Oster's Fair Index (OFI)

Overview:

Oster's Fair Index (OFI) stands out as a sophisticated indicator to offer traders a comprehensive assessment of a stock's fundamental valuation. Unlike many conventional indicators that focus solely on technical analysis, OFI places a strong emphasis on fundamental metrics, providing traders with a deeper understanding of a stock's intrinsic worth. It applies Oster's method (explained below) to determine the fundamental fair price of a stock.

Innovative Approach to Fundamental Analysis:

OFI employs a unique approach to fundamental analysis, integrating multiple key metrics including Yield, P/S (Price-to-Sales) ratio, P/E (Price-to-Earnings) ratio, Debt/Asset ratio, and P/FCF (Price-to-Free-Cash-Flow) ratio. These metrics collectively offer a holistic view of a company's financial health, allowing traders to gauge its potential for growth and profitability. Notably, the fundamental metrics included in OFI are regarded as the most crucial indicators for fundamental stock evaluation according to Oster's method. Dividend yield and P/S ratio are prioritized as the most significant, followed by the P/E ratio, with supplementary consideration given to the debt-to-asset ratio and price-to-free cash flow ratio. This weighting reflects their importance in determining a stock's fair value according to the methodology, which is integrated into OFI's calculation process.

Customizable Parameters for Tailored Analysis:

One of OFI's standout features is its flexibility, allowing users to customize the fundamental parameters based on their specific investment strategy or preferences. Traders can selectively include or exclude metrics, adjust weighting factors, and set alarm thresholds to align with their unique trading objectives. This customization empowers traders to tailor OFI according to their individual preferences and market perspectives. Although a default value has been set for the weighting of the parameters, traders still have the option to customize it based on their own trading strategy and preference, ensuring that OFI remains adaptable to diverse trading styles and objectives.

Sophisticated Calculation Methodology:

Behind the scenes, OFI employs a sophisticated calculation methodology to derive its insights. It retrieves fundamental data for the selected stock, such as total revenue, earnings per share, debt-to-asset ratio, free cash flow per share, and dividend yield. However, these metrics are not viewed in isolation; rather, they are considered in relation to historical trends. For instance, while a low debt-to-asset ratio may indicate fundamental strength for a company, it must be interpreted in the context of its historical performance. If the debt-to-asset ratio has historically been consistently lower, it may suggest weaker performance despite the seemingly favorable current ratio. Furthermore, OFI goes beyond mere fundamental metrics by incorporating the stock price itself into its analysis. A low debt-to-asset ratio becomes even more attractive for the company if the stock price is also historically low, indicating undervaluation. OFI takes all these aspects into account, providing traders with a comprehensive and nuanced evaluation of a stock's fundamental attractiveness, considering all these aspects in relation to each of the fundamental metrics mentioned above.

Normalized Fairness Differentials for Standardized Comparison:

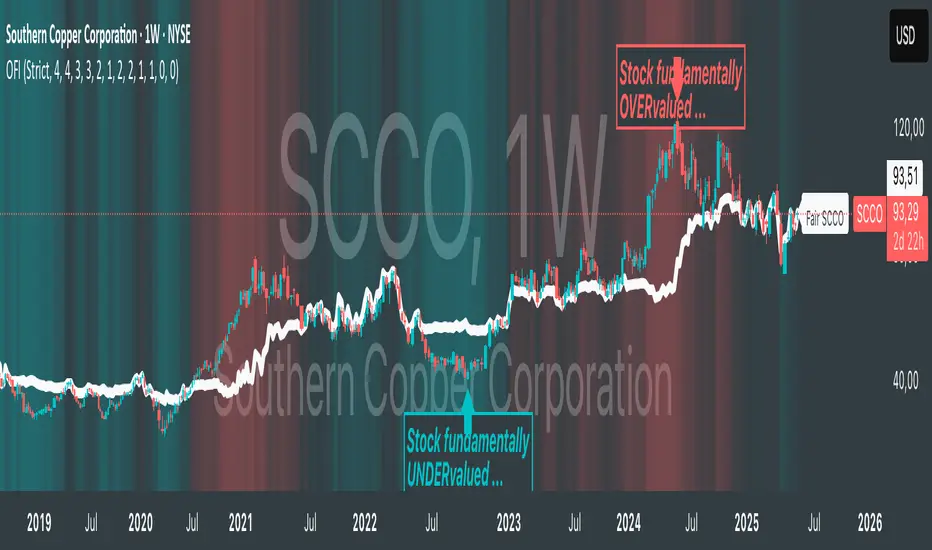

OFI employs a method where the aforementioned fundamental metrics interact as described earlier. These metrics are combined into a fundamental, normalized value using weighting factors. This value is then normalized by the moving price range of the last 12 months. The result provides insights not only into when the stock price was undervalued, overvalued, or fair, but also enables traders to estimate potential price movements based on the fundamental health of the company. Additionally, a dashed fair price line simply represents the sum of the current stock price and the OFI value. This line illustrates the fair price level of the stock derived from the methodology.

Interpretation:

A negative OFI indicates that the stock may be undervalued based on fundamental metrics. Conversely, a positive OFI suggests that the stock may be overvalued according to fundamental analysis. A zero OFI implies that the stock is trading at a fair price relative to its fundamentals, indicating a balanced valuation scenario. The values of OFI are not arbitrary; they represent the degree of overvaluation or undervaluation in the currency set in the chart settings. This means traders can discern, for example, how many USD the stock is undervalued or overvalued by. Additionally, a dashed fair price line simply represents the sum of the current stock price and the OFI value, illustrating the fair price levels of the stock derived from the methodology.

Dynamic Color Coding for Visual Clarity:

To enhance usability, OFI features dynamic color coding that visually highlights the fair price differentials. Green signifies potential undervaluation, red indicates potential overvaluation, and neutral colors represent fair valuation. This intuitive visual feedback enables traders to quickly identify opportunities and risks.

Alerts:

OFI generates alerts based on these interpretations to assist traders in making informed decisions. An Undervalued Signal (BUY) is triggered when the OFI is below zero and meets the buy threshold criteria. This indicates that the stock is fundamentally undervalued, prompting a BUY alert. Conversely, an Overvalued Signal (SELL) is generated when the OFI surpasses zero and meets the sell threshold criteria. This signals that the stock is fundamentally overvalued, prompting a SELL alert. When OFI hovers around zero, suggesting that the stock is trading at a fair price, a Fair Price Reached (FAIR) alert is generated. This encourages traders to consider profit-taking strategies given the balanced valuation.

Justification of Originality and Value:

In a landscape saturated with technical indicators, OFI distinguishes itself by offering traders a refreshingly simple yet powerful approach to fundamental analysis. While traditional methods often involve laborious scrutiny of financial metrics or even poring over entire company balance sheets, OFI streamlines this process, providing traders with a swift overview of a stock's fundamental health. Its strength lies in seamlessly integrating fundamental analysis with stock price movements, offering insights into how price correlates with fundamental metrics.

One could say we marry the simplicity of technical analysis with the depth of fundamental analysis. This unique combination empowers traders to make informed decisions with ease, leveraging the best of both worlds to navigate the markets effectively.

Conclusion:

In conclusion, Oster's Fair Index (OFI) represents a pioneering advancement in the realm of fundamental analysis, offering both sophisticated calculation methodologies and intuitive, user-friendly features. By marrying these elements with customizable parameters and intuitive visuals, OFI equips traders with a powerful tool for evaluating the fundamental valuation of stocks. Whether you're a seasoned investor or a novice trader, OFI offers invaluable insights that can inform and enrich your trading journey.

Traders can adjust fundamental considerations based on price dynamics, enhancing adaptability. A parameter called "Strictness" allows for customization, with options like "Easy", "Moderate", or "Strict", each dictating the emphasis on fundamentals relative to price movements - the stricter the valuation, the more weight fundamental under- or overvaluation has on price momentum.

The oscillator has been replaced by an intuitive color highlighting that color-codes the degree of fundamental undervaluation or overvaluation.

Compared to the FREE version, the FULL version of OFI has the following significant advantages: not limited to US stocks (all globally available stocks can be used), special alarm signals with individual thresholds can be applied and use of intuitive color coding

- Price-to-Book Ratio (P/B Ratio)

- Price-to-Cash-Flow Ratio (P/CF Ratio)

- Return on Equity (ROE)

- Current Ratio (CR)

- Intangible Assets (IA)

- changed styling

- Price-Earnings-to-Growth Ratio (PEG)

- Return on Invested Capital (ROIC)

- Net Profit Margin

- Operating Profit Margin

- FCF Margin

- EBITDA-Interest-Coverage Ratio

- Revenue Growth

- EPS Growth

סקריפט להזמנה בלבד

רק משתמשים שאושרו על ידי המחבר יכולים לגשת לסקריפט הזה. יהיה עליך לשלוח בקשת גישה ולקבל אישור לשימוש. בדרך כלל, הגישה ניתנת לאחר תשלום. למידע נוסף, עקוב אחר ההוראות של היוצר בהמשך או צור קשר עם s_i_m_o_n_s ישירות.

TradingView לא ממליצה לשלם עבור סקריפט או להשתמש בו אלא אם כן אתה סומך לחלוטין על המחבר שלו ומבין כיצד הוא פועל. ייתכן שתוכל גם למצוא חלופות חינמיות וקוד פתוח ב-סקריפטים הקהילתיים שלנו.

הוראות המחבר

כתב ויתור

סקריפט להזמנה בלבד

רק משתמשים שאושרו על ידי המחבר יכולים לגשת לסקריפט הזה. יהיה עליך לשלוח בקשת גישה ולקבל אישור לשימוש. בדרך כלל, הגישה ניתנת לאחר תשלום. למידע נוסף, עקוב אחר ההוראות של היוצר בהמשך או צור קשר עם s_i_m_o_n_s ישירות.

TradingView לא ממליצה לשלם עבור סקריפט או להשתמש בו אלא אם כן אתה סומך לחלוטין על המחבר שלו ומבין כיצד הוא פועל. ייתכן שתוכל גם למצוא חלופות חינמיות וקוד פתוח ב-סקריפטים הקהילתיים שלנו.