PROTECTED SOURCE SCRIPT

מעודכן QuantFrame | Fractalyst

What’s the purpose of this indicator?

The purpose of QuantFrame is to provide traders with a systematic approach to analyzing market structure, eliminating subjectivity, and enhancing decision-making. By clearly identifying and labeling structural breaks, QuantFrame helps traders:

1. Refine Market Analysis: Transition from discretionary market observation to a structured framework.

2. Identify Key Levels: Highlight important liquidity and invalidation zones for potential entries, exits, and risk management.

3. Streamline Multi-Timeframe Analysis: Track market trends and structural changes across different timeframes seamlessly.

4. Enhance Consistency: Reduce guesswork by following a rule-based methodology for identifying structural breaks.

How Does This Indicator Identify Market Structure?

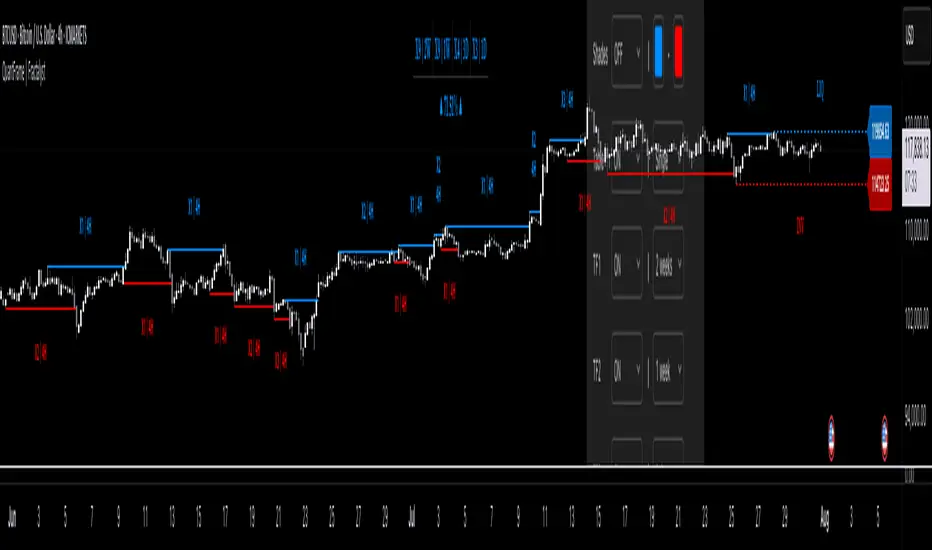

1. Swing Detection

• The indicator identifies key swing points on the chart. These are local highs or lows where the price reverses direction, forming the foundation of market structure.

2. Structural Break Validation

• A structural break is flagged when a candle closes above a previous swing high (bullish) or below a previous swing low (bearish).

• Break Confirmation Process:

To confirm the break, the indicator applies the following rules:

• Valid Swing Preceding the Break: There must be at least one valid swing point before the break.

3. Numeric Labeling

• Each confirmed structural break is assigned a unique numeric ID starting from 1.

• This helps traders track breaks sequentially and analyze how the market structure evolves over time.

4. Liquidity and Invalidation Zones

• For every confirmed structural break, the indicator highlights two critical zones:

1. Liquidity Zone (LIQ): Represents the structural liquidity level.

2. Invalidation Zone (INV): Acts as Invalidation point if the structure fails to hold.

What do the extremities show us on the charts?

When using QuantFrame for market structure analysis, the extremities—Liquidity Level (LIQ) and Invalidation Level (INV)—serve as critical reference points for understanding price behavior and making informed trading decisions.

Here's a detailed explanation of what these extremities represent and how they function:

Liquidity Level (LIQ)

Definition: The Liquidity Level is a key price zone where the market is likely to retest, consolidate, or seek liquidity. It represents areas where orders are concentrated, making it a high-probability reaction zone.

Purpose: Traders use this level to anticipate potential pullbacks or continuation patterns. It helps in identifying areas where price may pause or reverse temporarily due to the presence of significant liquidity.

Key Insight: If a candle closes above or below the LIQ, it results in another break of structure (BOS) in the same direction. This indicates that price is continuing its trend and has successfully absorbed liquidity at that level.

Invalidation Level (INV)

Definition: The Invalidation Level marks the threshold that, if breached, signifies a structural shift in the market. It acts as a critical point where the current market bias becomes invalid.

Purpose: This level is often used as a stop-loss or re-evaluation point for trading strategies. It ensures that traders have a clear boundary for risk management.

Key Insight: If a candle closes above or below the INV, it signals a shift in market structure:

A closure above the INV in a bearish trend indicates a shift from bearish to bullish bias.

A closure below the INV in a bullish trend indicates a shift from bullish to bearish bias.

What does the top table display?

The top table in QuantFrame serves as a multi-timeframe trend overview. Here’s what it provides:

1. Numeric Break IDs Across Multiple Timeframes:

• Each numeric break corresponds to a confirmed structural break on a specific timeframe, helping traders track the most recent breaks systematically.

2. Trend Direction via Text Color:

• The color of the text reflects the current trend direction:

• Blue indicates a bullish structure.

• Red signifies a bearish structure.

3. Higher Timeframe Insights Without Manual Switching:

• The table eliminates the need to switch between timeframes by presenting a consolidated view of the market trend across multiple timeframes, saving time and improving decision-making.

What is the Multi-Timeframe Trend Score (MTTS)?

MTTS is a score that quantifies trend strength and direction across multiple timeframes.

How does MTTS work?

1. Break Detection:

• Analyzes bullish and bearish structural breaks on each timeframe.

2. Trend Scoring:

• Scores each timeframe based on the frequency and quality of bullish/bearish breaks.

3. MTTS Calculation:

• Averages the scores across all timeframes to produce a unified trend strength value.

How is MTTS interpreted?

• ⬆ (Above 50): Indicates an overall bullish trend.

• ⬇ (Below 50): Suggests an overall bearish trend.

• ⇅ (Exactly 50): Represents a neutral or balanced market structure.

How to Use QuantFrame?

1. Implement a Systematic Market Structure Framework:

• Use QuantFrame to analyze market structure objectively by identifying key structural breaks and marking liquidity (LIQ) and invalidation (INV) zones.

• This eliminates guesswork and provides a clear framework for understanding market movements.

2. Leverage MTTS for Directional Bias:

• Refer to the MTTS table to identify the multi-timeframe directional bias, giving you the broader market context.

• Align your trading decisions with the overall trend or structure to improve accuracy and consistency.

3. Apply Your Preferred Entry Model:

• Once the market context is clear, use your preferred entry model to capitalize on the identified structure and trend.

• Manage trades dynamically as price delivers, using the provided liquidity and invalidation zones for risk management.

What Makes QuantFrame Original?

1. Objective Market Structure Analysis:

• Unlike subjective methods, QuantFrame uses a rule-based approach to identify structural breaks, ensuring consistency and reducing emotional decision-making.

2. Multi-Timeframe Integration:

• The MTTS table consolidates trend data across multiple timeframes, offering a bird’s-eye view of market trends without the need to switch charts manually.

• This unique feature allows traders to align strategies with higher-timeframe trends for more informed decision-making.

3. Liquidity and Invalidation Zones:

• Automatically marks Liquidity (LIQ) and Invalidation (INV) zones for every structural break, providing actionable levels for entries, exits, and risk management.

• These zones help traders define their risk-reward setups with precision.

4. Dynamic Trend Scoring (MTTS):

• The Multi-Timeframe Trend Score (MTTS) quantifies trend strength and direction across selected timeframes, offering a single, consolidated metric for market sentiment.

• This score is visualized with intuitive symbols (⬆, ⬇, ⇅) for quick decision-making.

5. Numeric Labeling of Breaks:

• Each structural break is assigned a unique numeric ID, making it easy to track, analyze, and backtest specific market scenarios.

6. Systematic Yet Flexible:

• While it provides a structured framework for market analysis, QuantFrame seamlessly integrates with any trading style. Traders can use it alongside their preferred entry models, adapting it to their unique strategies.

7. Enhanced Market Context:

• By combining structural insights with directional bias (via MTTS), the indicator equips traders with a complete market context, enabling them to make better-informed decisions.

Terms and Conditions | Disclaimer

Our charting tools are provided for informational and educational purposes only and should not be construed as financial, investment, or trading advice. They are not intended to forecast market movements or offer specific recommendations. Users should understand that past performance does not guarantee future results and should not base financial decisions solely on historical data.

Built-in components, features, and functionalities of our charting tools are the intellectual property of Fractalyst use, reproduction, or distribution of these proprietary elements is prohibited.

By continuing to use our charting tools, the user acknowledges and accepts the Terms and Conditions outlined in this legal disclaimer and agrees to respect our intellectual property rights and comply with all applicable laws and regulations.

The purpose of QuantFrame is to provide traders with a systematic approach to analyzing market structure, eliminating subjectivity, and enhancing decision-making. By clearly identifying and labeling structural breaks, QuantFrame helps traders:

1. Refine Market Analysis: Transition from discretionary market observation to a structured framework.

2. Identify Key Levels: Highlight important liquidity and invalidation zones for potential entries, exits, and risk management.

3. Streamline Multi-Timeframe Analysis: Track market trends and structural changes across different timeframes seamlessly.

4. Enhance Consistency: Reduce guesswork by following a rule-based methodology for identifying structural breaks.

How Does This Indicator Identify Market Structure?

1. Swing Detection

• The indicator identifies key swing points on the chart. These are local highs or lows where the price reverses direction, forming the foundation of market structure.

2. Structural Break Validation

• A structural break is flagged when a candle closes above a previous swing high (bullish) or below a previous swing low (bearish).

• Break Confirmation Process:

To confirm the break, the indicator applies the following rules:

• Valid Swing Preceding the Break: There must be at least one valid swing point before the break.

3. Numeric Labeling

• Each confirmed structural break is assigned a unique numeric ID starting from 1.

• This helps traders track breaks sequentially and analyze how the market structure evolves over time.

4. Liquidity and Invalidation Zones

• For every confirmed structural break, the indicator highlights two critical zones:

1. Liquidity Zone (LIQ): Represents the structural liquidity level.

2. Invalidation Zone (INV): Acts as Invalidation point if the structure fails to hold.

What do the extremities show us on the charts?

When using QuantFrame for market structure analysis, the extremities—Liquidity Level (LIQ) and Invalidation Level (INV)—serve as critical reference points for understanding price behavior and making informed trading decisions.

Here's a detailed explanation of what these extremities represent and how they function:

Liquidity Level (LIQ)

Definition: The Liquidity Level is a key price zone where the market is likely to retest, consolidate, or seek liquidity. It represents areas where orders are concentrated, making it a high-probability reaction zone.

Purpose: Traders use this level to anticipate potential pullbacks or continuation patterns. It helps in identifying areas where price may pause or reverse temporarily due to the presence of significant liquidity.

Key Insight: If a candle closes above or below the LIQ, it results in another break of structure (BOS) in the same direction. This indicates that price is continuing its trend and has successfully absorbed liquidity at that level.

Invalidation Level (INV)

Definition: The Invalidation Level marks the threshold that, if breached, signifies a structural shift in the market. It acts as a critical point where the current market bias becomes invalid.

Purpose: This level is often used as a stop-loss or re-evaluation point for trading strategies. It ensures that traders have a clear boundary for risk management.

Key Insight: If a candle closes above or below the INV, it signals a shift in market structure:

A closure above the INV in a bearish trend indicates a shift from bearish to bullish bias.

A closure below the INV in a bullish trend indicates a shift from bullish to bearish bias.

What does the top table display?

The top table in QuantFrame serves as a multi-timeframe trend overview. Here’s what it provides:

1. Numeric Break IDs Across Multiple Timeframes:

• Each numeric break corresponds to a confirmed structural break on a specific timeframe, helping traders track the most recent breaks systematically.

2. Trend Direction via Text Color:

• The color of the text reflects the current trend direction:

• Blue indicates a bullish structure.

• Red signifies a bearish structure.

3. Higher Timeframe Insights Without Manual Switching:

• The table eliminates the need to switch between timeframes by presenting a consolidated view of the market trend across multiple timeframes, saving time and improving decision-making.

What is the Multi-Timeframe Trend Score (MTTS)?

MTTS is a score that quantifies trend strength and direction across multiple timeframes.

How does MTTS work?

1. Break Detection:

• Analyzes bullish and bearish structural breaks on each timeframe.

2. Trend Scoring:

• Scores each timeframe based on the frequency and quality of bullish/bearish breaks.

3. MTTS Calculation:

• Averages the scores across all timeframes to produce a unified trend strength value.

How is MTTS interpreted?

• ⬆ (Above 50): Indicates an overall bullish trend.

• ⬇ (Below 50): Suggests an overall bearish trend.

• ⇅ (Exactly 50): Represents a neutral or balanced market structure.

How to Use QuantFrame?

1. Implement a Systematic Market Structure Framework:

• Use QuantFrame to analyze market structure objectively by identifying key structural breaks and marking liquidity (LIQ) and invalidation (INV) zones.

• This eliminates guesswork and provides a clear framework for understanding market movements.

2. Leverage MTTS for Directional Bias:

• Refer to the MTTS table to identify the multi-timeframe directional bias, giving you the broader market context.

• Align your trading decisions with the overall trend or structure to improve accuracy and consistency.

3. Apply Your Preferred Entry Model:

• Once the market context is clear, use your preferred entry model to capitalize on the identified structure and trend.

• Manage trades dynamically as price delivers, using the provided liquidity and invalidation zones for risk management.

What Makes QuantFrame Original?

1. Objective Market Structure Analysis:

• Unlike subjective methods, QuantFrame uses a rule-based approach to identify structural breaks, ensuring consistency and reducing emotional decision-making.

2. Multi-Timeframe Integration:

• The MTTS table consolidates trend data across multiple timeframes, offering a bird’s-eye view of market trends without the need to switch charts manually.

• This unique feature allows traders to align strategies with higher-timeframe trends for more informed decision-making.

3. Liquidity and Invalidation Zones:

• Automatically marks Liquidity (LIQ) and Invalidation (INV) zones for every structural break, providing actionable levels for entries, exits, and risk management.

• These zones help traders define their risk-reward setups with precision.

4. Dynamic Trend Scoring (MTTS):

• The Multi-Timeframe Trend Score (MTTS) quantifies trend strength and direction across selected timeframes, offering a single, consolidated metric for market sentiment.

• This score is visualized with intuitive symbols (⬆, ⬇, ⇅) for quick decision-making.

5. Numeric Labeling of Breaks:

• Each structural break is assigned a unique numeric ID, making it easy to track, analyze, and backtest specific market scenarios.

6. Systematic Yet Flexible:

• While it provides a structured framework for market analysis, QuantFrame seamlessly integrates with any trading style. Traders can use it alongside their preferred entry models, adapting it to their unique strategies.

7. Enhanced Market Context:

• By combining structural insights with directional bias (via MTTS), the indicator equips traders with a complete market context, enabling them to make better-informed decisions.

Terms and Conditions | Disclaimer

Our charting tools are provided for informational and educational purposes only and should not be construed as financial, investment, or trading advice. They are not intended to forecast market movements or offer specific recommendations. Users should understand that past performance does not guarantee future results and should not base financial decisions solely on historical data.

Built-in components, features, and functionalities of our charting tools are the intellectual property of Fractalyst use, reproduction, or distribution of these proprietary elements is prohibited.

By continuing to use our charting tools, the user acknowledges and accepts the Terms and Conditions outlined in this legal disclaimer and agrees to respect our intellectual property rights and comply with all applicable laws and regulations.

הערות שחרור

- Bug fix and improvementsסקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

📈 | Track record:

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

📈 | Track record:

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.