OPEN-SOURCE SCRIPT

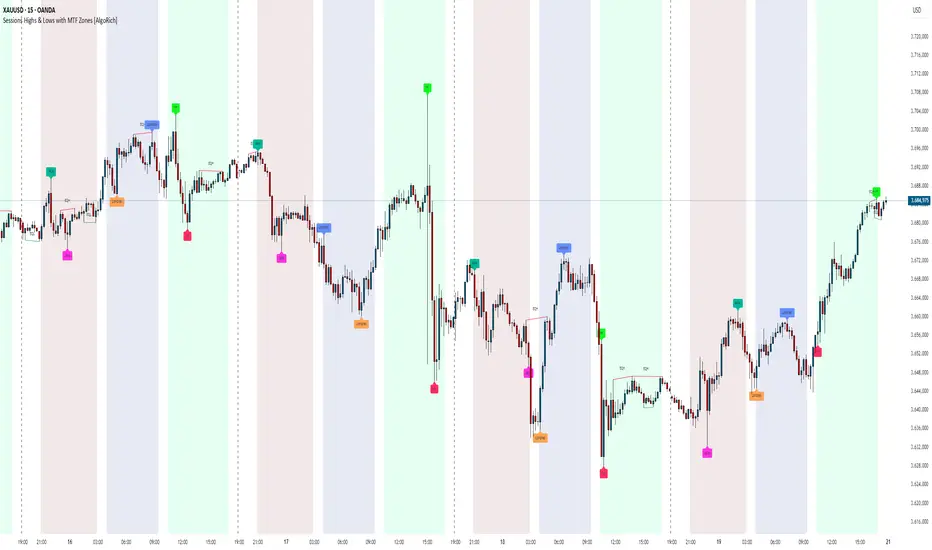

Sessions Highs & Lows with MTF Zones [AlgoRich]

Sessions Highs & Lows with MTF Zones [AlgoRich] — Description for Publication

What it does

This indicator marks and works with intra-session extremes and repeating liquidity zones:

Three configurable sessions (Asia / London / NY) with user-defined hours and colors. It shades the background during each session in your time zone (default UTC-3).

Session High/Low: while a session is open, it continuously updates its High/Low; when the session closes, it places labels at the exact bars where those extremes occurred (using the session name).

Equal Highs / Equal Lows (EQH / EQL) detection based on pivots and an ATR tolerance threshold. When two highs (or lows) are detected as “nearly equal,” it draws a line between them and tags EQH/EQL, highlighting potential liquidity/reaction areas.

How it works (under the hood)

The internal function f_sesion() checks whether a bar belongs to a session, whether it’s the start or end, and stores the session hi/lo and their bar_index. When the session ends, it creates the high/low labels.

Pivots are computed with ta.pivothigh / ta.pivotlow using pivotLength.

“Equality” between two extremes is decided by:

|Extreme1 − Extreme2| ≤ ATR(confluenceAtrLength) × threshold.

If Wait For Confirmation is enabled, the pivot must be fully formed (fewer signals, more robust). If disabled, it confirms with only 1 bar to the right (faster, more sensitive).

Parameters

General

UTC Zone: string like UTC-3 to evaluate session times correctly.

Session 1 / 2 / 3

Session name (e.g., Asia, London, NY).

Hours (format HHMM-HHMM, 24h).

Background shading ON/OFF and background color.

Label colors for the session’s High and Low.

Settings

Pivot Length: left/right bars to form a pivot.

ATR Length: ATR period used for the equality tolerance.

Threshold (0–1): ATR multiplier to decide whether two extremes are “equal” (e.g., 0.10 = difference ≤ 0.1 × ATR).

Wait For Confirmation: true = fully confirmed pivots; false = quicker confirmation (more anticipation, more noise).

Reading & suggested use

Session High/Low often act as liquidity references and potential resistance/support for the following session.

EQH/EQL can point to resting liquidity (areas prone to sweeps or breaks).

Use it as a map: combine these references with your plan (e.g., London/NY ORB, VWAP, order blocks).

What it does

This indicator marks and works with intra-session extremes and repeating liquidity zones:

Three configurable sessions (Asia / London / NY) with user-defined hours and colors. It shades the background during each session in your time zone (default UTC-3).

Session High/Low: while a session is open, it continuously updates its High/Low; when the session closes, it places labels at the exact bars where those extremes occurred (using the session name).

Equal Highs / Equal Lows (EQH / EQL) detection based on pivots and an ATR tolerance threshold. When two highs (or lows) are detected as “nearly equal,” it draws a line between them and tags EQH/EQL, highlighting potential liquidity/reaction areas.

How it works (under the hood)

The internal function f_sesion() checks whether a bar belongs to a session, whether it’s the start or end, and stores the session hi/lo and their bar_index. When the session ends, it creates the high/low labels.

Pivots are computed with ta.pivothigh / ta.pivotlow using pivotLength.

“Equality” between two extremes is decided by:

|Extreme1 − Extreme2| ≤ ATR(confluenceAtrLength) × threshold.

If Wait For Confirmation is enabled, the pivot must be fully formed (fewer signals, more robust). If disabled, it confirms with only 1 bar to the right (faster, more sensitive).

Parameters

General

UTC Zone: string like UTC-3 to evaluate session times correctly.

Session 1 / 2 / 3

Session name (e.g., Asia, London, NY).

Hours (format HHMM-HHMM, 24h).

Background shading ON/OFF and background color.

Label colors for the session’s High and Low.

Settings

Pivot Length: left/right bars to form a pivot.

ATR Length: ATR period used for the equality tolerance.

Threshold (0–1): ATR multiplier to decide whether two extremes are “equal” (e.g., 0.10 = difference ≤ 0.1 × ATR).

Wait For Confirmation: true = fully confirmed pivots; false = quicker confirmation (more anticipation, more noise).

Reading & suggested use

Session High/Low often act as liquidity references and potential resistance/support for the following session.

EQH/EQL can point to resting liquidity (areas prone to sweeps or breaks).

Use it as a map: combine these references with your plan (e.g., London/NY ORB, VWAP, order blocks).

סקריפט קוד פתוח

ברוח TradingView אמיתית, היוצר של הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יכולים לבדוק ולאמת את הפונקציונליות שלו. כל הכבוד למחבר! למרות שאתה יכול להשתמש בו בחינם, זכור שפרסום מחדש של הקוד כפוף לכללי הבית שלנו.

Comunidad de Trading híbrido

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

סקריפט קוד פתוח

ברוח TradingView אמיתית, היוצר של הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יכולים לבדוק ולאמת את הפונקציונליות שלו. כל הכבוד למחבר! למרות שאתה יכול להשתמש בו בחינם, זכור שפרסום מחדש של הקוד כפוף לכללי הבית שלנו.

Comunidad de Trading híbrido

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

Tenemos Algoritmos privados de alta efectividad

Te enseñamos a ser altamente rentable y de la manera más simple

Visitá nuestra web o seguinos en las redes sociales!

@algorichtrade

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.