OPEN-SOURCE SCRIPT

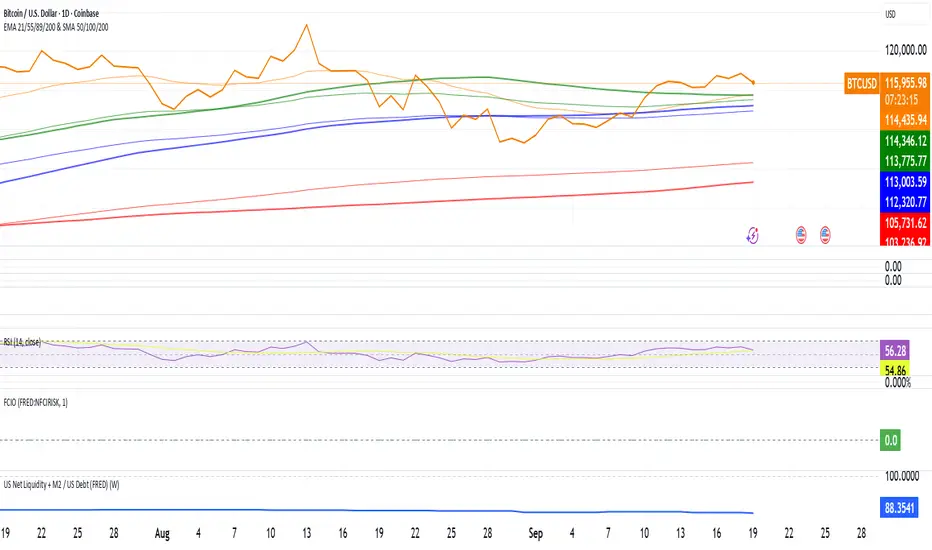

US Net Liquidity + M2 / US Debt (FRED)

US Net Liquidity + M2 / US Debt

🧩 What this chart shows

This indicator plots the ratio of US Net Liquidity + M2 Money Supply divided by Total Public Debt.

US Net Liquidity is defined here as the Federal Reserve Balance Sheet (WALCL) minus the Treasury General Account (TGA) and the Overnight Reverse Repo facility (ON RRP).

M2 Money Supply represents the broad pool of liquid money circulating in the economy.

US Debt uses the Federal Government’s total outstanding debt.

By combining net liquidity with M2, then dividing by total debt, this chart provides a structural view of how much monetary “fuel” is in the system relative to the size of the federal debt load.

🧮 Formula

Ratio

=

(

Fed Balance Sheet

−

(

TGA

+

ON RRP

)

)

+

M2

Total Public Debt

Ratio=

Total Public Debt

(Fed Balance Sheet−(TGA+ON RRP))+M2

An optional normalization feature scales the ratio to start at 100 on the first valid bar, making long-term trends easier to compare.

🔎 Why it matters

Liquidity vs. Debt Growth: The numerator (Net Liquidity + M2) captures the monetary resources available to markets, while the denominator (Debt) reflects the expanding obligation of the federal government.

Market Signal: Historically, shifts in net liquidity and money supply relative to debt have coincided with major turning points in risk assets like equities and Bitcoin.

Context: A rising ratio may suggest that liquidity conditions are improving relative to debt expansion, which can be supportive for risk assets. Conversely, a falling ratio may highlight tightening conditions or debt outpacing liquidity growth.

⚙️ How to use it

Overlay this chart against S&P 500, Bitcoin, or gold to analyze correlations with asset performance.

Watch for trend inflections—does the ratio bottom before equities rally, or peak before risk-off periods?

Use normalization for long historical comparisons, or raw values to see the absolute ratio.

📊 Data sources

This indicator pulls from FRED (Federal Reserve Economic Data) tickers available in TradingView:

WALCL: Fed balance sheet

RRPONTSYD: Overnight Reverse Repo

WTREGEN: Treasury General Account

M2SL: M2 money stock

GFDEBTN: Total federal public debt

⚠️ Notes

Some FRED series are updated weekly, others monthly—set your chart timeframe accordingly.

If any ticker is unavailable in your plan, replace it with the equivalent FRED symbol provided in TradingView.

This indicator is intended for macro analysis, not short-term trading signals.

🧩 What this chart shows

This indicator plots the ratio of US Net Liquidity + M2 Money Supply divided by Total Public Debt.

US Net Liquidity is defined here as the Federal Reserve Balance Sheet (WALCL) minus the Treasury General Account (TGA) and the Overnight Reverse Repo facility (ON RRP).

M2 Money Supply represents the broad pool of liquid money circulating in the economy.

US Debt uses the Federal Government’s total outstanding debt.

By combining net liquidity with M2, then dividing by total debt, this chart provides a structural view of how much monetary “fuel” is in the system relative to the size of the federal debt load.

🧮 Formula

Ratio

=

(

Fed Balance Sheet

−

(

TGA

+

ON RRP

)

)

+

M2

Total Public Debt

Ratio=

Total Public Debt

(Fed Balance Sheet−(TGA+ON RRP))+M2

An optional normalization feature scales the ratio to start at 100 on the first valid bar, making long-term trends easier to compare.

🔎 Why it matters

Liquidity vs. Debt Growth: The numerator (Net Liquidity + M2) captures the monetary resources available to markets, while the denominator (Debt) reflects the expanding obligation of the federal government.

Market Signal: Historically, shifts in net liquidity and money supply relative to debt have coincided with major turning points in risk assets like equities and Bitcoin.

Context: A rising ratio may suggest that liquidity conditions are improving relative to debt expansion, which can be supportive for risk assets. Conversely, a falling ratio may highlight tightening conditions or debt outpacing liquidity growth.

⚙️ How to use it

Overlay this chart against S&P 500, Bitcoin, or gold to analyze correlations with asset performance.

Watch for trend inflections—does the ratio bottom before equities rally, or peak before risk-off periods?

Use normalization for long historical comparisons, or raw values to see the absolute ratio.

📊 Data sources

This indicator pulls from FRED (Federal Reserve Economic Data) tickers available in TradingView:

WALCL: Fed balance sheet

RRPONTSYD: Overnight Reverse Repo

WTREGEN: Treasury General Account

M2SL: M2 money stock

GFDEBTN: Total federal public debt

⚠️ Notes

Some FRED series are updated weekly, others monthly—set your chart timeframe accordingly.

If any ticker is unavailable in your plan, replace it with the equivalent FRED symbol provided in TradingView.

This indicator is intended for macro analysis, not short-term trading signals.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.