PROTECTED SOURCE SCRIPT

Engulfing Cycle

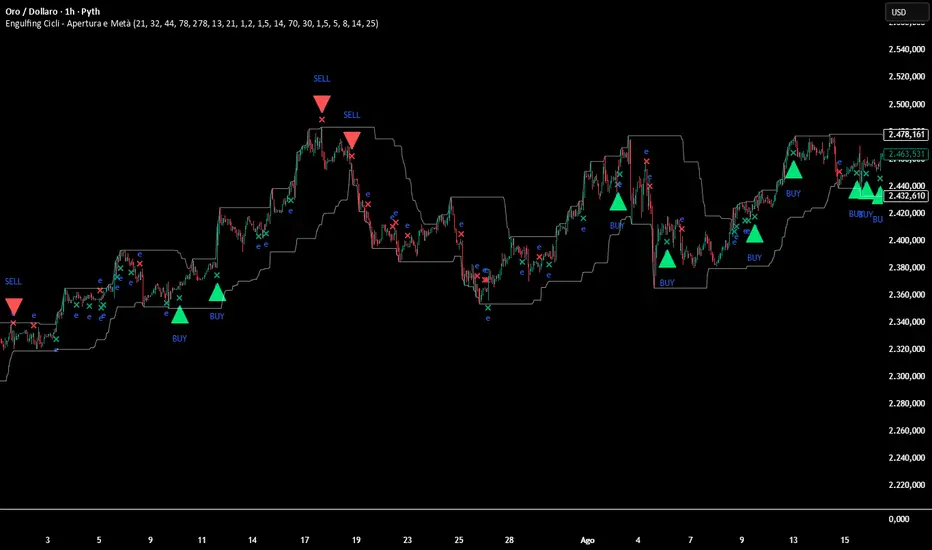

# **Engulfing Cycles - Opening & Mid Phase** 📊⚡

## **Advanced Cyclical Timing Strategy with Engulfing Patterns**

### **🎯 CORE CONCEPT**

Innovative strategy combining **engulfing candlestick patterns** with **market cycle analysis** to identify high-probability entry points during opening and mid-cycle phases. Not just another engulfing detector, but a complete system selecting ONLY patterns occurring at cyclically optimal moments.

### **⚙️ HOW IT WORKS**

**1. TWO CYCLE TYPES:**

- **Index Cycle**: From pivot low to pivot high (bullish phase)

- **Inverse Cycle**: From pivot high to pivot low (bearish phase)

**2. PRIVILEGED TIMING ZONES:**

- **OPENING ZONE**: First 8 bars after a pivot (maximum cycle energy)

- **MID ZONE**: Bars 14-25 (momentum renewal)

**3. MULTI-LEVEL SIGNAL SYSTEM:**

```

Level 1: Basic engulfing (gray signals)

Level 2: Engulfing in valid zone (orange)

Level 3: OPTIMAL engulfing with ≥3/6 filters (green/red)

```

### **🔍 INTEGRATED CONFIRMATION FILTERS**

**PRIMARY TREND:**

- Gann High/Low system for directional bias

- Dual EMA (78/278) for momentum confirmation

**MOMENTUM:**

- RSI for overbought/oversold conditions

- Volume above average (configurable)

**STRUCTURE:**

- Dynamic support/resistance levels

- Minimum distance from EMA for movement space

- Pullback validation

### **📈 COMPLETE VISUALIZATION**

**GRAPHICAL ELEMENTS:**

- ✅ **Color-coded signals** (gray → orange → green/red)

- ✅ **Cycle zone backgrounds** (green/blue for opening/mid)

- ✅ **EMA & Gann lines** with trend coloring

- ✅ **Support/Resistance** with circle style

- ✅ **Real-time info table** (top-right corner)

**INCLUDED DATA TABLE:**

- Total/optimal signal statistics

- Current cycle type (Index/Inverse)

- Bars since pivot counters

- Active filter status

- Current cycle zone

- Anti-spam lock status

### **⚡ MULTI-LEVEL ALERT SYSTEM**

**5 CONFIGURABLE ALERT TYPES:**

1. 🔔 **Any Engulfing** - General monitoring

2. ⬆️ **Bull Engulfing** - Basic bullish pattern

3. ⬇️ **Bear Engulfing** - Basic bearish pattern

4. 🟠 **In Valid Zone** - Added cyclical timing

5. 🟢🔴 **OPTIMAL SIGNALS** - Premium signals with maximum confirmation

### **🎚️ FULLY ADJUSTABLE PARAMETERS**

**CYCLES:**

- Minimum/Average/Maximum (21/32/44 default)

- Opening Zone (8 bars) and Mid Zone (14-25 bars)

**FILTERS:**

- Volume multiplier (1.2x default)

- Minimum engulfing body size (1.5x default)

- RSI thresholds (70/30)

- Minimum EMA distance (1.5%)

**TECHNICALS:**

- EMA periods (78/278)

- Gann periods (13/21)

- Pivot length (5)

### **🛡️ PROTECTION SYSTEMS**

**ANTI-SPAM:**

- 5-bar lock after signal

- Price stagnation detection

- Only 1 signal per movement

**QUALITY CONTROL:**

- Minimum 3/6 active filters required

- Cycle zone validation

- Volume and momentum confirmation

### **📊 PRACTICAL APPLICATION**

**RECOMMENDED TIMEFRAMES:** 1H, 4H, Daily

**ASSETS:** Major Forex pairs, Indices, Liquid stocks

**CONTEXT:** Best in markets with defined cycles

**OPTIMAL SIGNAL =**

```

[Engulfing Pattern] +

[Opening/Mid Cycle Zone] +

[Confirmed Gann Trend] +

[≥3 Active Filters] +

[No Anti-Spam Lock]

```

### **🎨 PROFESSIONAL DESIGN**

- Clean, non-invasive interface

- Intuitive color coding

- All elements toggleable

- Light performance (max_bars_back=500)

### **📋 UNIQUE FEATURES**

1. **CYCLICAL TIMING** - Not just WHAT, but WHEN

2. **SIGNAL GRADATION** - From basic to optimal

3. **SELF-CONTROL** - Built-in anti-false system

4. **TRANSPARENCY** - All filters visible in table

5. **FLEXIBILITY** - Adaptable to different trading styles

---

**⚠️ DISCLAIMER:** This is an advanced analytical tool. "Optimal" signals (green/red) offer higher reliability but still require appropriate risk management. Always backtest on historical data before live use.

**Author:** Alblanz

**Category:** Patterns + Cycles + Timing

**Complexity:** Medium-High

**Version:** 5.0

**Updated:** [4/12/2025

*For support or suggestions, leave a comment on the script page.*

## **Advanced Cyclical Timing Strategy with Engulfing Patterns**

### **🎯 CORE CONCEPT**

Innovative strategy combining **engulfing candlestick patterns** with **market cycle analysis** to identify high-probability entry points during opening and mid-cycle phases. Not just another engulfing detector, but a complete system selecting ONLY patterns occurring at cyclically optimal moments.

### **⚙️ HOW IT WORKS**

**1. TWO CYCLE TYPES:**

- **Index Cycle**: From pivot low to pivot high (bullish phase)

- **Inverse Cycle**: From pivot high to pivot low (bearish phase)

**2. PRIVILEGED TIMING ZONES:**

- **OPENING ZONE**: First 8 bars after a pivot (maximum cycle energy)

- **MID ZONE**: Bars 14-25 (momentum renewal)

**3. MULTI-LEVEL SIGNAL SYSTEM:**

```

Level 1: Basic engulfing (gray signals)

Level 2: Engulfing in valid zone (orange)

Level 3: OPTIMAL engulfing with ≥3/6 filters (green/red)

```

### **🔍 INTEGRATED CONFIRMATION FILTERS**

**PRIMARY TREND:**

- Gann High/Low system for directional bias

- Dual EMA (78/278) for momentum confirmation

**MOMENTUM:**

- RSI for overbought/oversold conditions

- Volume above average (configurable)

**STRUCTURE:**

- Dynamic support/resistance levels

- Minimum distance from EMA for movement space

- Pullback validation

### **📈 COMPLETE VISUALIZATION**

**GRAPHICAL ELEMENTS:**

- ✅ **Color-coded signals** (gray → orange → green/red)

- ✅ **Cycle zone backgrounds** (green/blue for opening/mid)

- ✅ **EMA & Gann lines** with trend coloring

- ✅ **Support/Resistance** with circle style

- ✅ **Real-time info table** (top-right corner)

**INCLUDED DATA TABLE:**

- Total/optimal signal statistics

- Current cycle type (Index/Inverse)

- Bars since pivot counters

- Active filter status

- Current cycle zone

- Anti-spam lock status

### **⚡ MULTI-LEVEL ALERT SYSTEM**

**5 CONFIGURABLE ALERT TYPES:**

1. 🔔 **Any Engulfing** - General monitoring

2. ⬆️ **Bull Engulfing** - Basic bullish pattern

3. ⬇️ **Bear Engulfing** - Basic bearish pattern

4. 🟠 **In Valid Zone** - Added cyclical timing

5. 🟢🔴 **OPTIMAL SIGNALS** - Premium signals with maximum confirmation

### **🎚️ FULLY ADJUSTABLE PARAMETERS**

**CYCLES:**

- Minimum/Average/Maximum (21/32/44 default)

- Opening Zone (8 bars) and Mid Zone (14-25 bars)

**FILTERS:**

- Volume multiplier (1.2x default)

- Minimum engulfing body size (1.5x default)

- RSI thresholds (70/30)

- Minimum EMA distance (1.5%)

**TECHNICALS:**

- EMA periods (78/278)

- Gann periods (13/21)

- Pivot length (5)

### **🛡️ PROTECTION SYSTEMS**

**ANTI-SPAM:**

- 5-bar lock after signal

- Price stagnation detection

- Only 1 signal per movement

**QUALITY CONTROL:**

- Minimum 3/6 active filters required

- Cycle zone validation

- Volume and momentum confirmation

### **📊 PRACTICAL APPLICATION**

**RECOMMENDED TIMEFRAMES:** 1H, 4H, Daily

**ASSETS:** Major Forex pairs, Indices, Liquid stocks

**CONTEXT:** Best in markets with defined cycles

**OPTIMAL SIGNAL =**

```

[Engulfing Pattern] +

[Opening/Mid Cycle Zone] +

[Confirmed Gann Trend] +

[≥3 Active Filters] +

[No Anti-Spam Lock]

```

### **🎨 PROFESSIONAL DESIGN**

- Clean, non-invasive interface

- Intuitive color coding

- All elements toggleable

- Light performance (max_bars_back=500)

### **📋 UNIQUE FEATURES**

1. **CYCLICAL TIMING** - Not just WHAT, but WHEN

2. **SIGNAL GRADATION** - From basic to optimal

3. **SELF-CONTROL** - Built-in anti-false system

4. **TRANSPARENCY** - All filters visible in table

5. **FLEXIBILITY** - Adaptable to different trading styles

---

**⚠️ DISCLAIMER:** This is an advanced analytical tool. "Optimal" signals (green/red) offer higher reliability but still require appropriate risk management. Always backtest on historical data before live use.

**Author:** Alblanz

**Category:** Patterns + Cycles + Timing

**Complexity:** Medium-High

**Version:** 5.0

**Updated:** [4/12/2025

*For support or suggestions, leave a comment on the script page.*

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.