OPEN-SOURCE SCRIPT

Combo Backtest 123 Reversal & Moving Average Envelopes

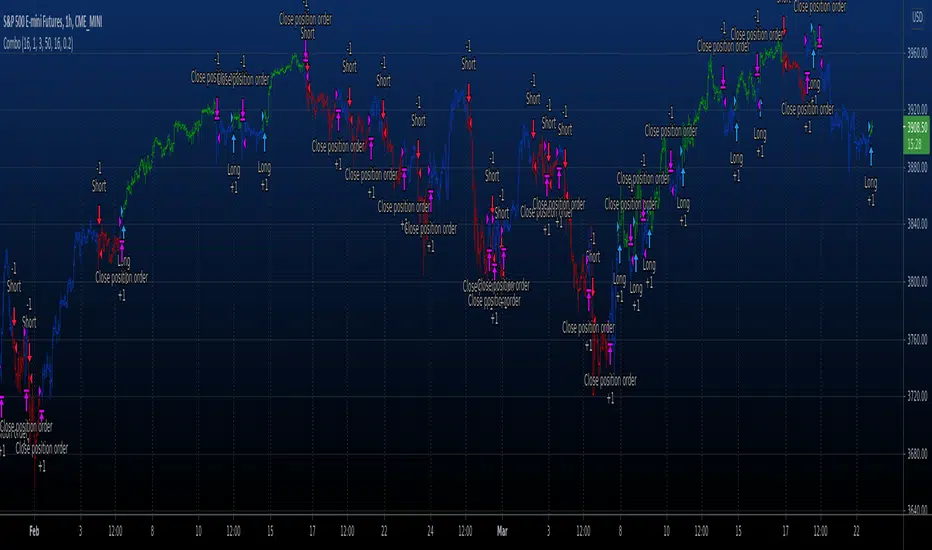

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Moving Average Envelopes are percentage-based envelopes set above and

below a moving average. The moving average, which forms the base for

this indicator, can be a simple or exponential moving average. Each

envelope is then set the same percentage above or below the moving average.

This creates parallel bands that follow price action. With a moving average

as the base, Moving Average Envelopes can be used as a trend following indicator.

However, this indicator is not limited to just trend following. The envelopes

can also be used to identify overbought and oversold levels when the trend is

relatively flat.

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

Moving Average Envelopes are percentage-based envelopes set above and

below a moving average. The moving average, which forms the base for

this indicator, can be a simple or exponential moving average. Each

envelope is then set the same percentage above or below the moving average.

This creates parallel bands that follow price action. With a moving average

as the base, Moving Average Envelopes can be used as a trend following indicator.

However, this indicator is not limited to just trend following. The envelopes

can also be used to identify overbought and oversold levels when the trend is

relatively flat.

WARNING:

- For purpose educate only

- This script to change bars colors.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט קוד פתוח

ברוח האמיתית של TradingView, יוצר הסקריפט הזה הפך אותו לקוד פתוח, כך שסוחרים יוכלו לעיין בו ולאמת את פעולתו. כל הכבוד למחבר! אמנם ניתן להשתמש בו בחינם, אך זכור כי פרסום חוזר של הקוד כפוף ל־כללי הבית שלנו.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.