OPEN-SOURCE SCRIPT

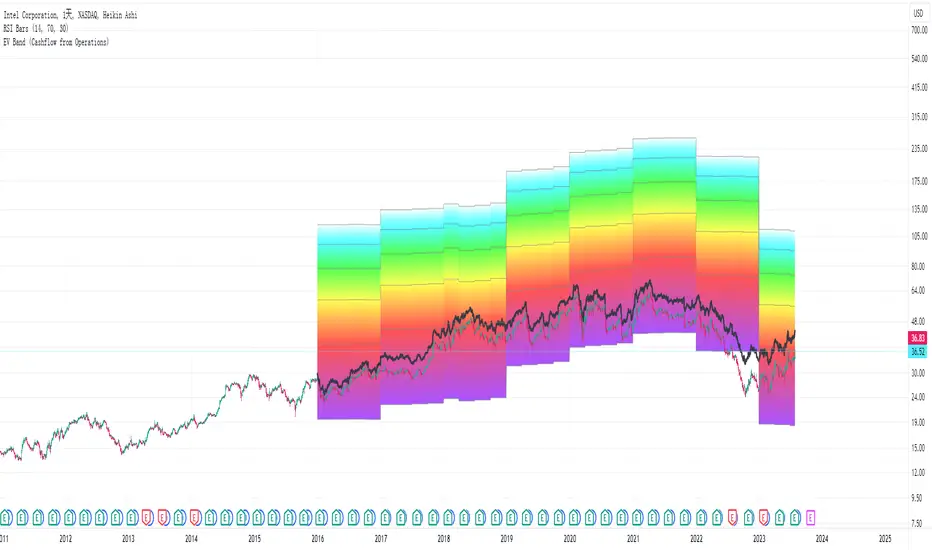

מעודכן Enterprise Value on Earnings / FCF / FFO Band

Enterprise Value per Diluted Share plotted as black line.

Bands start at 5x and stops at 30x, each represents a 5x increment.

Band Options (per Diluted Share, Fiscal Year):

①Free Cash Flow

②Operating Income

③Adjusted Funds from Operations

④Core Earnings

where:

These two adjustments are coarse and watered-down, so take them with a grain of salt.

For professional assessments of Core Earnings versus GAAP Earnings you may go to David Trainer at Great Speculations(costs money). I am unaffiliated with these entities.

Tips:

Disclaimer: Use at your own discretion. No guarantees for any accuracy or usefulness. If you decide to use it, I take no responsibility whatsoever for any consequences. Does not constitute financial advice. Past performance is not Indicative of future results.

Bands start at 5x and stops at 30x, each represents a 5x increment.

Band Options (per Diluted Share, Fiscal Year):

①Free Cash Flow

②Operating Income

③Adjusted Funds from Operations

④Core Earnings

where:

- AFfO = FFO - Unusual Income/Expenses + Tax Distortion (dafault 25% tax rate)

- Core Earnings = Net Income - Unusual Income/Expenses + Tax Distortion (default 25% tax rate)

These two adjustments are coarse and watered-down, so take them with a grain of salt.

For professional assessments of Core Earnings versus GAAP Earnings you may go to David Trainer at Great Speculations(costs money). I am unaffiliated with these entities.

Tips:

- ①③ are unapplicable to financials.

- ③ may work for REIT-like companies whose depreciation is mostly overstated(e.g. hydro-elec utility companies whose dams typically don't wear out in ten years; companies with assets that APPRECIATE in reality but they D&A them anyway).

- Probably none works for cyclicals, especially extreme boom-bust cyclicals such as oil, aluminum & shipping etc.

- Beware unnaturally low (dividend_payout+buyback)/net_income ratio as some majority shareholders may funnel money to themselves/cronies at the expense of small shareholders.

Disclaimer: Use at your own discretion. No guarantees for any accuracy or usefulness. If you decide to use it, I take no responsibility whatsoever for any consequences. Does not constitute financial advice. Past performance is not Indicative of future results.

הערות שחרור

Added Cashflow from Operations option.הערות שחרור

Changed most data timeframes from Fiscal Year to Trailing Twelve Months.Added EBITDA option. EBITDA is more useful for heavily indebted companies. The basic idea is that interest payments act as a tax shield but when leverage gets too high financing costs(credit spread) will go up. Interest rate going up or tax rate going down will also lower the optimal leverage ratio for tax shield. Do note that it shares the same pitfalls with most non-cash metrics: high sustaining CapEx, accounts "un"receivable, etc. As such, it is best to be used to compare companies within the same industry or when you are sure a company is purely cash flow based, the prime example being tobacco companies.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.