OPEN-SOURCE SCRIPT

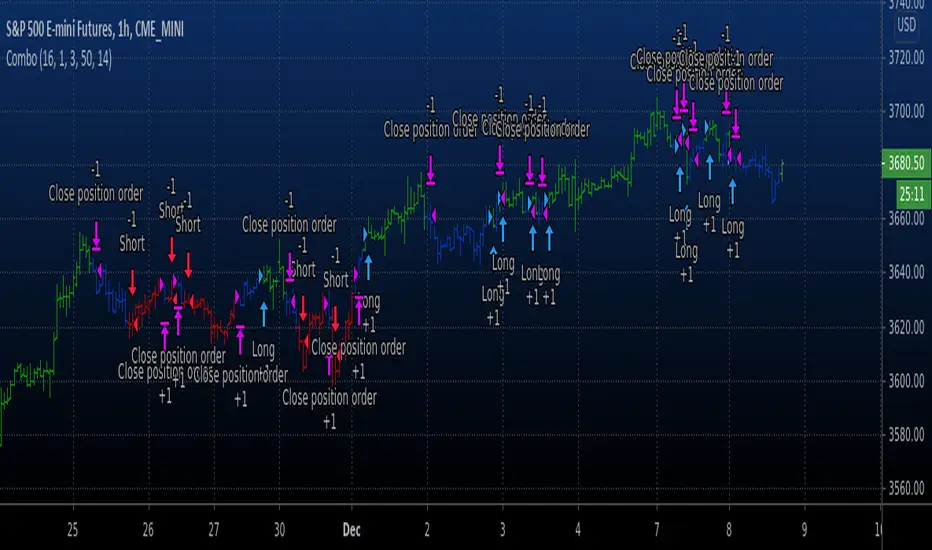

Combo Backtest 123 Reversal & Kaufman Moving Average Adaptive

// This is combo strategies for get a cumulative signal.

//

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Everyone wants a short-term, fast trading trend that works without large

losses. That combination does not exist. But it is possible to have fast

trading trends in which one must get in or out of the market quickly, but

these have the distinct disadvantage of being whipsawed by market noise

when the market is volatile in a sideways trending market. During these

periods, the trader is jumping in and out of positions with no profit-making

trend in sight. In an attempt to overcome the problem of noise and still be

able to get closer to the actual change of the trend, Kaufman developed an

indicator that adapts to market movement. This indicator, an adaptive moving

average (AMA), moves very slowly when markets are moving sideways but moves

swiftly when the markets also move swiftly, change directions or break out of

a trading range.

WARNING:

- For purpose educate only

- This script to change bars colors.

//

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Everyone wants a short-term, fast trading trend that works without large

losses. That combination does not exist. But it is possible to have fast

trading trends in which one must get in or out of the market quickly, but

these have the distinct disadvantage of being whipsawed by market noise

when the market is volatile in a sideways trending market. During these

periods, the trader is jumping in and out of positions with no profit-making

trend in sight. In an attempt to overcome the problem of noise and still be

able to get closer to the actual change of the trend, Kaufman developed an

indicator that adapts to market movement. This indicator, an adaptive moving

average (AMA), moves very slowly when markets are moving sideways but moves

swiftly when the markets also move swiftly, change directions or break out of

a trading range.

WARNING:

- For purpose educate only

- This script to change bars colors.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.