OPEN-SOURCE SCRIPT

מעודכן Pullback Trading Tool ALT R1.0 by JustUncleL

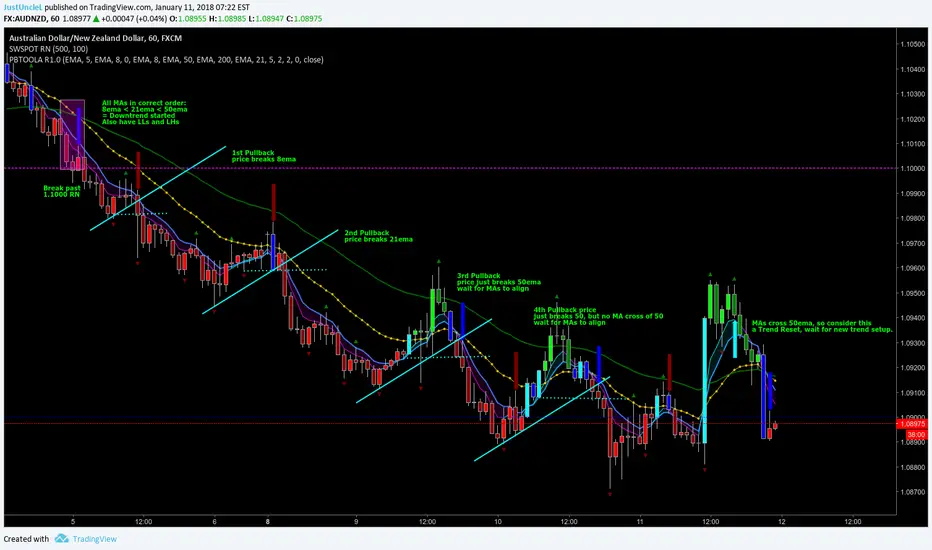

This study is an alternative Pullback Tool to my previous versions "Pullback Trading Tool R#.# by JustUncleL". This version aims to provide a cleaner but powerful trading tool. It incorporates the majority of the indicators needed to analyse trade Trends for Pullbacks and Reversals. You can optionally use Heikin Ashi candle or Renko charts. The notes here are mainly in reference to using standard Candlestick 60min signal chart (or Anchor chart time frame), other higher time frames can be used instead as Anchor Time Frames such as 240min(4hr) or 1440min(Daily).

NOTE: A Pullback is synomous to Retracement, generally a Pullback refers to a large Retracement of 100pips or more. In the context of this Tool and any comments related to it, a Pullback will be the same as a Retracement.

Incorporated within this tool are the following indicators:

1. Three Moving Averages (EMA by default) that can optionally be Anchored to a Higher Time Frame:

2. One Anchored Signal Moving Average line Yellow EMA21 (default).

3. Two Un-Anchored Moving Averages as Ribbon, can be disabled.

4. Display Pivots and optional Pivot Levels. By default Pivot is set to : 2 candles RHS of Pivot and 2 candles LHS of Pivot; this is the setting required to show standard Fractal points.

5. Optional HH, LH, LL, HL finder to help with drawing Trend lines and mini Trend Lines.

6. Coloured coded Bar based on the signal MA:

the Standard candle colours:

the Grab candles scheme:

7. Alert entry arrows generated within a Trend or at the start of a new trend.

NOTE: A Pullback is synomous to Retracement, generally a Pullback refers to a large Retracement of 100pips or more. In the context of this Tool and any comments related to it, a Pullback will be the same as a Retracement.

Incorporated within this tool are the following indicators:

1. Three Moving Averages (EMA by default) that can optionally be Anchored to a Higher Time Frame:

- DodgerBlue = EMA08 (default)

- Green = EMA50 (default)

- Gray = EMA200 (default), disabled by default.

2. One Anchored Signal Moving Average line Yellow EMA21 (default).

3. Two Un-Anchored Moving Averages as Ribbon, can be disabled.

- Aqua = EMA03 (default)

- Fuchsia = EMA08 (default)

4. Display Pivots and optional Pivot Levels. By default Pivot is set to : 2 candles RHS of Pivot and 2 candles LHS of Pivot; this is the setting required to show standard Fractal points.

5. Optional HH, LH, LL, HL finder to help with drawing Trend lines and mini Trend Lines.

6. Coloured coded Bar based on the signal MA:

the Standard candle colours:

- Blue = candle open and closed above signal MA.

- Red = candle open and closed below signal MA.

- Yellow = Candle stradle across signal MA.

the Grab candles scheme:

- Lime = Bull candle open and closed above signal MA.

- Green = Bear candle open and closed above signal MA.

- Red = Bull candle open and closed below signal MA.

- DarkRed = Bear candle open and closed below signal MA.

- Aqua = Bull candle closed across signal MA.

- Blue = Bear candle stradle across signal MA.

7. Alert entry arrows generated within a Trend or at the start of a new trend.

- An Uptrend is defined as anchored fast (8ema) above anchored signal (21ema) above anchored medium (50ema).

- A Downtrend is defined as anchored fast (8ema) below anchored signal (21ema) below anchored medium (50ema).

- A Pullback generates an red (short entry) or green (long entry) arrow when price crosses anchored fast or signal MAs and then crosses back to return to trend direction.

- A Trend Break, which is defined as any of the MAs crossing breaking trend, generates a blue (short) or aqua (long) arrow and then make new trend (in same or new trend direction).

הערות שחרור

HINTS:I cannot go into a full description, as Pullback trading incorporates a full trading Methodology, there are many articles and books written on the subject.

- I like to add the "Sweetspot Gold RN" indicator to the chart as well to help with support and resistance finding and shows where the important round number, "00", lines are.

- First on a weekly basis say Sunday night or Monday morning, analyse the Daily and Weekly charts to identify overall trends, and major support/resistant levels. Draw significant trend lines, vertical trend lines (VTL) and S/R levels.

use the Pivots option to guide VTL drawing and use Pivot/Fractals to help guide TL drawing. - Once the trend direction and any potential major reversals highlighted, drop down to the 60min chart and draw appropriate mini Trend line matching the established momentum direction. Take note of potential pull backs from and of the EMAs: 8EMA,21EMA and the 50EMA. Can use the Fractals and HH/LL points to guide your TL drawing.

- Check to see if the TL is broken and is pulling back off one of the EMA lines, then trade that alert, or drop down to lower time frames (TF) and perform the same analysis there and trade at the lower TF. Trading at lower TF you will be able to get tighter Stop loss settings.

- Other than the SweetSpot Gold RN indicator, you should not require any other indicator to trade trends for pullbacks and reversals.

- Set the optional Anchor time frame to 60min, then tighter SLs and earlier entries can be made on the lower time frames 15min or 5min.

- The Alert arrows should only be considered as guide entries, they will not always be correct. They tend to show better results on Heikin Ashi and Renko charts.

- I have been using this tool myself for some months and I'm getting good results. You must employ a good money management plan with any methology.

- Remember this tool is trading Pullbacks whilst you have a good trend present, use other techniques for a non-trending or ranging market.

- Try some of your own tests and setup variations.

הערות שחרור

R2 Update- Added Fractal Chaos Channel option for S/R Levels.

- Changed Fractals to Dots on the High/Low instead of triangles above/below.

- Added option to Anchor the base fast MA Ribbon.

- Added Gray fill colouring to Main Anchored MAs, making it Ribbon like.

- Change PB alert arrow definition to be the 1st Fractal Break after trend continue detection.

- Change Anchor to be based purely on Minutes, so 1month=30240mins (21 trading days), 1 week=7200mins (5 trading days), 1 Day=1440mins. This makes it more consistent across intraday and extraday chart Timeframes.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

JustUncleL

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

JustUncleL

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.