OPEN-SOURCE SCRIPT

מעודכן Total Return

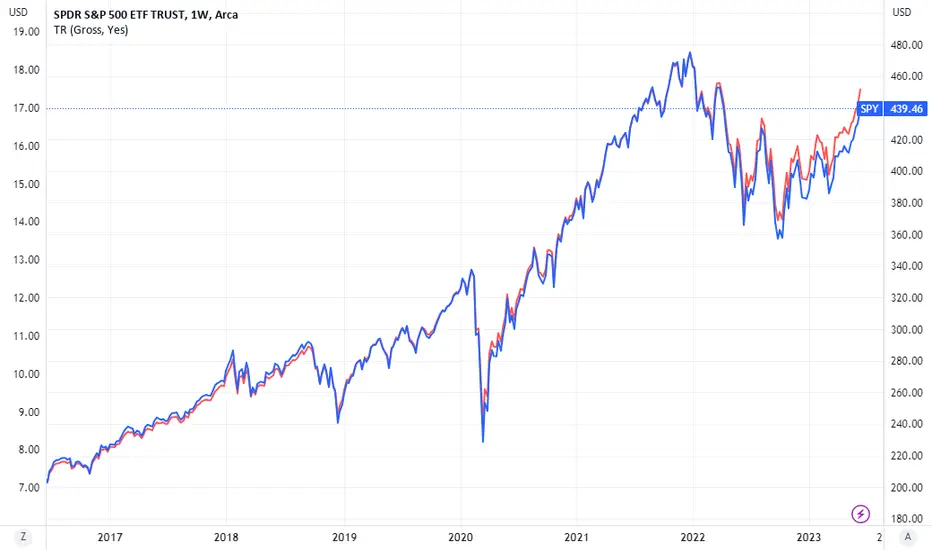

This script calculates a Total Return index for stocks that shows the total performance of a stock, incorporating returns from both the share price and dividends.

To understand this, consider the situation where you invest in a 5% div stock and hold the position for 10 years. Assume at the end of 10 years, the price has gone up by 50%. A price chart will then show a 50% return, but in reality the investor has also received 50% of the initial investment in dividends, making his total return substantially more. Exactly how much more depends on whether the investor reinvested the dividends in the stock, or just held them as cash. If the former, his total return will be well over 100%; in the latter, his total return will be 100% exactly.

There are 2 input options:

- Dividend type: allows the user to choose "gross" or "net". Note that most stocks will have a "gross" data series whereas many will not have a "net" series.

- Reinvestment: allows the user to choose whether dividends should be reinvested in the stock ("Yes") or held in cash ("No").

Total return formula:

- With reinvestment: log((today's closing price + dividends paid today) / (yesterday's closing price))

- Without reinvestment: log(today's closing price / yesterday's closing price) + log (dividends paid thus far / first closing price)

To understand this, consider the situation where you invest in a 5% div stock and hold the position for 10 years. Assume at the end of 10 years, the price has gone up by 50%. A price chart will then show a 50% return, but in reality the investor has also received 50% of the initial investment in dividends, making his total return substantially more. Exactly how much more depends on whether the investor reinvested the dividends in the stock, or just held them as cash. If the former, his total return will be well over 100%; in the latter, his total return will be 100% exactly.

There are 2 input options:

- Dividend type: allows the user to choose "gross" or "net". Note that most stocks will have a "gross" data series whereas many will not have a "net" series.

- Reinvestment: allows the user to choose whether dividends should be reinvested in the stock ("Yes") or held in cash ("No").

Total return formula:

- With reinvestment: log((today's closing price + dividends paid today) / (yesterday's closing price))

- Without reinvestment: log(today's closing price / yesterday's closing price) + log (dividends paid thus far / first closing price)

הערות שחרור

Deleted some comments.סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.