OPEN-SOURCE SCRIPT

MULTI-CONDITION RSI SIGNAL GENERATOR

═══════════════════════════════════════════════

MULTI-CONDITION RSI SIGNAL GENERATOR

═══════════════════════════════════════════════

OVERVIEW:

This indicator generates trading signals based on Relative Strength Index (RSI) movements with multiple confirmation layers designed to filter false signals and identify high-probability reversal opportunities.

═══════════════════════════════════════════════

WHAT MAKES THIS ORIGINAL:

═══════════════════════════════════════════════

Unlike basic RSI indicators that simply plot overbought/oversold crossovers, this system combines FOUR distinct confirmation mechanisms:

1. PERSISTENCE FILTERING - Requires RSI to remain in extreme zones for a minimum duration

2. LOOKBACK VALIDATION - Verifies recent extreme zone visits before signaling

3. DIVERGENCE DETECTION - Identifies price/RSI divergence for stronger signals

4. MOMENTUM CONFIRMATION - Provides trend-continuation entries via midline crosses

This multi-layered approach significantly reduces whipsaw trades that plague simple RSI crossover systems.

═══════════════════════════════════════════════

HOW IT WORKS (TECHNICAL METHODOLOGY):

═══════════════════════════════════════════════

STEP 1: RSI CALCULATION

- Standard RSI calculation using user-defined period (default: 14)

- Monitors two extreme zones: Overbought (default: 70) and Oversold (default: 30)

STEP 2: PERSISTENCE FILTERING

The script counts how many bars RSI has spent in extreme zones within the lookback period:

- For overbought signals: Counts bars where RSI > 70

- For oversold signals: Counts bars where RSI < 30

- Signal only triggers if count >= Minimum Duration (default: 4 bars)

This filters out brief spikes that immediately reverse, focusing on sustained extreme conditions that are more likely to lead to genuine reversals.

STEP 3: LOOKBACK VALIDATION

- Checks if RSI reached extreme zones within the Lookback Bars period (default: 20)

- Uses ta.highest() and ta.lowest() functions to verify recent extremes

- Ensures we're trading reversals from meaningful extremes, not random crossovers

STEP 4: BASIC SIGNAL GENERATION

- BUY SIGNAL: RSI crosses above the oversold level (30) after meeting persistence and lookback conditions

- SELL SIGNAL: RSI crosses below the overbought level (70) after meeting persistence and lookback conditions

STEP 5: DIVERGENCE DETECTION

The script identifies two types of divergence over the Divergence Lookback period (default: 5 bars):

A) BULLISH DIVERGENCE (indicates potential upward reversal):

- Price makes a lower low (current low < previous low)

- RSI makes a higher low (current RSI low > previous RSI low)

- Suggests weakening downward momentum

B) BEARISH DIVERGENCE (indicates potential downward reversal):

- Price makes a higher high (current high > previous high)

- RSI makes a lower high (current RSI high < previous RSI high)

- Suggests weakening upward momentum

STEP 6: STRONG SIGNAL CONFIRMATION

- STRONG BUY: Basic buy signal + bullish divergence present

- STRONG SELL: Basic sell signal + bearish divergence present

- These represent the highest-probability setups

STEP 7: MOMENTUM SIGNALS (OPTIONAL)

- MOMENTUM BUY: RSI crosses above 50 after being oversold (trend continuation)

- MOMENTUM SELL: RSI crosses below 50 after being overbought (trend continuation)

- Smaller signals for traders who want trend-following entries

═══════════════════════════════════════════════

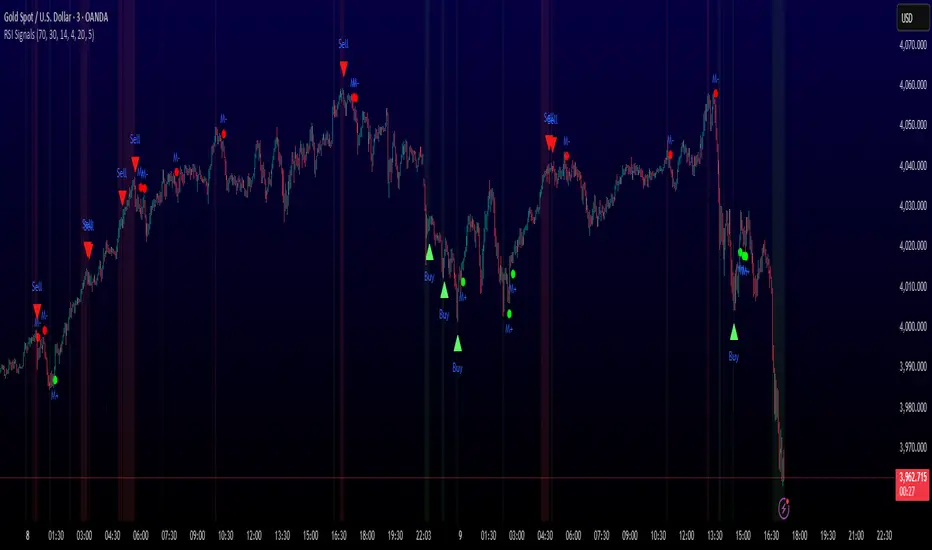

SIGNAL TYPES AND VISUAL INDICATORS:

═══════════════════════════════════════════════

📈 GREEN TRIANGLE (below bar) - Standard Buy Signal

RSI crossed above oversold level with confirmation filters

📉 RED TRIANGLE (above bar) - Standard Sell Signal

RSI crossed below overbought level with confirmation filters

🔵 BLUE TRIANGLE (below bar) - Strong Buy Signal

Buy signal + bullish divergence (HIGHEST PRIORITY)

🟣 PURPLE TRIANGLE (above bar) - Strong Sell Signal

Sell signal + bearish divergence (HIGHEST PRIORITY)

🟢 GREEN CIRCLE (small) - Momentum Buy

RSI crosses above 50 after oversold conditions

🔴 RED CIRCLE (small) - Momentum Sell

RSI crosses below 50 after overbought conditions

BACKGROUND SHADING:

- Light red background: RSI currently overbought

- Light green background: RSI currently oversold

═══════════════════════════════════════════════

PARAMETER SETTINGS:

═══════════════════════════════════════════════

1. OVERBOUGHT LEVEL (default: 70, range: 50-90)

- Higher values = fewer but stronger overbought signals

- Lower values = more sensitive to overbought conditions

- Recommended: 70 for standard markets, 80 for crypto/volatile assets

2. OVERSOLD LEVEL (default: 30, range: 10-50)

- Lower values = fewer but stronger oversold signals

- Higher values = more sensitive to oversold conditions

- Recommended: 30 for standard markets, 20 for crypto/volatile assets

3. RSI PERIOD (default: 14, range: 2-50)

- Standard RSI calculation period

- Lower = more sensitive/faster signals

- Higher = smoother/slower signals

- Recommended: 14 (industry standard)

4. MINIMUM DURATION (default: 4, range: 1-20)

- Required bars in extreme zone before signal

- Higher values = fewer signals but better quality

- Lower values = more signals but more false positives

- Recommended: 3-5 for day trading, 5-10 for swing trading

5. LOOKBACK BARS (default: 20, range: 5-100)

- How far back to check for extreme zone visits

- Should match your typical trading timeframe

- Recommended: 20 for intraday, 50 for daily charts

6. DIVERGENCE LOOKBACK (default: 5, range: 2-20)

- Period for comparing price/RSI highs and lows

- Lower values = more frequent divergence signals

- Higher values = more significant divergences

- Recommended: 5-10 depending on timeframe

═══════════════════════════════════════════════

HOW TO USE THIS INDICATOR:

═══════════════════════════════════════════════

RECOMMENDED TRADING APPROACH:

1. PRIMARY ENTRIES: Focus on Strong Buy/Sell signals (blue/purple triangles)

- These have the highest win rate due to divergence confirmation

- Wait for price action confirmation (support/resistance, candlestick patterns)

2. SECONDARY ENTRIES: Regular Buy/Sell signals (green/red triangles)

- Use these when Strong signals are infrequent

- Require additional confirmation from other indicators or chart patterns

3. TREND CONTINUATION: Momentum signals (small circles)

- Best used when overall trend is clear

- Not recommended for reversal trading

4. FILTER TRADES: Use background shading as context

- Be cautious entering longs when background is red (overbought)

- Be cautious entering shorts when background is green (oversold)

RISK MANAGEMENT GUIDELINES:

- Never risk more than 2-5% of capital per trade

- Use stop losses below recent swing lows (buys) or above swing highs (sells)

- Target at least 1.5:1 reward-to-risk ratio

- Consider position sizing based on signal strength

TIMEFRAME RECOMMENDATIONS:

- 15min - 1hour: Day trading with adjusted parameters (lower minimum duration)

- 4hour - Daily: Swing trading with default parameters

- Weekly: Position trading with increased lookback periods

COMPLEMENTARY TOOLS:

This indicator works best when combined with:

- Support and resistance levels

- Trend indicators (moving averages, trend lines)

- Volume analysis

- Price action patterns (engulfing candles, pin bars)

═══════════════════════════════════════════════

LIMITATIONS AND CONSIDERATIONS:

═══════════════════════════════════════════════

- This is NOT a standalone trading system - requires additional analysis

- RSI-based strategies perform best in ranging/choppy markets

- May generate fewer signals in strong trending markets

- Divergence signals can be early - wait for price confirmation

- Not recommended for highly illiquid assets

- Backtest on your specific market before live trading

- No indicator is 100% accurate - always use proper risk management

═══════════════════════════════════════════════

TECHNICAL NOTES:

═══════════════════════════════════════════════

- Code is original and does not reuse external libraries

- Uses Pine Script v5 native functions only

- Alert conditions included for all signal types

- No repainting - signals appear and remain fixed

- Efficient calculation methods minimize processing load

═══════════════════════════════════════════════

ALERT SETUP:

═══════════════════════════════════════════════

Four alert conditions are available:

1. "Buy Alert" - Triggers on standard buy signals

2. "Sell Alert" - Triggers on standard sell signals

3. "Strong Buy Alert" - Triggers on divergence-confirmed buy signals

4. "Strong Sell Alert" - Triggers on divergence-confirmed sell signals

To set up alerts: Right-click chart → Add Alert → Select desired condition

═══════════════════════════════════════════════

This indicator is provided for educational and informational purposes. Always practice proper risk management and never trade with money you cannot afford to lose.

MULTI-CONDITION RSI SIGNAL GENERATOR

═══════════════════════════════════════════════

OVERVIEW:

This indicator generates trading signals based on Relative Strength Index (RSI) movements with multiple confirmation layers designed to filter false signals and identify high-probability reversal opportunities.

═══════════════════════════════════════════════

WHAT MAKES THIS ORIGINAL:

═══════════════════════════════════════════════

Unlike basic RSI indicators that simply plot overbought/oversold crossovers, this system combines FOUR distinct confirmation mechanisms:

1. PERSISTENCE FILTERING - Requires RSI to remain in extreme zones for a minimum duration

2. LOOKBACK VALIDATION - Verifies recent extreme zone visits before signaling

3. DIVERGENCE DETECTION - Identifies price/RSI divergence for stronger signals

4. MOMENTUM CONFIRMATION - Provides trend-continuation entries via midline crosses

This multi-layered approach significantly reduces whipsaw trades that plague simple RSI crossover systems.

═══════════════════════════════════════════════

HOW IT WORKS (TECHNICAL METHODOLOGY):

═══════════════════════════════════════════════

STEP 1: RSI CALCULATION

- Standard RSI calculation using user-defined period (default: 14)

- Monitors two extreme zones: Overbought (default: 70) and Oversold (default: 30)

STEP 2: PERSISTENCE FILTERING

The script counts how many bars RSI has spent in extreme zones within the lookback period:

- For overbought signals: Counts bars where RSI > 70

- For oversold signals: Counts bars where RSI < 30

- Signal only triggers if count >= Minimum Duration (default: 4 bars)

This filters out brief spikes that immediately reverse, focusing on sustained extreme conditions that are more likely to lead to genuine reversals.

STEP 3: LOOKBACK VALIDATION

- Checks if RSI reached extreme zones within the Lookback Bars period (default: 20)

- Uses ta.highest() and ta.lowest() functions to verify recent extremes

- Ensures we're trading reversals from meaningful extremes, not random crossovers

STEP 4: BASIC SIGNAL GENERATION

- BUY SIGNAL: RSI crosses above the oversold level (30) after meeting persistence and lookback conditions

- SELL SIGNAL: RSI crosses below the overbought level (70) after meeting persistence and lookback conditions

STEP 5: DIVERGENCE DETECTION

The script identifies two types of divergence over the Divergence Lookback period (default: 5 bars):

A) BULLISH DIVERGENCE (indicates potential upward reversal):

- Price makes a lower low (current low < previous low)

- RSI makes a higher low (current RSI low > previous RSI low)

- Suggests weakening downward momentum

B) BEARISH DIVERGENCE (indicates potential downward reversal):

- Price makes a higher high (current high > previous high)

- RSI makes a lower high (current RSI high < previous RSI high)

- Suggests weakening upward momentum

STEP 6: STRONG SIGNAL CONFIRMATION

- STRONG BUY: Basic buy signal + bullish divergence present

- STRONG SELL: Basic sell signal + bearish divergence present

- These represent the highest-probability setups

STEP 7: MOMENTUM SIGNALS (OPTIONAL)

- MOMENTUM BUY: RSI crosses above 50 after being oversold (trend continuation)

- MOMENTUM SELL: RSI crosses below 50 after being overbought (trend continuation)

- Smaller signals for traders who want trend-following entries

═══════════════════════════════════════════════

SIGNAL TYPES AND VISUAL INDICATORS:

═══════════════════════════════════════════════

📈 GREEN TRIANGLE (below bar) - Standard Buy Signal

RSI crossed above oversold level with confirmation filters

📉 RED TRIANGLE (above bar) - Standard Sell Signal

RSI crossed below overbought level with confirmation filters

🔵 BLUE TRIANGLE (below bar) - Strong Buy Signal

Buy signal + bullish divergence (HIGHEST PRIORITY)

🟣 PURPLE TRIANGLE (above bar) - Strong Sell Signal

Sell signal + bearish divergence (HIGHEST PRIORITY)

🟢 GREEN CIRCLE (small) - Momentum Buy

RSI crosses above 50 after oversold conditions

🔴 RED CIRCLE (small) - Momentum Sell

RSI crosses below 50 after overbought conditions

BACKGROUND SHADING:

- Light red background: RSI currently overbought

- Light green background: RSI currently oversold

═══════════════════════════════════════════════

PARAMETER SETTINGS:

═══════════════════════════════════════════════

1. OVERBOUGHT LEVEL (default: 70, range: 50-90)

- Higher values = fewer but stronger overbought signals

- Lower values = more sensitive to overbought conditions

- Recommended: 70 for standard markets, 80 for crypto/volatile assets

2. OVERSOLD LEVEL (default: 30, range: 10-50)

- Lower values = fewer but stronger oversold signals

- Higher values = more sensitive to oversold conditions

- Recommended: 30 for standard markets, 20 for crypto/volatile assets

3. RSI PERIOD (default: 14, range: 2-50)

- Standard RSI calculation period

- Lower = more sensitive/faster signals

- Higher = smoother/slower signals

- Recommended: 14 (industry standard)

4. MINIMUM DURATION (default: 4, range: 1-20)

- Required bars in extreme zone before signal

- Higher values = fewer signals but better quality

- Lower values = more signals but more false positives

- Recommended: 3-5 for day trading, 5-10 for swing trading

5. LOOKBACK BARS (default: 20, range: 5-100)

- How far back to check for extreme zone visits

- Should match your typical trading timeframe

- Recommended: 20 for intraday, 50 for daily charts

6. DIVERGENCE LOOKBACK (default: 5, range: 2-20)

- Period for comparing price/RSI highs and lows

- Lower values = more frequent divergence signals

- Higher values = more significant divergences

- Recommended: 5-10 depending on timeframe

═══════════════════════════════════════════════

HOW TO USE THIS INDICATOR:

═══════════════════════════════════════════════

RECOMMENDED TRADING APPROACH:

1. PRIMARY ENTRIES: Focus on Strong Buy/Sell signals (blue/purple triangles)

- These have the highest win rate due to divergence confirmation

- Wait for price action confirmation (support/resistance, candlestick patterns)

2. SECONDARY ENTRIES: Regular Buy/Sell signals (green/red triangles)

- Use these when Strong signals are infrequent

- Require additional confirmation from other indicators or chart patterns

3. TREND CONTINUATION: Momentum signals (small circles)

- Best used when overall trend is clear

- Not recommended for reversal trading

4. FILTER TRADES: Use background shading as context

- Be cautious entering longs when background is red (overbought)

- Be cautious entering shorts when background is green (oversold)

RISK MANAGEMENT GUIDELINES:

- Never risk more than 2-5% of capital per trade

- Use stop losses below recent swing lows (buys) or above swing highs (sells)

- Target at least 1.5:1 reward-to-risk ratio

- Consider position sizing based on signal strength

TIMEFRAME RECOMMENDATIONS:

- 15min - 1hour: Day trading with adjusted parameters (lower minimum duration)

- 4hour - Daily: Swing trading with default parameters

- Weekly: Position trading with increased lookback periods

COMPLEMENTARY TOOLS:

This indicator works best when combined with:

- Support and resistance levels

- Trend indicators (moving averages, trend lines)

- Volume analysis

- Price action patterns (engulfing candles, pin bars)

═══════════════════════════════════════════════

LIMITATIONS AND CONSIDERATIONS:

═══════════════════════════════════════════════

- This is NOT a standalone trading system - requires additional analysis

- RSI-based strategies perform best in ranging/choppy markets

- May generate fewer signals in strong trending markets

- Divergence signals can be early - wait for price confirmation

- Not recommended for highly illiquid assets

- Backtest on your specific market before live trading

- No indicator is 100% accurate - always use proper risk management

═══════════════════════════════════════════════

TECHNICAL NOTES:

═══════════════════════════════════════════════

- Code is original and does not reuse external libraries

- Uses Pine Script v5 native functions only

- Alert conditions included for all signal types

- No repainting - signals appear and remain fixed

- Efficient calculation methods minimize processing load

═══════════════════════════════════════════════

ALERT SETUP:

═══════════════════════════════════════════════

Four alert conditions are available:

1. "Buy Alert" - Triggers on standard buy signals

2. "Sell Alert" - Triggers on standard sell signals

3. "Strong Buy Alert" - Triggers on divergence-confirmed buy signals

4. "Strong Sell Alert" - Triggers on divergence-confirmed sell signals

To set up alerts: Right-click chart → Add Alert → Select desired condition

═══════════════════════════════════════════════

This indicator is provided for educational and informational purposes. Always practice proper risk management and never trade with money you cannot afford to lose.

סקריפט קוד פתוח

ברוח TradingView אמיתית, היוצר של הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יכולים לבדוק ולאמת את הפונקציונליות שלו. כל הכבוד למחבר! למרות שאתה יכול להשתמש בו בחינם, זכור שפרסום מחדש של הקוד כפוף לכללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

סקריפט קוד פתוח

ברוח TradingView אמיתית, היוצר של הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יכולים לבדוק ולאמת את הפונקציונליות שלו. כל הכבוד למחבר! למרות שאתה יכול להשתמש בו בחינם, זכור שפרסום מחדש של הקוד כפוף לכללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.