OPEN-SOURCE SCRIPT

Global M2 Index Percentage

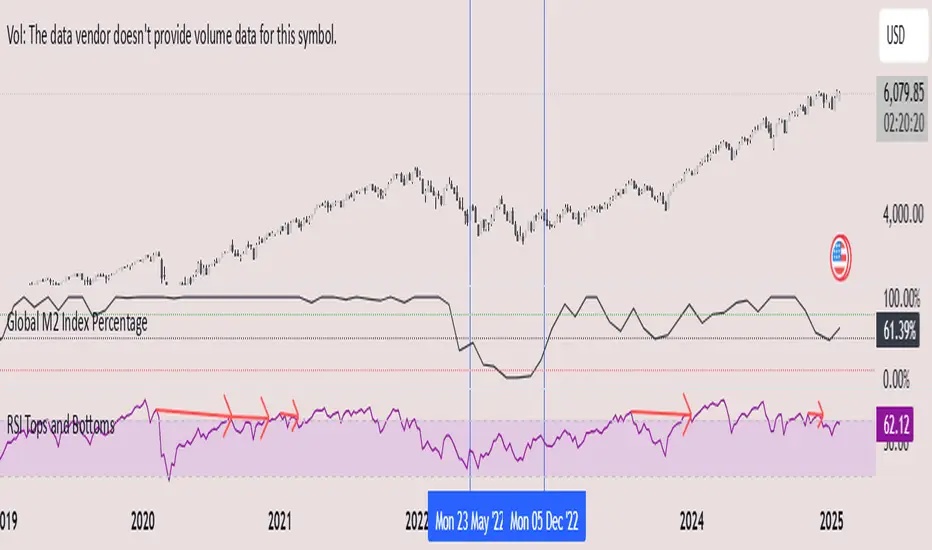

### **Global M2 Index Percentage**

**Description:**

The **Global M2 Index Percentage** is a custom indicator designed to track and visualize the global money supply (M2) in a normalized percentage format. It aggregates M2 data from major economies (e.g., the US, EU, China, Japan, and the UK) and adjusts for exchange rates to provide a comprehensive view of global liquidity. This indicator helps traders and investors understand the broader macroeconomic environment, identify trends in money supply, and make informed decisions based on global liquidity conditions.

---

### **How It Works:**

1. **Data Aggregation**:

- The indicator collects M2 data from key economies and adjusts it using exchange rates to calculate a global M2 value.

- The formula for global M2 is:

\[

\text{Global M2} = \frac{(\text{CN M2} \times \text{CNY/USD}) + (\text{US M2}) + (\text{EU M2} \times \text{EUR/USD}) + (\text{JP M2} \times \text{JPY/USD}) + (\text{UK M2} \times \text{GBP/USD})}{1,000,000,000,000}

\]

2. **Normalization**:

- The global M2 value is normalized into a percentage (0% to 100%) based on its range over a user-defined period (default: 13 weeks).

- The formula for normalization is:

\[

\text{M2 Index} = \frac{\text{Current M2} - \text{Lowest M2 (13 weeks)}}{\text{Highest M2 (13 weeks)} - \text{Lowest M2 (13 weeks)}} \times 100

\]

3. **Visualization**:

- The indicator plots the M2 Index as a line chart.

- Key reference levels are highlighted:

- **10% (Red Line)**: Oversold level (low liquidity).

- **50% (Black Line)**: Neutral level.

- **80% (Green Line)**: Overbought level (high liquidity).

---

### **How to Use the Indicator:**

#### **1. Understanding the M2 Index:**

- **Below 10%**: Indicates extremely low liquidity, which may signal economic contraction or tight monetary policy.

- **Above 80%**: Indicates high liquidity, which may signal loose monetary policy or potential inflationary pressures.

- **Between 10% and 80%**: Represents a neutral to moderate liquidity environment.

#### **2. Trading Strategies:**

- **Long-Term Investing**:

- Use the M2 Index to assess global liquidity trends.

- **High M2 Index (e.g., >80%)**: Consider investing in risk assets (stocks, commodities) as liquidity supports growth.

- **Low M2 Index (e.g., <10%)**: Shift to defensive assets (bonds, gold) as liquidity tightens.

- **Short-Term Trading**:

- Combine the M2 Index with technical indicators (e.g., RSI, MACD) for timing entries and exits.

- **M2 Index Rising + RSI Oversold**: Potential buying opportunity.

- **M2 Index Falling + RSI Overbought**: Potential selling opportunity.

#### **3. Macroeconomic Analysis**:

- Use the M2 Index to monitor the impact of central bank policies (e.g., quantitative easing, rate hikes).

- Correlate the M2 Index with inflation data (CPI, PPI) to anticipate inflationary or deflationary trends.

---

### **Key Features:**

- **Customizable Timeframe**: Adjust the lookback period (e.g., 13 weeks, 26 weeks) to suit your trading style.

- **Multi-Economy Data**: Aggregates M2 data from the US, EU, China, Japan, and the UK for a global perspective.

- **Normalized Output**: Converts raw M2 data into an easy-to-interpret percentage format.

- **Reference Levels**: Includes key levels (10%, 50%, 80%) for quick analysis.

---

### **Example Use Case:**

- **Scenario**: The M2 Index rises from 49% to 62% over two weeks.

- **Interpretation**: Global liquidity is increasing, potentially due to central bank stimulus.

- **Action**:

- **Long-Term**: Increase exposure to equities and commodities.

- **Short-Term**: Look for buying opportunities in oversold assets (e.g., RSI < 30).

---

### **Why Use the Global M2 Index Percentage?**

- **Macro Insights**: Understand the broader economic environment and its impact on financial markets.

- **Risk Management**: Identify periods of high or low liquidity to adjust your portfolio accordingly.

- **Enhanced Timing**: Combine with technical analysis for better entry and exit points.

---

### **Conclusion:**

The **Global M2 Index Percentage** is a powerful tool for traders and investors seeking to incorporate macroeconomic data into their strategies. By tracking global liquidity trends, this indicator helps you make informed decisions, whether you're trading short-term or planning long-term investments. Add it to your TradingView charts today and gain a deeper understanding of the global money supply!

---

**Disclaimer**: This indicator is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a professional before making investment decisions.

**Description:**

The **Global M2 Index Percentage** is a custom indicator designed to track and visualize the global money supply (M2) in a normalized percentage format. It aggregates M2 data from major economies (e.g., the US, EU, China, Japan, and the UK) and adjusts for exchange rates to provide a comprehensive view of global liquidity. This indicator helps traders and investors understand the broader macroeconomic environment, identify trends in money supply, and make informed decisions based on global liquidity conditions.

---

### **How It Works:**

1. **Data Aggregation**:

- The indicator collects M2 data from key economies and adjusts it using exchange rates to calculate a global M2 value.

- The formula for global M2 is:

\[

\text{Global M2} = \frac{(\text{CN M2} \times \text{CNY/USD}) + (\text{US M2}) + (\text{EU M2} \times \text{EUR/USD}) + (\text{JP M2} \times \text{JPY/USD}) + (\text{UK M2} \times \text{GBP/USD})}{1,000,000,000,000}

\]

2. **Normalization**:

- The global M2 value is normalized into a percentage (0% to 100%) based on its range over a user-defined period (default: 13 weeks).

- The formula for normalization is:

\[

\text{M2 Index} = \frac{\text{Current M2} - \text{Lowest M2 (13 weeks)}}{\text{Highest M2 (13 weeks)} - \text{Lowest M2 (13 weeks)}} \times 100

\]

3. **Visualization**:

- The indicator plots the M2 Index as a line chart.

- Key reference levels are highlighted:

- **10% (Red Line)**: Oversold level (low liquidity).

- **50% (Black Line)**: Neutral level.

- **80% (Green Line)**: Overbought level (high liquidity).

---

### **How to Use the Indicator:**

#### **1. Understanding the M2 Index:**

- **Below 10%**: Indicates extremely low liquidity, which may signal economic contraction or tight monetary policy.

- **Above 80%**: Indicates high liquidity, which may signal loose monetary policy or potential inflationary pressures.

- **Between 10% and 80%**: Represents a neutral to moderate liquidity environment.

#### **2. Trading Strategies:**

- **Long-Term Investing**:

- Use the M2 Index to assess global liquidity trends.

- **High M2 Index (e.g., >80%)**: Consider investing in risk assets (stocks, commodities) as liquidity supports growth.

- **Low M2 Index (e.g., <10%)**: Shift to defensive assets (bonds, gold) as liquidity tightens.

- **Short-Term Trading**:

- Combine the M2 Index with technical indicators (e.g., RSI, MACD) for timing entries and exits.

- **M2 Index Rising + RSI Oversold**: Potential buying opportunity.

- **M2 Index Falling + RSI Overbought**: Potential selling opportunity.

#### **3. Macroeconomic Analysis**:

- Use the M2 Index to monitor the impact of central bank policies (e.g., quantitative easing, rate hikes).

- Correlate the M2 Index with inflation data (CPI, PPI) to anticipate inflationary or deflationary trends.

---

### **Key Features:**

- **Customizable Timeframe**: Adjust the lookback period (e.g., 13 weeks, 26 weeks) to suit your trading style.

- **Multi-Economy Data**: Aggregates M2 data from the US, EU, China, Japan, and the UK for a global perspective.

- **Normalized Output**: Converts raw M2 data into an easy-to-interpret percentage format.

- **Reference Levels**: Includes key levels (10%, 50%, 80%) for quick analysis.

---

### **Example Use Case:**

- **Scenario**: The M2 Index rises from 49% to 62% over two weeks.

- **Interpretation**: Global liquidity is increasing, potentially due to central bank stimulus.

- **Action**:

- **Long-Term**: Increase exposure to equities and commodities.

- **Short-Term**: Look for buying opportunities in oversold assets (e.g., RSI < 30).

---

### **Why Use the Global M2 Index Percentage?**

- **Macro Insights**: Understand the broader economic environment and its impact on financial markets.

- **Risk Management**: Identify periods of high or low liquidity to adjust your portfolio accordingly.

- **Enhanced Timing**: Combine with technical analysis for better entry and exit points.

---

### **Conclusion:**

The **Global M2 Index Percentage** is a powerful tool for traders and investors seeking to incorporate macroeconomic data into their strategies. By tracking global liquidity trends, this indicator helps you make informed decisions, whether you're trading short-term or planning long-term investments. Add it to your TradingView charts today and gain a deeper understanding of the global money supply!

---

**Disclaimer**: This indicator is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a professional before making investment decisions.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.