PROTECTED SOURCE SCRIPT

ETHUSDT Long-Short using EMA,OBV,ADX,LinearReg,DXY(No repaint)

This script strategy is used to follow the trending EMA with a delta difference (Price-EMA) to know when to enter and with 5 variables mentioned below, stop loss is below EMA line all the time in long and above EMA line in short, is like a trailing stop after candle is closed. Hard stop is also placed to prevent big candles movements, also correlation between VIX and ETH when the correlation is <-0.2 the position can be opened.

Indicators used:

EMA , OBV , ADX , Linear regression and Dollar Index trending, Leverage is available for Long and Short positions.

LONG

SHORT

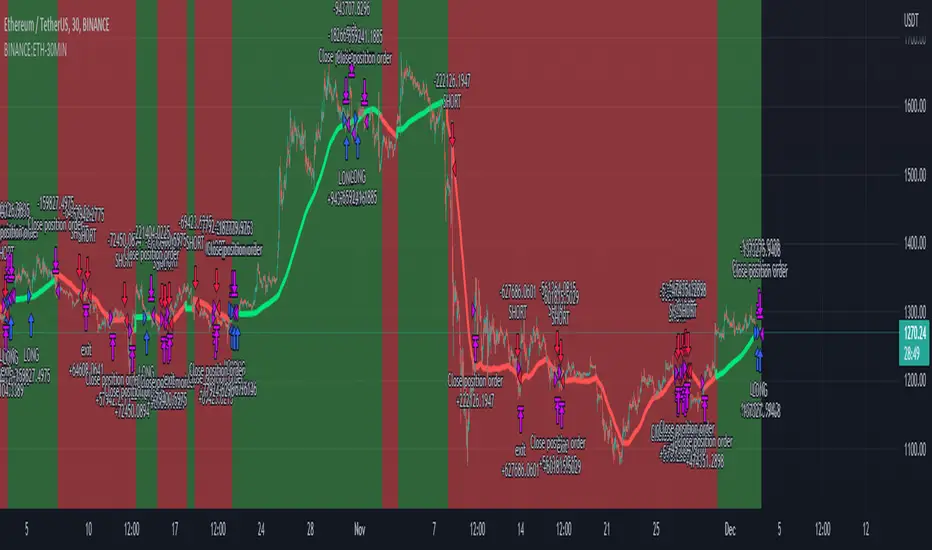

ETHUSDT 30 minutes Timeframe

ETHUSDT 30 minutes Timeframe

Indicators used:

EMA , OBV , ADX , Linear regression and Dollar Index trending, Leverage is available for Long and Short positions.

LONG

- When Price is above EMA and price-ema difference is smaller than "Long delta Price/MA"

- OBV(4hrs) is above OBV-EMA(110)

- Linear regression is strong

- ADX is strong >50

- DXY is trending down

SHORT

- When Price is below EMA and ema-price difference is smaller than "Long delta Price/MA"

- OBV(4hrs) is below OBV-EMA(110)

- Linear regression is weak

- ADX is weak <50

- DXY is trending up

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

סקריפט מוגן

סקריפט זה פורסם כמקור סגור. עם זאת, תוכל להשתמש בו בחופשיות וללא כל מגבלות – למד עוד כאן

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.