INVITE-ONLY SCRIPT

One For All - Overextended Price Channel

- Introduction :

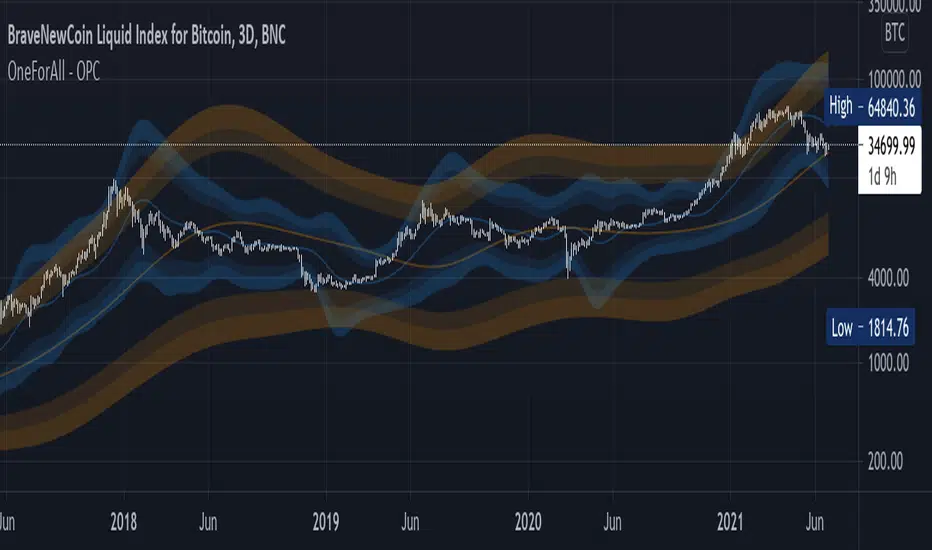

Channels are very useful tools to assess overextended price, volatility and upcoming retracement or impulsive moves (such as Bollinger Band squeezes). It is an indispensable addition to any trader using Mean Reversion theory for a scalp-trade or swing-trade.

This script contains :

- 2 channels Keltner-style, usingthe True Range for volatility

- a fully customizable volatility (channel width) and smoothing period (up to the ALMA parameters)

- both channel separately configurable, i.e. having a different volatility setting or smoothing method for each

- a useful selection of smoothing methods) to be used instead of the standard SMA or EMA, such as ALMA or Hull

- an embedded readjustment of the lower bands to avoid the drop on a logarithmic scale (see explanation below)

- a double layered channels with a gradient color to help dollar cost averaging in and out of positions

- Why another channel indicator ?

I have found most conventional channels to be either not based on "proper" volatility (e.g. standard deviation of price action for Bollinger Band), or the bottom channel to be ill adapted to the logarithmic scale and plunges to 0 on some high volatility periods, messing with readability on logarithmic auto-scaled chart.

Also, I find the channels to be most useful when superimposed with another one of longer length; especially a pair of channels with a 50 and 200 period moving average respectively. Mean Reversion traders that mostly trade the 50 and 200 SMA/EMA know what I am talking about as having a channel helps to have a better visual for a proper of entry and exit point.

Lastly, wondering why traders mostly use the SMA/EMA for the channel center, historic reason, personal preference, stubborn beliefs...? Well you will find that using other smoothing method such as the ALMA or Hull shows very interesting restults that seem -I dare say- more accurate, this option is provided in this script (some screen shot below speak for themselves).

- Disclaimer :

This indicator was originally intended to be used along with the Trend Insight System to improve performance, and the default configuration mostly backtested on BTCUSD.

Please use with caution, proper risk management and along with your favorite oscillator, candlestick reading and signals system.

- Some explanation :

Based on Mean Reversion paradigm, everything has a tendency to revert back to the mean :

- when the price enters the upper channel, it is supposed to be (or start getting) overbought as the market is getting overheated, thus prone to correction,

- on the other hand, when the price enters the lower channel, it is supposed to be (or getting) oversold and the market looks favorable for a buy-in.

Depending on the trading style used, a trader will usually either wait until the price leaves the channel towards the mean before taking action (conservative style) or you will set limit orders inside the channel as you expect a reversion to the mean (more agressive/risky style).

With two channels, more complex (and maybe precise) rules can be built to optimize one's trading strategy, especially adjusting the volatility multiplier inputs for each channel. Using different smoothing method for each is interesting to play with (especially Hull for the 50 and maybe VWMA for the 200) but not keenly advised unless you know what you are doing.

An example using the conventional Volume Weighted Keltner-like channel :

A more interesting channel using the most recent ALMA smoothing method :

Another variant using the Hull smoothing method to better see squeezes and overextensions :

This last screenshot shows the reason why it was originally intended to be used along with the Verbatim of the Trend Insigth System :

- Important notes :

While this version is fun to use thanks to a very customizable side, you might get into the neverending maze of trying tofind an optimal setting for volatility and smoothing length to adapt to each and every market you are trading. Hence, be wary of overoptimization which is risky at best and counter productive at worst (according to legendary traders such as Mark Douglas).

In the end, sticking with 50/200 length and a single setting on volatility might be wiser. Even if, needless to say, the volatility needs to be adjusted between a nascent and volatile market (such as crypto) compared to standard call markets that are much less volatile.

- End notes :

It will always be considered a work in progress to help bring out the best of trading with channels, any comment and suggestion are welcomed.

סקריפט להזמנה בלבד

הגישה לסקריפט זה מוגבלת למשתמשים שהוסמכו על ידי הכותב ובדרך כלל דורשת תשלום. אתה יכול להוסיף אותו למועדפים שלך, אך תוכל להשתמש בו רק לאחר שתבקש אישור ותקבל אותו מהמחבר שלו. למידע נוסף, צור קשר עם CptFantastic, או עקוב אחר הוראות המחבר למטה.

TradingView לא מציעה לשלם עבור סקריפט ולהשתמש בו אלא אם כן אתה סומך ב-100% על המחבר שלו ומבין כיצד הסקריפט עובד. במקרים רבים, אתה יכול למצוא אלטרנטיבה טובה לקוד פתוח בחינם בבסקריפטים הקהילתיים שלנו.

הוראות המחבר

″This is a complimentary indicator only provided to users of the Trend Insight System.

A simpler public and open-source version is available and listed in my Profile/Scripts page.

רוצה להשתמש בסקריפ זה בגרף?

אזהרה: נא לקרוא לפני בקשת גישה.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.