OPEN-SOURCE SCRIPT

מעודכן [COG]StochRSI Zenith

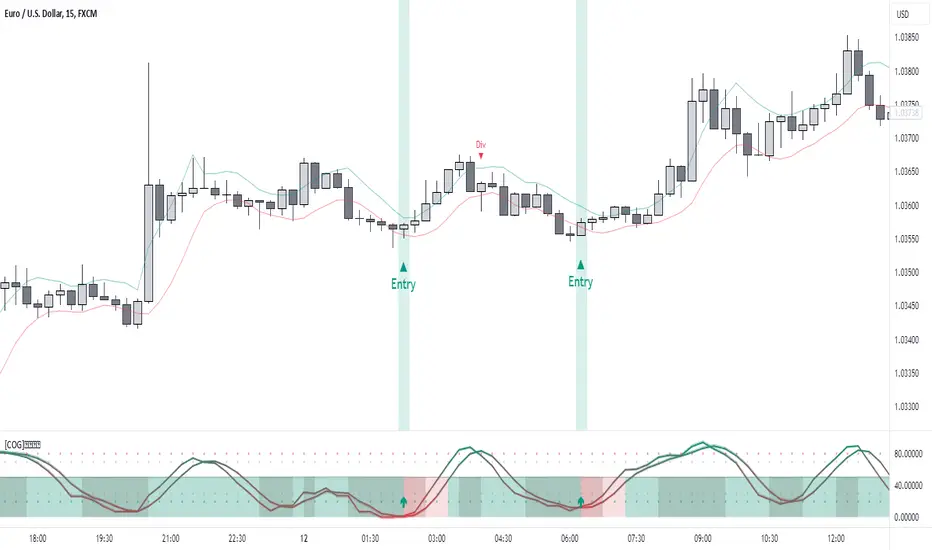

📊 [COG]StochRSI Zenith

This indicator combines the traditional Stochastic RSI with enhanced visualization features and multi-timeframe analysis capabilities. It's designed to provide traders with a comprehensive view of market conditions through various technical components.

🔑 Key Features:

• Advanced StochRSI Implementation

- Customizable RSI and Stochastic calculation periods

- Multiple moving average type options (SMA, EMA, SMMA, LWMA)

- Adjustable signal line parameters

• Visual Enhancement System

- Dynamic wave effect visualization

- Energy field display for momentum visualization

- Customizable color schemes for bullish and bearish signals

- Adaptive transparency settings

• Multi-Timeframe Analysis

- Higher timeframe confirmation

- Synchronized market structure analysis

- Cross-timeframe signal validation

• Divergence Detection

- Automated bullish and bearish divergence identification

- Customizable lookback period

- Clear visual signals for confirmed divergences

• Signal Generation Framework

- Price action confirmation

- SMA-based trend filtering

- Multiple confirmation levels for reduced noise

- Clear entry signals with customizable display options

📈 Technical Components:

1. Core Oscillator

- Base calculation: 13-period RSI (adjustable)

- Stochastic calculation: 8-period (adjustable)

- Signal lines: 5,3 smoothing (adjustable)

2. Visual Systems

- Wave effect with three layers of visualization

- Energy field display with dynamic intensity

- Reference bands at 20/30/50/70/80 levels

3. Confirmation Mechanisms

- SMA trend filter

- Higher timeframe alignment

- Price action validation

- Divergence confirmation

⚙️ Customization Options:

• Visual Parameters

- Wave effect intensity and speed

- Energy field sensitivity

- Color schemes for bullish/bearish signals

- Signal display preferences

• Technical Parameters

- All core calculation periods

- Moving average types

- Divergence detection settings

- Signal confirmation criteria

• Display Settings

- Chart and indicator signal placement

- SMA line visualization

- Background highlighting options

- Label positioning and size

🔍 Technical Implementation:

The indicator combines several advanced techniques to generate signals. Here are key components with code examples:

1. Core StochRSI Calculation:

// Base RSI calculation

Pine Script®

// StochRSI transformation

Pine Script®

2. Signal Generation System:

// Core signal conditions

Pine Script®

// Enhanced signal generation

Pine Script®

3. Multi-Timeframe Analysis:

Pine Script®

The HTF filter looks at a higher timeframe (default: 4H) to confirm the trend

It only allows:

Long trades when the higher timeframe is bullish

Short trades when the higher timeframe is bearish

📈 Trading Application Guide:

1. Signal Identification

• Oversold Opportunities (< 30 level)

- Look for bullish crosses of K-line above D-line

- Confirm with higher timeframe alignment

- Wait for price action confirmation (bullish candle)

• Overbought Conditions (> 70 level)

- Watch for bearish crosses of K-line below D-line

- Verify higher timeframe condition

- Confirm with bearish price action

2. Divergence Trading

• Bullish Divergence

- Price makes lower lows while indicator makes higher lows

- Most effective when occurring in oversold territory

- Use with support levels for entry timing

• Bearish Divergence

- Price makes higher highs while indicator shows lower highs

- Most reliable in overbought conditions

- Combine with resistance levels

3. Wave Effect Analysis

• Strong Waves

- Multiple wave lines moving in same direction indicate momentum

- Wider wave spread suggests increased volatility

- Use for trend strength confirmation

• Energy Field

- Higher intensity in trading zones suggests stronger moves

- Use for momentum confirmation

- Watch for energy field convergence with price action

The energy field is like a heat map that shows momentum strength

It gets stronger (more visible) when:

Price is in oversold (<30) or overbought (>70) zones

The indicator lines are moving apart quickly

A strong signal is forming

Think of it as a "strength meter" - the more visible the energy field, the stronger the potential move

4. Risk Management Integration

• Entry Confirmation

- Wait for all signal components to align

- Use higher timeframe for trend direction

- Confirm with price action and SMA positions

• Stop Loss Placement

- Consider placing stops beyond recent swing points

- Use ATR for dynamic stop calculation

- Account for market volatility

5. Position Management

• Partial Profit Taking

- Consider scaling out at overbought/oversold levels

- Use wave effect intensity for exit timing

- Monitor energy field for momentum shifts

• Trade Duration

- Short-term: Use primary signals in trading zones

- Swing trades: Focus on divergence signals

- Position trades: Utilize higher timeframe signals

⚠️ Important Usage Notes:

• Avoid:

- Trading against strong trends

- Relying solely on single signals

- Ignoring higher timeframe context

- Over-leveraging based on signals

Remember: This tool is designed to assist in analysis but should never be used as the sole decision-maker for trades. Always maintain proper risk management and combine with other forms of analysis.

This indicator combines the traditional Stochastic RSI with enhanced visualization features and multi-timeframe analysis capabilities. It's designed to provide traders with a comprehensive view of market conditions through various technical components.

🔑 Key Features:

• Advanced StochRSI Implementation

- Customizable RSI and Stochastic calculation periods

- Multiple moving average type options (SMA, EMA, SMMA, LWMA)

- Adjustable signal line parameters

• Visual Enhancement System

- Dynamic wave effect visualization

- Energy field display for momentum visualization

- Customizable color schemes for bullish and bearish signals

- Adaptive transparency settings

• Multi-Timeframe Analysis

- Higher timeframe confirmation

- Synchronized market structure analysis

- Cross-timeframe signal validation

• Divergence Detection

- Automated bullish and bearish divergence identification

- Customizable lookback period

- Clear visual signals for confirmed divergences

• Signal Generation Framework

- Price action confirmation

- SMA-based trend filtering

- Multiple confirmation levels for reduced noise

- Clear entry signals with customizable display options

📈 Technical Components:

1. Core Oscillator

- Base calculation: 13-period RSI (adjustable)

- Stochastic calculation: 8-period (adjustable)

- Signal lines: 5,3 smoothing (adjustable)

2. Visual Systems

- Wave effect with three layers of visualization

- Energy field display with dynamic intensity

- Reference bands at 20/30/50/70/80 levels

3. Confirmation Mechanisms

- SMA trend filter

- Higher timeframe alignment

- Price action validation

- Divergence confirmation

⚙️ Customization Options:

• Visual Parameters

- Wave effect intensity and speed

- Energy field sensitivity

- Color schemes for bullish/bearish signals

- Signal display preferences

• Technical Parameters

- All core calculation periods

- Moving average types

- Divergence detection settings

- Signal confirmation criteria

• Display Settings

- Chart and indicator signal placement

- SMA line visualization

- Background highlighting options

- Label positioning and size

🔍 Technical Implementation:

The indicator combines several advanced techniques to generate signals. Here are key components with code examples:

1. Core StochRSI Calculation:

// Base RSI calculation

rsi = ta.rsi(close, rsi_length)

// StochRSI transformation

stochRSI = ((ta.highest(rsi, stoch_length) - ta.lowest(rsi, stoch_length)) != 0) ?

(100 * (rsi - ta.lowest(rsi, stoch_length))) /

(ta.highest(rsi, stoch_length) - ta.lowest(rsi, stoch_length)) : 0

2. Signal Generation System:

// Core signal conditions

crossover_buy = crossOver(sk, sd, cross_threshold)

valid_buy_zone = sk < 30 and sd < 30

price_within_sma_bands = close <= sma_high and close >= sma_low

// Enhanced signal generation

if crossover_buy and valid_buy_zone and price_within_sma_bands and htf_allows_long

if is_bullish_candle

long_signal := true

else

awaiting_bull_confirmation := true

3. Multi-Timeframe Analysis:

[htf_sk, htf_sd] = request.security(syminfo.tickerid, mtf_period,

[getMa(stochRSI, signal_k_length),

getMa(getMa(stochRSI, signal_k_length), signal_d_length)])

The HTF filter looks at a higher timeframe (default: 4H) to confirm the trend

It only allows:

Long trades when the higher timeframe is bullish

Short trades when the higher timeframe is bearish

📈 Trading Application Guide:

1. Signal Identification

• Oversold Opportunities (< 30 level)

- Look for bullish crosses of K-line above D-line

- Confirm with higher timeframe alignment

- Wait for price action confirmation (bullish candle)

• Overbought Conditions (> 70 level)

- Watch for bearish crosses of K-line below D-line

- Verify higher timeframe condition

- Confirm with bearish price action

2. Divergence Trading

• Bullish Divergence

- Price makes lower lows while indicator makes higher lows

- Most effective when occurring in oversold territory

- Use with support levels for entry timing

• Bearish Divergence

- Price makes higher highs while indicator shows lower highs

- Most reliable in overbought conditions

- Combine with resistance levels

3. Wave Effect Analysis

• Strong Waves

- Multiple wave lines moving in same direction indicate momentum

- Wider wave spread suggests increased volatility

- Use for trend strength confirmation

• Energy Field

- Higher intensity in trading zones suggests stronger moves

- Use for momentum confirmation

- Watch for energy field convergence with price action

The energy field is like a heat map that shows momentum strength

It gets stronger (more visible) when:

Price is in oversold (<30) or overbought (>70) zones

The indicator lines are moving apart quickly

A strong signal is forming

Think of it as a "strength meter" - the more visible the energy field, the stronger the potential move

4. Risk Management Integration

• Entry Confirmation

- Wait for all signal components to align

- Use higher timeframe for trend direction

- Confirm with price action and SMA positions

• Stop Loss Placement

- Consider placing stops beyond recent swing points

- Use ATR for dynamic stop calculation

- Account for market volatility

5. Position Management

• Partial Profit Taking

- Consider scaling out at overbought/oversold levels

- Use wave effect intensity for exit timing

- Monitor energy field for momentum shifts

• Trade Duration

- Short-term: Use primary signals in trading zones

- Swing trades: Focus on divergence signals

- Position trades: Utilize higher timeframe signals

⚠️ Important Usage Notes:

• Avoid:

- Trading against strong trends

- Relying solely on single signals

- Ignoring higher timeframe context

- Over-leveraging based on signals

Remember: This tool is designed to assist in analysis but should never be used as the sole decision-maker for trades. Always maintain proper risk management and combine with other forms of analysis.

הערות שחרור

small change on commentsהערות שחרור

Added option to choose Entry Colour individuallyסקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

CognitiveAlpha

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

CognitiveAlpha

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.