatically adjusts the indicator parameters according to the current timeframe for optimal performance across different timeframes.

• Custom Settings: Allows you to set your own values for pivot length and volume multiplier to tailor the indicator to your trading strategy.

• Visual Markers: Clearly highlights significant pivot points with high volume using colored symbols on the chart.

• Alerts: Integrates alert functionalities to notify you when important pivot points are detected.

Settings:

• Use Custom Settings: Enable this option to use your own parameters instead of automatic adjustments.

• Custom Pivot Length: Set the number of bars to be used for determining pivot points.

• Custom Volume Multiplier: Define the factor by which the average volume is multiplied to set the threshold for significant volume.

• Show Settings in Chart: Displays the current indicator settings directly on the chart.

How to Use the Indicator:

1. Add to Chart:

• Add the “Pivot Volume Confluence” indicator to your desired financial instrument.

2. Adjust Settings:

• Adjust the settings according to your needs or use the preset default values.

• Enable “Use Custom Settings” to input your own values for pivot length and volume multiplier.

3. Interpret the Signals:

• Red downward triangles mark pivot highs with significantly high volume and may indicate potential downward reversal points.

• Green upward triangles mark pivot lows with significantly high volume and may indicate potential upward reversal points.

• Use these markers to identify entry and exit points or to confirm existing trading positions.

4. Set Up Alerts:

• Set up alerts to be notified when a significant pivot point occurs.

• This allows you to react promptly to market movements without having to monitor the chart constantly.

Notes:

• Delay in Pivot Detection: Due to the calculation method, pivot points are recognized only after confirmation by subsequent bars. This leads to a natural delay that should be considered when interpreting the signals.

• Adjusting the Volume Multiplier: A lower multiplier will result in more signals, while a higher multiplier will highlight only the most significant volume spikes.

• Compatibility: The indicator is universally applicable and suitable for various markets such as stocks, forex, commodities, and cryptocurrencies.

• Performance: Using very short timeframes or having many charts open simultaneously may affect performance.

Benefits:

• Deep Market Analysis: By combining price and volume data, you gain a more comprehensive view of market activities.

• Flexibility: The ability to adjust settings allows you to fine-tune the indicator to your specific trading strategy.

• Notifications: With integrated alerts, you won’t miss important signals and can make timely trading decisions.

Disclaimer:

Please note that trading financial instruments involves risks and is not suitable for all investors. Past performance is not indicative of future results. Use this indicator as part of a comprehensive trading strategy and always conduct your own analysis.

Key Features:

• Pivot Point Identification: Automatically detects local highs and lows on the chart based on a customizable pivot length.

• Volume Analysis: Compares the volume at the pivot point with the average volume of the last N bars to recognize significant volume spikes.

• Timeframe-Based Adjustment: Automatically adjusts the indicator parameters according to the current timeframe for optimal performance across different timeframes.

• Custom Settings: Allows you to set your own values for pivot length and volume multiplier to tailor the indicator to your trading strategy.

• Visual Markers: Clearly highlights significant pivot points with high volume using colored symbols on the chart.

• Alerts: Integrates alert functionalities to notify you when important pivot points are detected.

Settings:

• Use Custom Settings: Enable this option to use your own parameters instead of automatic adjustments.

• Custom Pivot Length: Set the number of bars to be used for determining pivot points.

• Custom Volume Multiplier: Define the factor by which the average volume is multiplied to set the threshold for significant volume.

• Show Settings in Chart: Displays the current indicator settings directly on the chart.

How to Use the Indicator:

1. Add to Chart:

• Add the “Pivot Volume Confluence” indicator to your desired financial instrument.

2. Adjust Settings:

• Adjust the settings according to your needs or use the preset default values.

• Enable “Use Custom Settings” to input your own values for pivot length and volume multiplier.

3. Interpret the Signals:

• Red downward triangles mark pivot highs with significantly high volume and may indicate potential downward reversal points.

• Green upward triangles mark pivot lows with significantly high volume and may indicate potential upward reversal points.

• Use these markers to identify entry and exit points or to confirm existing trading positions.

4. Set Up Alerts:

• Set up alerts to be notified when a significant pivot point occurs.

• This allows you to react promptly to market movements without having to monitor the chart constantly.

Notes:

• Delay in Pivot Detection: Due to the calculation method, pivot points are recognized only after confirmation by subsequent bars. This leads to a natural delay that should be considered when interpreting the signals.

• Adjusting the Volume Multiplier: A lower multiplier will result in more signals, while a higher multiplier will highlight only the most significant volume spikes.

• Compatibility: The indicator is universally applicable and suitable for various markets such as stocks, forex, commodities, and cryptocurrencies.

• Performance: Using very short timeframes or having many charts open simultaneously may affect performance.

Benefits:

• Deep Market Analysis: By combining price and volume data, you gain a more comprehensive view of market activities.

• Flexibility: The ability to adjust settings allows you to fine-tune the indicator to your specific trading strategy.

• Notifications: With integrated alerts, you won’t miss important signals and can make timely trading decisions.

Disclaimer:

Please note that trading financial instruments involves risks and is not suitable for all investors. Past performance is not indicative of future results. Use this indicator as part of a comprehensive trading strategy and always conduct your own analysis.

הערות שחרור

# Pivot Volume Confluence Indicator## Description

The **Pivot Volume Confluence** indicator helps traders identify significant pivot points (local highs and lows) accompanied by increased trading volume. This combination can signal important market turning points and provides valuable insights into potential support and resistance areas.

## Key Features

- **Pivot Point Identification**: Automatically detects local highs and lows on the chart based on a customizable pivot length.

- **Volume Analysis**: Compares the volume at the pivot point with the average volume over a specified period to recognize significant volume spikes.

- **Timeframe-Based Adjustment**: Automatically adjusts indicator parameters according to the current timeframe for optimal performance across different timeframes.

- **Custom Settings**: Allows you to set your own values for pivot length, volume multiplier, and average volume period to tailor the indicator to your trading strategy.

- **Multiple Pivot Detection Methods**: Offers options to choose different methods for pivot detection, including:

- **Standard Pivot**

- **Reduced Pivot Length**

- **No Future Bars**

- **Volume Only**

- **Zero Right Bars**

- **Visual Markers**: Clearly highlights significant pivot points with high volume using colored symbols on the chart.

- **Alerts**: Integrates alert functionalities to notify you when important pivot points are detected.

## Settings

- **Use Custom Settings**: Enable this option to use your own parameters instead of automatic adjustments.

- **Custom Pivot Length**: Set the number of bars to be used for determining pivot points.

- **Custom Volume Multiplier**: Define the factor by which the average volume is multiplied to set the threshold for significant volume.

- **Volume Average Period (`volAvgPeriod`)**: Specify the number of bars over which the average volume is calculated. This parameter influences the sensitivity of the volume threshold.

- **Pivot Detection Method**: Choose the method for detecting pivot points:

- **Standard Pivot**: Uses standard pivot point calculation with the specified pivot length.

- **Reduced Pivot Length**: Uses a smaller pivot length to reduce delay in signal appearance.

- **No Future Bars**: Identifies potential pivots without requiring future bars, providing immediate signals.

- **Volume Only**: Marks bars based solely on high volume, without pivot detection.

- **Zero Right Bars**: Uses pivot functions with zero right bars, reducing delay but potentially increasing false signals.

- **Show Settings in Chart**: Displays the current indicator settings directly on the chart.

## How to Use the Indicator

1. **Add to Chart**:

- Add the "Pivot Volume Confluence" indicator to your desired financial instrument.

2. **Adjust Settings**:

- Customize the settings according to your needs or use the preset default values.

- Enable **Use Custom Settings** to input your own values for pivot length, volume multiplier, and average volume period.

- Select the desired **Pivot Detection Method** under the settings.

3. **Interpret the Signals**:

- **Red downward triangles** indicate pivot highs with significantly high volume, suggesting potential downward reversal points.

- **Green upward triangles** indicate pivot lows with significantly high volume, suggesting potential upward reversal points.

- Use these markers to identify entry and exit points or to confirm existing trading positions.

4. **Set Up Alerts**:

- Set up alerts to be notified when a significant pivot point occurs.

- This allows you to react promptly to market movements without constantly monitoring the chart.

## Understanding `volAvgPeriod`

- **Definition**: `volAvgPeriod` is the number of bars over which the average volume (`volAvg`) is calculated.

- **Function**: The average volume serves as a baseline to determine if the current volume is significantly higher than usual.

- **Impact on Indicator**:

- **Shorter `volAvgPeriod`**: Makes the average volume more responsive to recent changes, allowing quicker reactions to sudden volume increases.

- **Longer `volAvgPeriod`**: Smooths out short-term fluctuations, providing a more stable average but potentially making the indicator less responsive to recent volume spikes.

- **Adjustment Tips**:

- If you receive too many or too few signals, adjust `volAvgPeriod` to better match the volume characteristics of the instrument you're trading.

- For instruments with volatile volume, a longer `volAvgPeriod` may help reduce noise.

## Notes

- **Delay in Pivot Detection**:

- Depending on the selected pivot detection method, there may be a natural delay in signal appearance due to the need for confirmation from subsequent bars.

- **Adjusting the Volume Multiplier**:

- A lower multiplier results in more signals, while a higher multiplier highlights only the most significant volume spikes.

- **Performance Considerations**:

- Using very short timeframes or having many charts open simultaneously may affect performance, especially if the indicator generates numerous labels.

- **Testing Different Methods**:

- Experiment with different pivot detection methods and settings to find the combination that best suits your trading style.

## Benefits

- **Deep Market Analysis**: Combining price and volume data provides a comprehensive view of market activities.

- **Flexibility**: Adjustable settings allow you to fine-tune the indicator to your specific trading strategy.

- **Immediate Signals**: Options to reduce signal delay enable quicker responses to market changes.

- **Notifications**: Integrated alerts ensure you won't miss important signals, allowing timely trading decisions.

## Disclaimer

Trading financial instruments involves risks and may not be suitable for all investors. Past performance is not indicative of future results. Use this indicator as part of a comprehensive trading strategy and always conduct your own analysis.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

Discord: discord.gg/9QW9fHM6Cv

Website: lumospectra.com

Website: lumospectra.com

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

Discord: discord.gg/9QW9fHM6Cv

Website: lumospectra.com

Website: lumospectra.com

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.