OPEN-SOURCE SCRIPT

Market Structure Trailing Stop [BigBeluga]

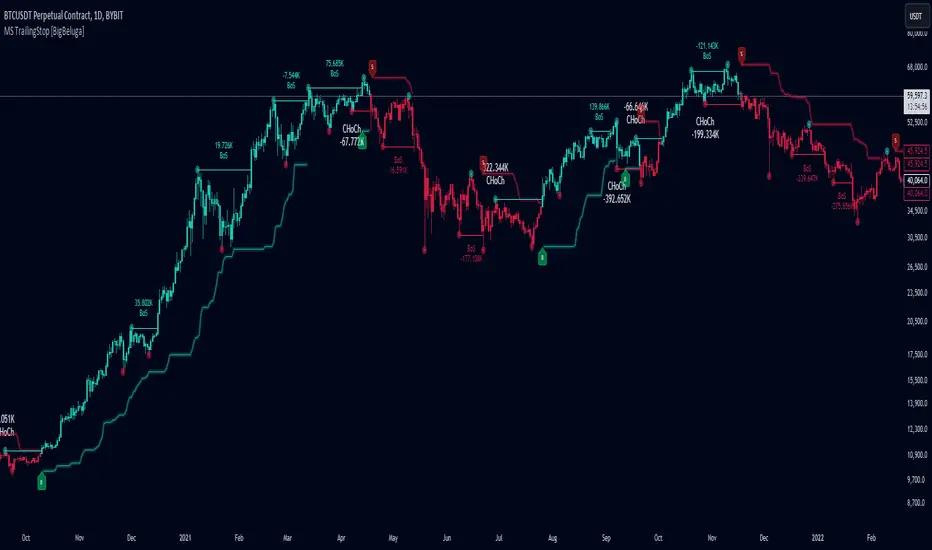

The Market Structure Trailing Stop indicator is an advanced tool for identifying market structure shifts, liquidity sweeps, and potential trend reversals using comprehensive volume analysis. This indicator combines the analysis of market structure pivots (CHoCH - Change of Character) with a sophisticated volume-based trailing stop logic. By evaluating delta volume at key structural points, it allows traders to identify high-probability trend continuations or reversals and manage their trades more effectively.

🔵 KEY FEATURES

● Market Structure Analysis

● Advanced Volume Analysis

● Trailing Stop Logic

● Liquidity Sweep Detection

🔵 HOW TO USE

● Identifying Market Structure Shifts

● Using the Trailing Stop Feature

● Liquidity Sweep Interpretation

🔵 CUSTOMIZATION

🔵 CONCLUSION

The Market Structure Trailing Stop indicator combines advanced volume analysis with market structure detection to provide traders with a powerful tool for identifying and managing trends. By leveraging delta volume at key structure points, it helps traders validate trend strength and manage their positions with a dynamic trailing stop strategy. The addition of liquidity sweep detection further enhances its utility, offering early warnings of potential trend reversals. This indicator is ideal for traders who want to gain a deeper understanding of market structure while incorporating volume-based insights into their trading strategies.

🔵 KEY FEATURES

● Market Structure Analysis

- Pivot-Based Market Structure: The indicator identifies high and lows using user-defined periods, allowing traders to spot key market structure shifts.

- Change of Character (CHoCH): The first significant break of a market structure is marked as a CHoCH, indicating a potential trend reversal.

- Break of Structure (BoS): The indicator highlights subsequent breaks of structure after CHoCH, providing traders with crucial insights into trend strength.

● Advanced Volume Analysis

- Delta Volume Evaluation: The indicator calculates delta volume (difference between up and down volume) at each ChoCh or BoS market structure point to assess the strength of the move. Identify Delta Volume from break point back to Pivot

● Trailing Stop Logic

- Volume-Validated Trailing Stop: The indicator automatically plots a trailing stop if the delta volume at the UP CHoCH is positive and above the defined threshold and vice versa for Down CHoCH , allowing traders to protect their profits while riding the trend.

- Trend Weakness Detection: If a subsequent BoS occurs with negative delta volume or lower volume than the input threshold, the trailing stop disappears, indicating potential trend exhaustion or reversal.

- Dynamic Stop Placement: The trailing stop is dynamically adjusted based on market structure and volume, providing traders with a more adaptive stop-loss strategy.

Up Trend Trailing Stop:Down Trend Trailing Stop:

● Liquidity Sweep Detection

- Liquidity Sweep (X) Labels: The indicator identifies liquidity sweeps—points where the price temporarily reverses to sweep liquidity above or below a key level—marked with an “X” label.

- Potential Reversal Zones: These liquidity sweeps are potential reversal zones, especially when accompanied by significant delta volume changes, providing traders with early warnings of potential trend reversals.

🔵 HOW TO USE

● Identifying Market Structure Shifts

- Change of Character (CHoCH): When a CHoCH occurs, the indicator calculates the total volume from the high point to the break point. If the delta volume is positive and exceeds the input threshold, a trailing stop is plotted, signaling potential trend continuation.

- Break of Structure (BoS): If BoS is enabled, subsequent breaks of structure are highlighted. If these BoS points show weaker volume or negative delta volume, the trailing stop will disappear, indicating that the trend may be losing strength.

● Using the Trailing Stop Feature

- Protecting Profits: Once a CHoCH occurs and the delta volume validates the trend, the trailing stop will be plotted below (or above) the price to protect profits while allowing the trend to run.

- Trend Reversal Signals: If the trailing stop disappears due to weak volume at subsequent BoS points, it may signal that the trend is losing momentum, and traders may consider closing their positions or tightening their stops manually.

● Liquidity Sweep Interpretation

- Spotting Reversal Zones: Liquidity sweeps, marked with an “X” label, indicate zones where the price has swept liquidity. These areas can serve as potential reversal zones, especially when significant delta volume is observed at these points.

- Early Reversal Warnings: Traders can use these liquidity sweep labels as early warnings for potential trend reversals, particularly in conjunction with other technical analysis methods.

🔵 CUSTOMIZATION

- Highs and Lows Calculation: Customize the number of bars to the left and right for identifying pivots and market structure shifts.

- Volume Threshold: Define the volume threshold to filter out weaker moves and focus on significant market structure shifts.

- BoS and Liquidity Sweep Labels: Toggle on or off the BoS and Liquidity Sweep labels to tailor the indicator to your trading style.

- Trend Color: Enable or disable trend coloring for candles to visually highlight uptrends and downtrends on the chart.

🔵 CONCLUSION

The Market Structure Trailing Stop indicator combines advanced volume analysis with market structure detection to provide traders with a powerful tool for identifying and managing trends. By leveraging delta volume at key structure points, it helps traders validate trend strength and manage their positions with a dynamic trailing stop strategy. The addition of liquidity sweep detection further enhances its utility, offering early warnings of potential trend reversals. This indicator is ideal for traders who want to gain a deeper understanding of market structure while incorporating volume-based insights into their trading strategies.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.