PROTECTED SOURCE SCRIPT

Alpha Tracker -> PROFABIGHI_CAPITAL

🌟 Overview

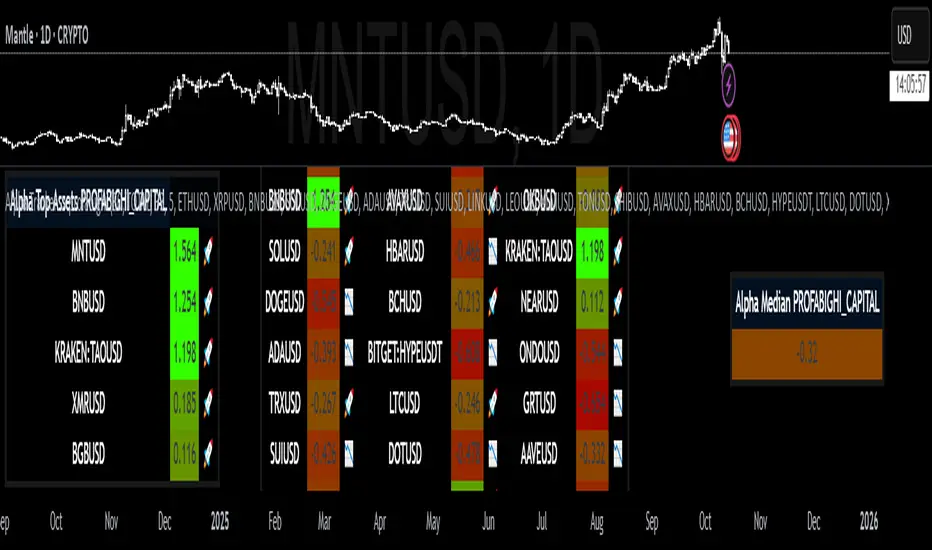

The Alpha Tracker → PROFABIGHI_CAPITAL is a sophisticated performance analytics tool that computes and visualizes the risk-adjusted excess returns (alpha) of up to 33 customizable altcoins against a user-defined benchmark over a flexible lookback horizon. By leveraging daily return covariance and beta adjustments, it dynamically generates color-gradient tables showcasing individual alphas, median benchmarks, and ranked top performers with intuitive emoji indicators, empowering traders to swiftly pinpoint relative outperformance and inform portfolio rotations or allocation decisions.

⚙️ General Settings

– Alpha Measurement Length: Defines the historical window for return averaging and covariance calculations, where shorter periods emphasize recent momentum while longer horizons capture sustained trends—crucial for aligning with trading horizons like short-term scalping (e.g., 10-20 days) versus long-term positioning (e.g., 50+ days).

– Benchmark Symbol: Serves as the market reference for alpha isolation, typically a broad index like total crypto cap to gauge systemic risk-adjusted gains; selecting alternatives like Bitcoin enables coin-specific outperformance analysis.

– Number of Altcoins to Display: Controls the scale of the main table, from a focused watchlist of 5-10 high-conviction assets to a comprehensive 33-symbol scan for broad-market screening—impacts computational load and visual density.

– Number of Top Alpha Assets: Limits the dedicated leaderboard to the highest alphas, streamlining focus on actionable leaders (e.g., 3-7 for quick scans) while maintaining full data in the primary view for deeper dives.

💎 Asset Selection Settings

– Asset 1-17 (Left Group): Curates the primary column of the main table with foundational altcoins, allowing sequential customization from blue-chip like ETHUSD to mid-caps like XRPUSD—each input fetches daily closes for independent alpha computation, with tooltips guiding symbol formatting.

– Asset 18-33 (Right Group): Expands to secondary symbols in the right column, supporting diverse exposure from established tokens like LTCUSD to emerging ones like ONDOUSD—seamless integration ensures balanced left-right distribution for ergonomic table reading.

– Dynamic Input Scaling: Automatically accommodates the total asset count by disabling unused inputs, preventing errors and optimizing data fetches—enables modular expansion from a minimal 5-asset portfolio to full 33 for exhaustive coverage.

🎨 Table Style Settings

– Low Alpha Color: Establishes the gradient's underperformance endpoint (e.g., deep red for negative alphas), visually signaling laggards that may warrant reduction or avoidance in allocations.

– High Alpha Color: Sets the outperformer anchor (e.g., bright green for positive alphas), highlighting assets generating excess returns beyond benchmark expectations.

– Neutral Alpha Value: Anchors the color spectrum's midpoint, where zero or breakeven alphas transition from red to green—fine-tuning shifts the bias toward aggressive or conservative interpretations.

– Alpha Color Range: Widens or narrows the transition bandwidth around neutral, creating smoother blends for subtle rankings or sharper contrasts for binary hot/cold asset identification.

– Table Background: Applies a semi-opaque dark base across all tables, ensuring low-glare readability on both light and dark themes while maintaining professional aesthetics.

– Table Border: Defines frame outlines for structural definition, with gray subtlety preventing visual clutter while framing content effectively.

📡 Data Fetching

– Benchmark Data Retrieval: Employs security requests for daily closes from the chosen symbol, ensuring a stable time series for covariance baseline without intraday noise.

– Asset Data Retrieval: Parallel daily close fetches for selected symbols, gracefully handling invalid inputs by substituting NA values to preserve table stability.

– Rate of Change Computation: Derives 1-period percentage returns for assets and benchmark, forming the raw input for mean and covariance matrices.

– Error Handling for NA Values: Replaces missing data with sentinel placeholders (-9999) in tables, displaying as gray neutrals to flag data gaps without disrupting layout.

🧮 Calculations

– Return Series Generation: Applies rate of change over one day for each asset and benchmark, capturing discrete daily movements essential for alpha's excess return focus.

– Mean Return Averaging: Computes simple moving averages of returns over the lookback, providing smoothed historical performance baselines for both series.

– Covariance Estimation: Averages the product of asset and benchmark returns minus their means' product, quantifying linear co-dependence critical for beta adjustment.

– Benchmark Variance: Averages squared benchmark deviations from its mean, measuring systemic volatility to normalize asset sensitivity.

– Beta Coefficient: Divides covariance by variance to derive market beta, isolating systematic risk before alpha extraction.

– Alpha Derivation: Subtracts beta-adjusted benchmark mean from asset mean, yielding the intercept as true excess return attributable to security-specific factors.

📋 Table Display

– Dynamic Table Dimensions: Auto-scales columns (up to 9 for tri-column layout) and rows based on asset count plus header, optimizing space for 1-33 symbols without overflow.

– Main Table Population: Features a branded header spanning the top, followed by asset symbols, rounded alphas (3 decimals), and performance emojis in balanced trios for scannable rows.

– Alpha Color Gradient: Maps values from low (red) through neutral (midpoint) to high (green), with gray for invalids—enables instant visual ranking across the dataset.

– Emoji Performance Icons: Renders rocket for above-median alphas (outperformers) and downward arrow for below (laggards), adding emotional quick-scan appeal.

– Median Table Summary: Compact single-column view of the central alpha with gradient coloring, serving as a neutral benchmark for relative assessments.

– Top Assets Table: Ranks the highest alphas descending in a 3-column format (symbol, value, emoji), with header branding for focused opportunity highlighting.

– Array-Based Sorting: Generates descending indices from alpha array, reconstructing sorted lists for leaderboard extraction while preserving originals for display.

🔔 Alerts

– Dynamic Alert Construction: Compiles a newline-separated list of symbols and rounded alphas on the last bar, stripping prefixes for clean formatting.

– Once-Per-Bar Frequency: Triggers alerts at close with the complete dataset, facilitating external integrations like notifications or automation.

– Content Customization: Formats messages for readability, excluding NA values to focus on actionable data points.

✅ Key Takeaways

– Streamlines alpha computation across portfolios, transforming complex risk-adjusted metrics into intuitive, gradient-scored tables for rapid insights.

– Benchmark-relative ranking with medians and tops enables proactive asset rotation based on true outperformance.

– Customizable symbols and lookbacks adapt to diverse crypto watches, from majors to niche alts.

– Visual emojis and colors provide at-a-glance sentiment, complementing numerical precision.

– Automated alerts deliver full-dataset updates, bridging analysis to actionable trading decisions.

The Alpha Tracker → PROFABIGHI_CAPITAL is a sophisticated performance analytics tool that computes and visualizes the risk-adjusted excess returns (alpha) of up to 33 customizable altcoins against a user-defined benchmark over a flexible lookback horizon. By leveraging daily return covariance and beta adjustments, it dynamically generates color-gradient tables showcasing individual alphas, median benchmarks, and ranked top performers with intuitive emoji indicators, empowering traders to swiftly pinpoint relative outperformance and inform portfolio rotations or allocation decisions.

⚙️ General Settings

– Alpha Measurement Length: Defines the historical window for return averaging and covariance calculations, where shorter periods emphasize recent momentum while longer horizons capture sustained trends—crucial for aligning with trading horizons like short-term scalping (e.g., 10-20 days) versus long-term positioning (e.g., 50+ days).

– Benchmark Symbol: Serves as the market reference for alpha isolation, typically a broad index like total crypto cap to gauge systemic risk-adjusted gains; selecting alternatives like Bitcoin enables coin-specific outperformance analysis.

– Number of Altcoins to Display: Controls the scale of the main table, from a focused watchlist of 5-10 high-conviction assets to a comprehensive 33-symbol scan for broad-market screening—impacts computational load and visual density.

– Number of Top Alpha Assets: Limits the dedicated leaderboard to the highest alphas, streamlining focus on actionable leaders (e.g., 3-7 for quick scans) while maintaining full data in the primary view for deeper dives.

💎 Asset Selection Settings

– Asset 1-17 (Left Group): Curates the primary column of the main table with foundational altcoins, allowing sequential customization from blue-chip like ETHUSD to mid-caps like XRPUSD—each input fetches daily closes for independent alpha computation, with tooltips guiding symbol formatting.

– Asset 18-33 (Right Group): Expands to secondary symbols in the right column, supporting diverse exposure from established tokens like LTCUSD to emerging ones like ONDOUSD—seamless integration ensures balanced left-right distribution for ergonomic table reading.

– Dynamic Input Scaling: Automatically accommodates the total asset count by disabling unused inputs, preventing errors and optimizing data fetches—enables modular expansion from a minimal 5-asset portfolio to full 33 for exhaustive coverage.

🎨 Table Style Settings

– Low Alpha Color: Establishes the gradient's underperformance endpoint (e.g., deep red for negative alphas), visually signaling laggards that may warrant reduction or avoidance in allocations.

– High Alpha Color: Sets the outperformer anchor (e.g., bright green for positive alphas), highlighting assets generating excess returns beyond benchmark expectations.

– Neutral Alpha Value: Anchors the color spectrum's midpoint, where zero or breakeven alphas transition from red to green—fine-tuning shifts the bias toward aggressive or conservative interpretations.

– Alpha Color Range: Widens or narrows the transition bandwidth around neutral, creating smoother blends for subtle rankings or sharper contrasts for binary hot/cold asset identification.

– Table Background: Applies a semi-opaque dark base across all tables, ensuring low-glare readability on both light and dark themes while maintaining professional aesthetics.

– Table Border: Defines frame outlines for structural definition, with gray subtlety preventing visual clutter while framing content effectively.

📡 Data Fetching

– Benchmark Data Retrieval: Employs security requests for daily closes from the chosen symbol, ensuring a stable time series for covariance baseline without intraday noise.

– Asset Data Retrieval: Parallel daily close fetches for selected symbols, gracefully handling invalid inputs by substituting NA values to preserve table stability.

– Rate of Change Computation: Derives 1-period percentage returns for assets and benchmark, forming the raw input for mean and covariance matrices.

– Error Handling for NA Values: Replaces missing data with sentinel placeholders (-9999) in tables, displaying as gray neutrals to flag data gaps without disrupting layout.

🧮 Calculations

– Return Series Generation: Applies rate of change over one day for each asset and benchmark, capturing discrete daily movements essential for alpha's excess return focus.

– Mean Return Averaging: Computes simple moving averages of returns over the lookback, providing smoothed historical performance baselines for both series.

– Covariance Estimation: Averages the product of asset and benchmark returns minus their means' product, quantifying linear co-dependence critical for beta adjustment.

– Benchmark Variance: Averages squared benchmark deviations from its mean, measuring systemic volatility to normalize asset sensitivity.

– Beta Coefficient: Divides covariance by variance to derive market beta, isolating systematic risk before alpha extraction.

– Alpha Derivation: Subtracts beta-adjusted benchmark mean from asset mean, yielding the intercept as true excess return attributable to security-specific factors.

📋 Table Display

– Dynamic Table Dimensions: Auto-scales columns (up to 9 for tri-column layout) and rows based on asset count plus header, optimizing space for 1-33 symbols without overflow.

– Main Table Population: Features a branded header spanning the top, followed by asset symbols, rounded alphas (3 decimals), and performance emojis in balanced trios for scannable rows.

– Alpha Color Gradient: Maps values from low (red) through neutral (midpoint) to high (green), with gray for invalids—enables instant visual ranking across the dataset.

– Emoji Performance Icons: Renders rocket for above-median alphas (outperformers) and downward arrow for below (laggards), adding emotional quick-scan appeal.

– Median Table Summary: Compact single-column view of the central alpha with gradient coloring, serving as a neutral benchmark for relative assessments.

– Top Assets Table: Ranks the highest alphas descending in a 3-column format (symbol, value, emoji), with header branding for focused opportunity highlighting.

– Array-Based Sorting: Generates descending indices from alpha array, reconstructing sorted lists for leaderboard extraction while preserving originals for display.

🔔 Alerts

– Dynamic Alert Construction: Compiles a newline-separated list of symbols and rounded alphas on the last bar, stripping prefixes for clean formatting.

– Once-Per-Bar Frequency: Triggers alerts at close with the complete dataset, facilitating external integrations like notifications or automation.

– Content Customization: Formats messages for readability, excluding NA values to focus on actionable data points.

✅ Key Takeaways

– Streamlines alpha computation across portfolios, transforming complex risk-adjusted metrics into intuitive, gradient-scored tables for rapid insights.

– Benchmark-relative ranking with medians and tops enables proactive asset rotation based on true outperformance.

– Customizable symbols and lookbacks adapt to diverse crypto watches, from majors to niche alts.

– Visual emojis and colors provide at-a-glance sentiment, complementing numerical precision.

– Automated alerts deliver full-dataset updates, bridging analysis to actionable trading decisions.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, אתה יכול להשתמש בו באופן חופשי וללא כל הגבלה - למד עוד כאן.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, אתה יכול להשתמש בו באופן חופשי וללא כל הגבלה - למד עוד כאן.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.