Volatility Barometer (VB)Volatility Barometer (VB)

The Volatility Barometer (VB) is a comprehensive market sentiment indicator designed to measure aggregate stress and fear in the equity market. It consolidates three critical volatility metrics into a single, easy-to-interpret score, providing a broader view of market conditions than any single metric alone.

Core Components

The barometer synthesizes information from:

VIX Index (VIX): The standard measure of implied 30-day stock market volatility.

VVIX Index (VVIX): The volatility of the VIX itself, often seen as the "volatility of volatility." High VVIX readings can signal uncertainty about the VIX's future path.

VIX Futures Term Structure (VX1!−VX2!): The spread between the front-month and second-month VIX futures. A positive spread (contango) is typical, while a negative spread (backwardation) often signals imminent market stress.

How It Works

To create a unified view, the indicator normalizes each of these three components using a Z-score. The Z-score measures how many standard deviations a value is from its historical mean over a user-defined period (defaulting to 252 days, or one trading year).

These three standardized Z-scores are then combined into a final VB Score using a weighted average. Users can customize these weights in the indicator's settings to emphasize the components they find most important.

How to Interpret

The VB Score is plotted as a single line that oscillates around a zero level, with its color changing to reflect the prevailing market regime:

High Stress (Red Line): When the score rises above the "High stress threshold" (default: 1.5), it indicates heightened market fear and risk-off sentiment. This is a period of significant stress, often associated with market downturns.

Low Stress (Green Line): When the score falls below the "Low stress threshold" (default: -1.0), it signals complacency and low perceived risk in the market. Extreme low readings can sometimes precede volatility spikes.

Neutral (Blue Line): Scores between the high and low thresholds represent normal market conditions.

By providing a weighted, multi-faceted view of volatility, the Volatility Barometer helps traders and investors identify market regimes, confirm trading biases, and anticipate potential shifts in market sentiment.

חפש סקריפטים עבור "Volatility"

Volatility Percentage IndicatorThis simple indicator plot 11 lines in the chart at prices that correspond to -5%, -4%, -3%, -2%, -1%, 0%, 1%, 2%, 3%, 4%, 5%, referred to realtime price.

So the lines will move with the price.

The indicator is intended to give an at-a-glance information on price volatility by comparing the amplitude of the last candles with the percentages above.

Volatility Ratio Adaptive RSX [Loxx]Volatility Ratio Adaptive RSX this indicator adds volatility ratio adapting and speed value to RSX in order to make it more responsive to market condition changes at the times of high volatility, and to make it smoother in the times of low volatility

What is RSX?

RSI is a very popular technical indicator, because it takes into consideration market speed, direction and trend uniformity. However, the its widely criticized drawback is its noisy (jittery) appearance. The Jurik RSX retains all the useful features of RSI, but with one important exception: the noise is gone with no added lag.

Included:

-Toggle on/off bar coloring

Volatility {RCVI} Stop-Limit SelectorA Stop-Limit Selector powered by the Relative Candle Volatility & Directionality Index (RCVI and RCDI) to help suggest the latest suitable Stop-Limit prices @ multiple levels of risk-control "tightness" depending on what is desired.

Stop-Limit Levels can be Enabled/Disabled in the settings.

Note: In no way is this intended as a financial/investment/trading advice. You are responsible for your own investment/trade decisions.

Please PM me for access information.

Volatility Decay & SqueezeThis has only been tested for crypto. The squeeze currently shown here should result in volatility upwards. This is an attempt to monitor volatility as a leading indicator and is currently under development.

Volatility SkewThis indicator measure the historical skew of actual volatility for an individual security. It measure the volatility of up moves versus down moves over the period and gives a ratio. When the indicator is greater than one, it indicators that volatility is greater to the upside, when it is below 1 it indicates that volatility is skewed to the downside.

This is not comparable to the SKEW index, since that measures the implied volatility across option strikes, rather than using historical volatility.

Volatility IndexThis is a composite volatility index to show percentile of current volatility compared to that of the last 52 bars. As this is a weekly chart (and this script is intended for usage on weekly charts) we can see the yearly percentile rank of volatility.

As shown when volatility is in the lower 25%tile (viewed on weekly) the market is calm and likes to rise; when the volatility is above the 25%tile you can see that the market tends to have larger and 'choppier' moves.

This is /not/ 'just the vix' this takes into consideration the volatility of all major US indexes including the SPX500, Dow 30, Nasdaq 100, and Russel 2000.

Please remember that this is just plotting:( volatility index - lowest(index,52) )/( highest(index,52)-lowest(index,52) ) so for 'yearly percentile' check the weekly chart (52 weeks = 1yr)

Volatility RegimeThis is a useful volatility indicator to be used on a Daily time Frame

and paired with the Market Regime indicator.

Gray means that the markets have low volatility (calm) and might be consolidating before resuming or reversing the trend.

Teal means that volatility is somewhere around the average.

And Yellow means it has spiked up and we are in a high volatility regime.

When you pair it with the Market Regime filter for Bull/Bear markets you will

find that the best bull markets start from low volatility and mature on high volatility.

More often than not, the top comes when The Market Regime is very strong (Super Bull)

and volatility is high.

Similarly, the bottom arrives when the Market Regime is very bearish (Super Bear)

and volatility is high.

Volatility % Bands (O→C)Volatility % Bands (O→C) is an indicator designed to visualize the percentage change from Open to Close of each candle, providing a clear view of short-term momentum and volatility.

**Histogram**: Displays bar-by-bar % change (Close vs Open). Green bars indicate positive changes, while red bars indicate negative ones, making momentum shifts easy to identify.

**Moving Average Line**: Plots the Simple Moving Average (SMA) of the absolute % change, helping traders track the average volatility over a chosen period.

**Background Bands**: Based on the user-defined Level Step, ±1 to ±5 zones are highlighted as shaded bands, allowing quick recognition of whether volatility is low, moderate, or extreme.

**Label**: Shows the latest candle’s % change and the current SMA value as a floating label on the right, making it convenient for real-time monitoring.

This tool can be useful for volatility breakout strategies, day trading, and short-term momentum analysis.

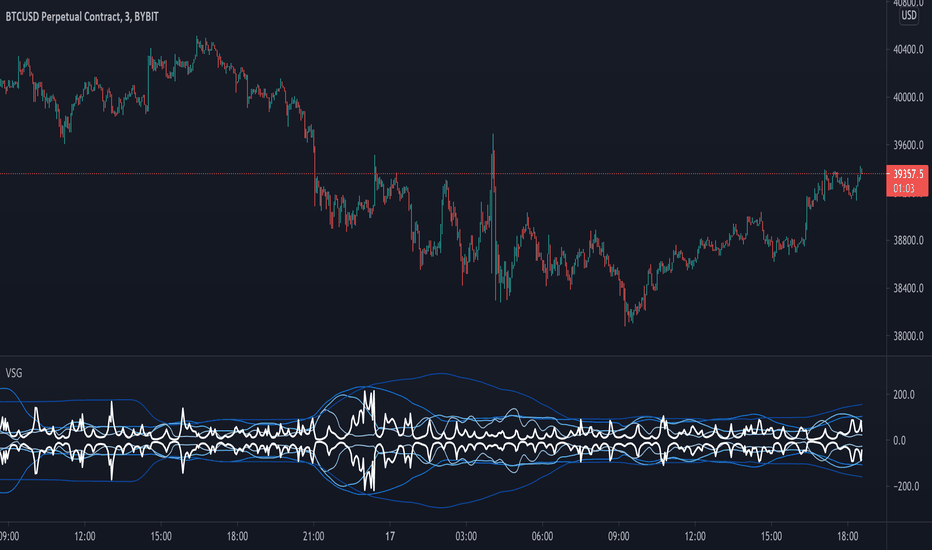

Volatility - Sacred GeometryThis indicator is designed to pick up changes in volatility before it happens. It also shows current volatility, as price action drops the blue lines contract. The script uses the blue lines to locate spikes in volatility.

Example of dump revealing itself with plenty of notice.

Here large changes in price action are shown when the white lines spike. Traders can get a heads up on any pump or dump a few candles before it happens.

This example shows a low volatility channel vs high volatility channel. The blue lines expand as price range increases.

Trends can be discovered by studying the patterns.

* This indicator does not use sacred geometry, I just called it that because it looks like it. *

If anyone is interested in developing this indicator any further please get in contact.

Volatility Index of Range Verification█ OVERVIEW

This is a volatility indicator created by extending concepts from Tushar Chande's Range Action Verification Index (RAVI).

█ CONCEPTS

This indicator constructs range of the RAVI indicator. It uses this range to build a histogram that represents how fast the range is changing, or a measure of volatility. A line is then constructed, either from a moving average or standard deviation depending on the settings that can serve as an action trigger.

█ INPUTS

• Fast MA Period: the period of the quickest moving average that is used to build the RAVI indicator line

• Slow MA Period: the period of the slowest moving average that is used to build the RAVI indicator line

• MA Type: the type of moving average to use, either Simple or Exponential

• Price Source: the type of price source to use; close, high, low, hlc3, etc.

• Lookback Period: how far back to construct the minimum and maximum of the range

• Standard Range: the standard range of the indicator. a smaller range will exaggerate differences in the columns, and vice-versa

• Volatility Period: the period used for the trigger line moving average

• Std. Deviation Mode?: Whether the trigger line will plot using a moving average or a multiple of Standard Deviation.

• Deviation Multiplier: How many deviations to use if the trigger line is in Std. Deviation Mode

Volatility Price TargetsPrints lines on the chart marking the price points for the standard deviation move using historical volatility. This script was born out of a need to easily spot target points for the wings of my Iron Condor Options trades. The study only shows on the Daily chart. Volatility is calculated based on the standard deviation of the daily returns of price. Price targets are calculated off yesterday's closing price and will not reprint.

Inputs

Days to Expiration - allow you to enter the number of days to expiration for the option, default is 30 for those monthly options traders but can be adjusted to your desire.

Standard Deviation - you can enter the number of deviations for which to calculate the price points 1,2, or 3.

Days in Year - you can adjust the number of days in the year used to calculate the daily volatility multiplier.

Volatility ForecasterThe indicator predicts periods of increased market volatility on 24 hours ahead, based on statistical data. It shows a time intervals, when it is better to give special attention to a market. Time, when the probability of market acceleration, momentum or a trend reversal becomes most likely. The idea is based on a simple logical conclusion – if the market was volatile in the same time periods in the past, then this will happen again in the future.

English - Full description and instruction

The indicator is useful for all markets. But especially for cryptocurrency, which, unlike stock market or forex, doesn’t have time-limited trading sessions and weekends. Therefore, statistical analysis is the only way to reliably determine periods of increased activity of market participants.

The indicator can't predict all volatility. But it provides a fairly accurate prediction of statistical volatility, - one that periodically occurs at the same time.

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

Индикатор прогнозирует периоды повышенной волатильности рынка на 24 часа вперёд, основываясь на статистических данных. Он показывает временные интервалы при которых стоит уделить рынку повышенное внимание, когда вероятность ускорения рынка, импульса или перелома тренда, становится наиболее вероятным. Идея строиться на простом логическом выводе, - если рынок был волатилен в одни и те же временные периоды в прошлом, то это повторится в будущем.

Русский - Полное описание и инструкция

Индикатор полезен для всех рынков. Но особенно для криптовалютного, который в отличии от фондового или форекс не имеет ограниченных по времени торговых сессий и не рабочих дней. По этому, статистический анализ единственный способ надежно определить периоды повышенной активности участников рынка.

Индикатор не может предсказать всю волатильность. Но обеспечивает достаточно точное предсказание статистической волатильности, - такой которая периодически возникает в одно и то же время.

Volatility IntensifierThe background becomes increasingly dark during periods of high volatility.

...and yes, it can get completely black!

This makes it easier to identify areas that are "hot" with price action and appealing to trade.

Follow and comment to be added to the access to this indicator granted every Monday.

Like for more indicators! Thanks to all of my followers, you are the real MVP <3

To clarify; No, this indicator is based off of volatility, NOT volume :)

Volatility Targeting: Single Asset [BackQuant]Volatility Targeting: Single Asset

An educational example that demonstrates how volatility targeting can scale exposure up or down on one symbol, then applies a simple EMA cross for long or short direction and a higher timeframe style regime filter to gate risk. It builds a synthetic equity curve and compares it to buy and hold and a benchmark.

Important disclaimer

This script is a concept and education example only . It is not a complete trading system and it is not meant for live execution. It does not model many real world constraints, and its equity curve is only a simplified simulation. If you want to trade any idea like this, you need a proper strategy() implementation, realistic execution assumptions, and robust backtesting with out of sample validation.

Single asset vs the full portfolio concept

This indicator is the single asset, long short version of the broader volatility targeted momentum portfolio concept. The original multi asset concept and full portfolio implementation is here:

That portfolio script is about allocating across multiple assets with a portfolio view. This script is intentionally simpler and focuses on one symbol so you can clearly see how volatility targeting behaves, how the scaling interacts with trend direction, and what an equity curve comparison looks like.

What this indicator is trying to demonstrate

Volatility targeting is a risk scaling framework. The core idea is simple:

If realized volatility is low relative to a target, you can scale position size up so the strategy behaves like it has a stable risk budget.

If realized volatility is high relative to a target, you scale down to avoid getting blown around by the market.

Instead of always being 1x long or 1x short, exposure becomes dynamic. This is often used in risk parity style systems, trend following overlays, and volatility controlled products.

This script combines that risk scaling with a simple trend direction model:

Fast and slow EMA cross determines whether the strategy is long or short.

A second, longer EMA cross acts as a regime filter that decides whether the system is ACTIVE or effectively in CASH.

An equity curve is built from the scaled returns so you can visualize how the framework behaves across regimes.

How the logic works step by step

1) Returns and simple momentum

The script uses log returns for the base return stream:

ret = log(price / price )

It also computes a simple momentum value:

mom = price / price - 1

In this version, momentum is mainly informational since the directional signal is the EMA cross. The lookback input is shared with volatility estimation to keep the concept compact.

2) Realized volatility estimation

Realized volatility is estimated as the standard deviation of returns over the lookback window, then annualized:

vol = stdev(ret, lookback) * sqrt(tradingdays)

The Trading Days/Year input controls annualization:

252 is typical for traditional markets.

365 is typical for crypto since it trades daily.

3) Volatility targeting multiplier

Once realized vol is estimated, the script computes a scaling factor that tries to push realized volatility toward the target:

volMult = targetVol / vol

This is then clamped into a reasonable range:

Minimum 0.1 so exposure never goes to zero just because vol spikes.

Maximum 5.0 so exposure is not allowed to lever infinitely during ultra low volatility periods.

This clamp is one of the most important “sanity rails” in any volatility targeted system. Without it, very low volatility regimes can create unrealistic leverage.

4) Scaled return stream

The per bar return used for the equity curve is the raw return multiplied by the volatility multiplier:

sr = ret * volMult

Think of this as the return you would have earned if you scaled exposure to match the volatility budget.

5) Long short direction via EMA cross

Direction is determined by a fast and slow EMA cross on price:

If fast EMA is above slow EMA, direction is long.

If fast EMA is below slow EMA, direction is short.

This produces dir as either +1 or -1. The scaled return stream is then signed by direction:

avgRet = dir * sr

So the strategy return is volatility targeted and directionally flipped depending on trend.

6) Regime filter: ACTIVE vs CASH

A second EMA pair acts as a top level regime filter:

If fast regime EMA is above slow regime EMA, the system is ACTIVE.

If fast regime EMA is below slow regime EMA, the system is considered CASH, meaning it does not compound equity.

This is designed to reduce participation in long bear phases or low quality environments, depending on how you set the regime lengths. By default it is a classic 50 and 200 EMA cross structure.

Important detail, the script applies regime_filter when compounding equity, meaning it uses the prior bar regime state to avoid ambiguous same bar updates.

7) Equity curve construction

The script builds a synthetic equity curve starting from Initial Capital after Start Date . Each bar:

If regime was ACTIVE on the previous bar, equity compounds by (1 + netRet).

If regime was CASH, equity stays flat.

Fees are modeled very simply as a per bar penalty on returns:

netRet = avgRet - (fee_rate * avgRet)

This is not realistic execution modeling, it is just a simple turnover penalty knob to show how friction can reduce compounded performance. Real backtesting should model trade based costs, spreads, funding, and slippage.

Benchmark and buy and hold comparison

The script pulls a benchmark symbol via request.security and builds a buy and hold equity curve starting from the same date and initial capital. The buy and hold curve is based on benchmark price appreciation, not the strategy’s asset price, so you can compare:

Strategy equity on the chart symbol.

Buy and hold equity for the selected benchmark instrument.

By default the benchmark is TVC:SPX, but you can set it to anything, for crypto you might set it to BTC, or a sector index, or a dominance proxy depending on your study.

What it plots

If enabled, the indicator plots:

Strategy Equity as a line, colored by recent direction of equity change, using Positive Equity Color and Negative Equity Color .

Buy and Hold Equity for the chosen benchmark as a line.

Optional labels that tag each curve on the right side of the chart.

This makes it easy to visually see when volatility targeting and regime gating change the shape of the equity curve relative to a simple passive hold.

Metrics table explained

If Show Metrics Table is enabled, a table is built and populated with common performance statistics based on the simulated daily returns of the strategy equity curve after the start date. These include:

Net Profit (%) total return relative to initial capital.

Max DD (%) maximum drawdown computed from equity peaks, stored over time.

Win Rate percent of positive return bars.

Annual Mean Returns (% p/y) mean daily return annualized.

Annual Stdev Returns (% p/y) volatility of daily returns annualized.

Variance of annualized returns.

Sortino Ratio annualized return divided by downside deviation, using negative return stdev.

Sharpe Ratio risk adjusted return using the risk free rate input.

Omega Ratio positive return sum divided by negative return sum.

Gain to Pain total return sum divided by absolute loss sum.

CAGR (% p/y) compounded annual growth rate based on time since start date.

Portfolio Alpha (% p/y) alpha versus benchmark using beta and the benchmark mean.

Portfolio Beta covariance of strategy returns with benchmark returns divided by benchmark variance.

Skewness of Returns actually the script computes a conditional value based on the lower 5 percent tail of returns, so it behaves more like a simple CVaR style tail loss estimate than classic skewness.

Important note, these are calculated from the synthetic equity stream in an indicator context. They are useful for concept exploration, but they are not a substitute for professional backtesting where trade timing, fills, funding, and leverage constraints are accurately represented.

How to interpret the system conceptually

Vol targeting effect

When volatility rises, volMult falls, so the strategy de risks and the equity curve typically becomes smoother. When volatility compresses, volMult rises, so the system takes more exposure and tries to maintain a stable risk budget.

This is why volatility targeting is often used as a “risk equalizer”, it can reduce the “biggest drawdowns happen only because vol expanded” problem, at the cost of potentially under participating in explosive upside if volatility rises during a trend.

Long short directional effect

Because direction is an EMA cross:

In strong trends, the direction stays stable and the scaled return stream compounds in that trend direction.

In choppy ranges, the EMA cross can flip and create whipsaws, which is where fees and regime filtering matter most.

Regime filter effect

The 50 and 200 style filter tries to:

Keep the system active in sustained up regimes.

Reduce exposure during long down regimes or extended weakness.

It will always be late at turning points, by design. It is a slow filter meant to reduce deep participation, not to catch bottoms.

Common applications

This script is mainly for understanding and research, but conceptually, volatility targeting overlays are used for:

Risk budgeting normalize risk so your exposure is not accidentally huge in high vol regimes.

System comparison see how a simple trend model behaves with and without vol scaling.

Parameter exploration test how target volatility, lookback length, and regime lengths change the shape of equity and drawdowns.

Framework building as a reference blueprint before implementing a proper strategy() version with trade based execution logic.

Tuning guidance

Lookback lower values react faster to vol shifts but can create unstable scaling, higher values smooth scaling but react slower to regime changes.

Target volatility higher targets increase exposure and drawdown potential, lower targets reduce exposure and usually lower drawdowns, but can under perform in strong trends.

Signal EMAs tighter EMAs increase trade frequency, wider EMAs reduce churn but react slower.

Regime EMAs slower regime filters reduce false toggles but will miss early trend transitions.

Fees if you crank this up you will see how sensitive higher turnover parameter sets are to friction.

Final note

This is a compact educational demonstration of a volatility targeted, long short single asset framework with a regime gate and a synthetic equity curve. If you want a production ready implementation, the correct next step is to convert this concept into a strategy() script, add realistic execution and cost modeling, test across multiple timeframes and market regimes, and validate out of sample before making any decision based on the results.

Volatility Percentile🎲 Volatility is an important measure to be included in trading plan and strategy. Strategies have varied outcome based on volatility of the instruments in hand.

For example,

🚩 Trend following strategies work better on low volatility instruments and reversal patterns work better in high volatility instruments. It is also important for us to understand the median volatility of an instrument before applying particular strategy strategy on them.

🚩 Different instrument will have different volatility range. For instance crypto currencies have higher volatility whereas major currency pairs have lower volatility with respect to their price. It is also important for us to understand if the current volatility of the instrument is relatively higher or lower based on the historical values.

This indicator is created to study and understand more about volatility of the instruments.

⬜ Process

▶ Volatility metric used here is ATR as percentage of price. Other things such as bollinger bandwidth etc can also be used with few changes.

▶ We use array based counters to count ATR values in different range. For example, if we are measuring ATR range based on precision 2, we will use array containing 10000 values all initially set to 0 which act as 10000 buckets to hold counters of different range. But, based on the ATR percentage range, they will be incremented. Let's say, if atr percent is 2, then 200th element of the array is increased by 1.

▶ When we do this for every bar, we have array of counters which has the division on how many bars had what range of atr percent.

▶ Using this array, we can calculate how many bars had atr percent more than current value, how many had less than current value, and how many bars in history has same atr percent as current value.

▶ With these information, we can calculate the percentile of atr percentage value. We can also plot a detailed table mentioning what percentile each range map to.

⬜ Settings

▶ ATR Parameters - this include Moving average type and Length for atr calculation.

▶ Rounding type refers to rounding ATR percentage value before we put into certain bucket. For example, if ATR percentage 2.7, round or ceil will make it 3, whereas floor will make it 2 which may fall into different buckets based on the precision selected.

▶ Precision refers to how much detailed the range should be. If precision set to 0, then we get array of 100 to collect the range where each value will represent a range of 1%. Similarly precision of 1 will lead to array of 1000 with each item representing range of 0.1. Default value used is 2 which is also the max precision possible in this script. This means, we use array of 10000 to track the range and percentile of the ATR.

▶ Display Settings - Inverse when applied track percentile with respect to lowest value of ATR instead of high. By default this is set to false. Other two options allow users to enable stats table. When detailed stats are enabled, ATR Percentile as plot is hidden.

▶ Table Settings - Allows users to select set size and coloring options.

▶ Indicator Time Window - Allow users to select particular timeframe instead of all available bars to run the study. By default windows are disabled. Users can chose start and end time individually.

Indicator display components can be described as below:

K's Volatility BandsVolatility bands come in all shapes and forms contrary to what is believed. Bollinger bands remain the principal indicator in the volatility bands family. K's Volatility bands is an attempt at optimizing the original bands. Below is the method of calculation:

* We must first start by calculating a rolling measure based on the average between the highest high and the lowest low in the last specified lookback window. This will give us a type of moving average that tracks the market price. The specificity here is that when the market does not make higher highs nor lower lows, the line will be flat. A flat line can also be thought of as a magnet of the price as the ranging property could hint to a further sideways movement.

* The K’s volatility bands assume the worst with volatility and thus will take the maximum volatility for a given lookback period. Unlike the Bollinger bands which will take the latest volatility calculation every single step of time, K’s volatility bands will suppose that we must be protected by the maximum of volatility for that period which will give us from time to time stable support and resistance levels.

Therefore, the difference between the Bollinger bands and K's volatility bands are as follows:

* Bollinger Bands' formula calculates a simple moving average on the closing prices while K's volatility bands' formula calculates the average of the highest highs and the lowest lows.

* Bollinger Bands' formula calculates a simple standard deviation on the closing prices while K's volatility bands' formula calculates the highest standard deviation for the lookback period.

Applying the bands is similar to applying any other volatility bands. We can list the typical strategies below:

* The range play strategy : This is the usual reversal strategy where we buy whenever the price hits the lower band and sell short whenever it hits the upper band.

* The band re-entry strategy : This strategy awaits the confirmation that the price has recognized the band and has shaped a reaction around it and has reintegrated the whole envelope. It may be slightly lagging in nature but it may filter out bad trades.

* Following the trend strategy : This is a controversial strategy that is the opposite of the first one. It assumes that whenever the upper band is surpassed, a buy signal is generated and whenever the lower band is broken, a sell signal is generated.

* Combination with other indicators : The bands can be combined with other technical indicators such as the RSI in order to have more confirmation. This is however no guarantee that the signals will improve in quality.

* Specific strategy on K’s volatility bands : This one is similar to the first range play strategy but it adds the extra filter where the trade has a higher conviction if the median line is flat. The reason for this is that a flat line means that no higher highs nor lower lows have been made and therefore, we may be in a sideways market which is a fertile ground for mean-reversion strategies.

Volatility Trend IndicatorThe Volatility Trade Indicator signals bullish / bearish trend based on the volatility of the underlying asset.

During bull markets, volatility is typically low and price moves occur slowly and steadily. During bear markets, volatility is typically high and price movement is much more volatile in both directions.

The Volatility Trade Indicator measures the volatility of the underlying asset in relationship to the historic volatility over a specific timespan.

Low volatility regimes are signaled in green with an indicator value of below 0, high volatility regimes are signaled in red with an indicator value above 0.

During low volatility regime you want to look for long entries, during high volatility regimes you want to look for short entries.

Volatility FilterOver the past few weeks (as of today, which is: 12th of October 2018) there has been little to no volatility in most of the major cryptocurrencies. What volatility does come in comes and goes very quickly. It's difficult to discern good and bad moments to be in a trade. As a result I decided to create a volatility filter based on Hurst exponent market phases, Bollinger Band width, moving averages, volume and the average true range. The results are the above.

You can use this indicator against any asset or within any market. It actually reaps excellent results against the DJI and XAUUSD One of my suggested uses for it is if you're scalping, only enter a position when there is volatility (when there's no background color present). If you're swinging, only enter a position when there's low volatility (when the red background color is present).

Another way to use it (although this isn't intended, just incidental) is to take a position in the direction of the first bar after the red background has gone/after low volatility has passed. So if we get a declining candle when we exit a low volatility zone, short. Otherwise long. This is the experimental side of it though.

However, this indicator won't tell you what direction to trade in, so in order to get use from it I suggest having a trend filter and a trigger. Luckily these two things are in most traders' arsenal. If not, take a look at my other script which is a timelessly brilliant trigger for buying and selling:

Something else to consider is that the volatility is relative. If we go through a period of incredibly high volatility then afterwards we can sometimes expect the volatility filter to plot a red background even though there is still acceptable volatility left in the market. The volatility at that point is much less than the volatility beforehand.

With all that said, this easy-to-read tool will help you avoid flat periods when scalping and, conversely, help you determine good times to enter a swing trade. For those who had difficulty trading the markets as of late due to volatility, this indicator is perfect for you

Access to the filter is provided for 10$, payable in most low-transaction-fee cryptocurrencies. Access is limited to 250 customers. For more information message me through TradingView or message @overttherainbow through Telegram.

Have a nice day and good luck trading.

Volatility Forecast [30m-4h] — CryptoVolatility Forecast — CryptoIndicator by GhostMMXM — TradingView

CLOSED-SOURCE SCRIPT

Updated: November 15, 2025

The Volatility Forecast indicator is your early warning system for crypto explosions. Designed specifically for high-vol markets like BTC, ETH, and SOL, it scans for volatility squeezes (compression patterns) and assigns an Ignition Score (0–100) to predict range expansions 30 minutes to 4 hours ahead.

Think of it as spotting a coiled spring: Low volatility + rising volume + active sessions = imminent breakout. No more getting caught flat-footed in chop — this flags the setups where the market's about to unsqueeze with force. Perfect for scalpers on 15m/30m charts who want to position before the move.

Overview Chart: Volatility Squeeze CROSS/USDT

Grey background glow signals a building squeeze (Ignition Score: 82). Notice the NR7 diamond marking narrow range consolidation before the 60% upside breakout.

Release Notes

Initial release: Full Pine Script v5 implementation with multi-timeframe ATR, Bollinger contraction, NR7, volume surges, session filters, and momentum candles.

Release Notes

Added breakout direction labels (UP/DN) for optional bias.

Release Notes

Optimized for crypto: Integrated UTC sessions (Asia/US) to filter low-liquidity hours. Thresholds fine-tuned for 30m–4h horizons.

Release Notes

Error fixes applied: Renamed reserved keywords (e.g., range → candle_range), proper line breaks, and non-repainting alerts.

Key Features

Ignition Score (0–100): Composite metric blending 6 factors — scores high when a volatility pop is likely.

Squeeze Detection: Bollinger Band Width contraction + NR7 (narrowest range in 7 bars) for VCP-style setups.

Volume & Momentum Proxy: Surges in volume + strong-bodied candles signal hidden accumulation.

Session Filter: Only triggers during high-activity windows (00:00–08:00 & 13:00–21:00 UTC).

Breakout Bias: Optional UP/DN labels on Bollinger probes post-squeeze.

Custom Alerts: Fire on score ≥75, with ticker and score in messages.

Key Features: Settings Panel & Score Breakdown

Score Calculation: Sum the points, cap at 100. Alert on ≥75 crossover.

Session Times

"0000-0800,1300-2100"

UTC windows — add London (0800-1200) for alts.

No repainting: All calcs use closed bars.

Usage Tips & Examples

Apply on 15m or 30m charts for cryptos

Combine with EMA 50/200 for trend filter.

Spot the Setup: Orange glow + purple NR7 diamond = prep for entry. Wait for VOL triangle.

Risk Management: Ignore in low-liquidity hours; backtest on 1-month data for edge (aim >60% win rate on breakouts).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This script is for educational purposes — always DYOR and manage risk. Crypto trading involves high risk of loss.

Volatility Dashboard (ATR-Based)Here's a brief description of what this indicator does:

- This measures volatility of currents based on ATR (Average True Range) and plots them against the smoothed ATR baseline (SMA of ATR for the same periods).

- It categorizes the market as one of the three regimes depending on the above-mentioned ratio:

- High Volatility (ratio > 1.2)

- Normal Volatility (between 0.8 and 1.2),

|- Low Volatility (ratio < 0.8, green)

- For each type of trading regime, Value Area (VA) coverage to use: for example: 60-65% in high vol trade regimes, 70% in normal trade regimes, 80-85% in low trade regimes

* What you’ll see on the chart:

- Compact dashboard in the top-right corner featuring:

- ATR (present, default length 20)

- ATR Avg (ATR baseline)

- The volatility regime identified based on the color-coded background and the coverage recommended for the VA.

Important inputs that can be adjusted:

- ATR Length (default 20) - “High/Low volatility thresholds” (default values: 1.2 – The VA coverage recommendations for each scheme (text) Purpose: - Quickly determine whether volatility is above/below average and adjust the coverage of the Value Area.

If you're using this for the GC1! Use 14 ATR Length, For ES or NQ Use Default Setting(20)

Volatility Based Momentum with MTF Screener by QTX Algo SystemsVolatility Based Momentum with MTF Screener by QTX Algo Systems

Overview

This indicator builds on our original Volatility Based Momentum tool by integrating a Multi Time Frame (MTF) Screener that provides real-time, cross-market momentum analysis. It dynamically adjusts momentum signals using adaptive volatility measurements, ensuring that signals reflect true market strength across various timeframes and assets.

How It Works

Core Momentum Analysis:

The indicator uses a double‐smoothed SMI combined with a Price – Moving Average Ratio (PMARP) to assess short-term momentum. These metrics filter out noise and generate per-candle signals based on sustained market energy.

Adaptive Volatility Measurement:

An adaptive volatility factor—derived from a Bollinger Band Width Percentile (BBWP) calculation—scales the momentum readings, ensuring that only strong signals in a sufficiently volatile market are considered.

MTF Screener Integration:

The MTF Screener scans multiple timeframes simultaneously, confirming that a momentum signal is consistent across different market views. This extra layer of screening reduces false signals and helps ensure that the detected momentum is robust and reliable.

Real-Time Visual Feedback:

Dynamic visual cues, such as color changes and signal markers, indicate when the momentum and volatility align, providing a clear, actionable overview.

Why It’s Different and Valuable

This indicator isn’t just a simple overlay of standard momentum and volatility measures—it’s a multi-layered system that verifies signals across multiple timeframes. The integrated MTF Screener provides broader context and cross-validation, making it a more dependable tool for confirming trend strength. This level of depth in analysis offers enhanced clarity and helps traders make more confident decisions compared to using conventional indicators in isolation.

How to Use

Review Per-Candle Signals: Observe the momentum signals generated on your chart and note when they are confirmed by the adaptive volatility measure.

Cross-Check with MTF Screener: Ensure that signals appear consistently across multiple timeframes before taking action.

Adjust Settings for Your Style: Customize the volatility threshold, and MTF settings to match your specific trading approach.

Integrate with Your Strategy: Use the insights from this indicator alongside other analysis tools to optimize your entry and exit points.

Disclaimer

This indicator is for educational purposes only and is intended to support your trading strategy. It does not guarantee performance, and past results are not indicative of future outcomes. Always apply proper risk management and conduct your own analysis before trading.

Volatility-Volume Index (VVI)Volatility-Volume Index (VVI) – Indicator Description

The Volatility-Volume Index (VVI) is a custom trading indicator designed to identify market consolidation and anticipate breakouts by combining volatility (ATR) and trading volume into a single metric.

How It Works

Measures Volatility : Uses a 14-period Average True Range (ATR) to gauge price movement intensity.

Tracks Volume : Monitors trading activity to identify accumulation or distribution phases.

Normalization : ATR and volume are normalized using their respective 20-period Simple Moving Averages (SMA) for a balanced comparison.

Interpretation

VVI < 1: Low volatility and volume → Consolidation phase (range-bound market).

VVI > 1: Increased volatility and/or volume → Potential breakout or trend continuation.

How to Use VVI

Detect Consolidation:

Look for extended periods where VVI remains below 1.

Confirm with sideways price movement in a narrow range.

Anticipate Breakouts:

A spike above 1 signals a possible trend shift or breakout.

Why Use VVI?

Unlike traditional volatility indicators (ATR, Bollinger Bands) or volume-based tools (VWAP), VVI combines both elements to provide a clearer picture of consolidation zones and breakout potential.