OPEN-SOURCE SCRIPT

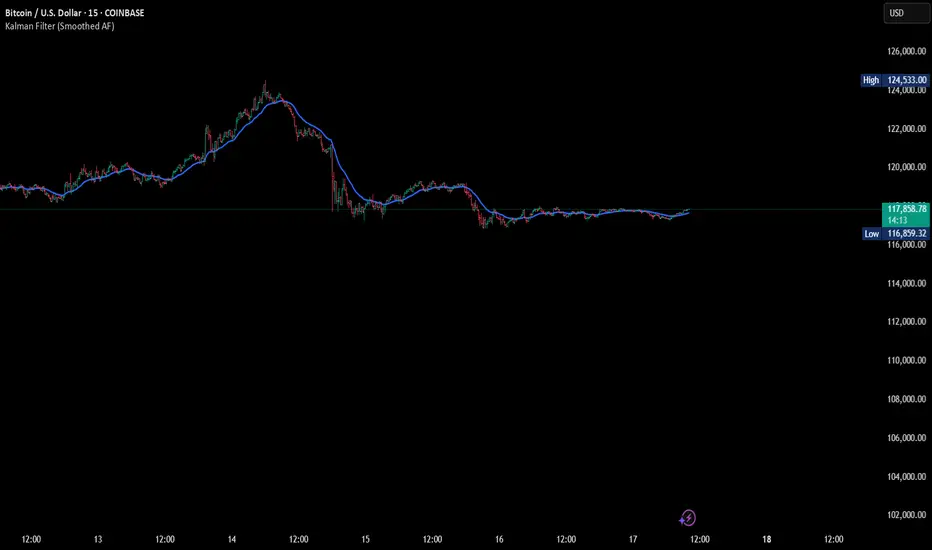

Kalman Filter (Smoothed)

The Kalman Filter is a recursive statistical algorithm that smooths noisy price data while adapting dynamically to new information. Unlike simple moving averages or EMAs, it minimizes lag by balancing measurement noise (R) and process noise (Q), giving traders a clean, adaptive estimate of true price action.

🔹 Core Features

Real-time recursive estimation

Adjustable noise parameters (R = sensitivity to price, Q = smoothness vs. responsiveness)

Reduces market noise without heavy lag

Overlay on chart for direct comparison with raw price

🔹 Trading Applications

Smoother trend visualization compared to traditional MAs

Spotting true direction during volatile/sideways markets

Filtering out market “whipsaws” for cleaner signals

Building blocks for advanced quant/trading models

⚠️ Note: The Kalman Filter is a state-space model; it doesn’t predict future price, but smooths past and present data into a more reliable signal.

🔹 Core Features

Real-time recursive estimation

Adjustable noise parameters (R = sensitivity to price, Q = smoothness vs. responsiveness)

Reduces market noise without heavy lag

Overlay on chart for direct comparison with raw price

🔹 Trading Applications

Smoother trend visualization compared to traditional MAs

Spotting true direction during volatile/sideways markets

Filtering out market “whipsaws” for cleaner signals

Building blocks for advanced quant/trading models

⚠️ Note: The Kalman Filter is a state-space model; it doesn’t predict future price, but smooths past and present data into a more reliable signal.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.