🍎 AAPL Swing/Day Trade: The Great Apple Heist Plan 🚨

Asset: AAPL (Apple Inc. Stock)

Market: US Stock

MarketVibe: Bullish, sneaky, and ready to loot some profits! 💰

📜 The Master Plan: Bullish EMA Pullback Heist

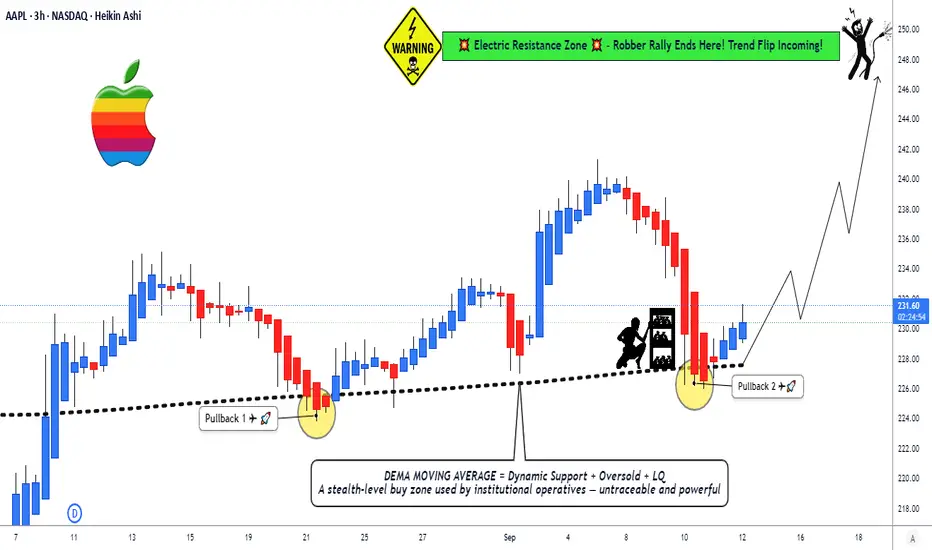

🎯 Strategy: We're pulling off a slick Double Exponential Moving Average (DEMA) pullback plan, targeting a breakout at dynamic support levels. Think of it as a high-stakes caper where we sneak in, grab the profits, and escape before the market knows what hit it! 😎

🔑 Key Setup Details:

Chart Setup: AAPL is showing a bullish setup with a DEMA pullback, signaling a potential swing or day trade opportunity.

Dynamic Line: We’re eyeing the DEMA as our guiding star 🌟 for entries and exits.

🚪 Entry: The Sneaky Thief Layering Strategy

🔍 How to Enter: Deploy the Thief Layering Strategy with multiple buy limit orders to maximize your entry precision:

🤑 Buy Limit Layers: Place orders at $227, $228, $229, $230 (or add more layers based on your risk appetite — you’re the mastermind here!).

💡 Pro Tip: Feel free to adjust entry levels to suit your style. The market’s your playground, so pick your spot!

🛑 Stop Loss: Protect Your Loot!

⚠️ Thief SL: Set your stop loss at $224 post-breakout to guard your stash.

Note: Dear Ladies & Gentlemen (Thief OGs 🕵️♂️), this SL is a suggestion. Adjust it based on your strategy and risk tolerance. You’re in charge of your heist, so protect your loot your way!

🎯 Target: Hit the Jackpot & Escape!

💥 Profit Target: Aim for $248, where a high-voltage resistance wall ⚡️ awaits, potentially paired with overbought conditions and a sneaky trap. Grab your profits and vanish before the market catches on!

Note: Dear Thief OGs, this target is a suggestion. Set your TP based on your goals and risk management. Take the money and run at your own discretion! 😏

👀 Related Pairs to Watch (Correlations & Opportunities)

To boost your heist, keep an eye on these correlated assets:

MSFT (Microsoft): Tech giant with similar market moves to AAPL. If AAPL’s bullish, MSFT might follow suit. Watch for parallel DEMA pullbacks.

MSFT (Microsoft): Tech giant with similar market moves to AAPL. If AAPL’s bullish, MSFT might follow suit. Watch for parallel DEMA pullbacks.

QQQ (Invesco QQQ ETF): Tracks the Nasdaq-100, where AAPL is a heavy hitter. QQQ’s trend can confirm AAPL’s bullish momentum.

QQQ (Invesco QQQ ETF): Tracks the Nasdaq-100, where AAPL is a heavy hitter. QQQ’s trend can confirm AAPL’s bullish momentum.

SPY (SPDR S&P 500 ETF): Broad market index. If SPY’s trending up, it supports AAPL’s bullish case.

SPY (SPDR S&P 500 ETF): Broad market index. If SPY’s trending up, it supports AAPL’s bullish case.

Key Correlation Insight: AAPL often moves in tandem with tech-heavy indices like QQQ. A bullish QQQ or MSFT can reinforce confidence in this trade setup.

⚡ Why This Setup Rock

Bullish Momentum: DEMA pullback signals a strong continuation pattern.

Layered Entries: Multiple limit orders reduce risk and increase flexibility.

Clear Risk Management: Defined SL and TP keep your heist disciplined.

Market Context: Tech sector strength (check QQQ/MSFT) supports AAPL’s upward move.

⚠️ Risk Disclaimer

Dear Thief OGs, this is not financial advice. The market’s a wild place, and you’re the master of your trades. Set your SL and TP based on your own risk tolerance and strategy. Steal profits wisely! 😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Hashtags: #AAPL #SwingTrading #DayTrading #StockMarket #ThiefStrategy #TechnicalAnalysis #Bullish #TradingView

Asset: AAPL (Apple Inc. Stock)

Market: US Stock

MarketVibe: Bullish, sneaky, and ready to loot some profits! 💰

📜 The Master Plan: Bullish EMA Pullback Heist

🎯 Strategy: We're pulling off a slick Double Exponential Moving Average (DEMA) pullback plan, targeting a breakout at dynamic support levels. Think of it as a high-stakes caper where we sneak in, grab the profits, and escape before the market knows what hit it! 😎

🔑 Key Setup Details:

Chart Setup: AAPL is showing a bullish setup with a DEMA pullback, signaling a potential swing or day trade opportunity.

Dynamic Line: We’re eyeing the DEMA as our guiding star 🌟 for entries and exits.

🚪 Entry: The Sneaky Thief Layering Strategy

🔍 How to Enter: Deploy the Thief Layering Strategy with multiple buy limit orders to maximize your entry precision:

🤑 Buy Limit Layers: Place orders at $227, $228, $229, $230 (or add more layers based on your risk appetite — you’re the mastermind here!).

💡 Pro Tip: Feel free to adjust entry levels to suit your style. The market’s your playground, so pick your spot!

🛑 Stop Loss: Protect Your Loot!

⚠️ Thief SL: Set your stop loss at $224 post-breakout to guard your stash.

Note: Dear Ladies & Gentlemen (Thief OGs 🕵️♂️), this SL is a suggestion. Adjust it based on your strategy and risk tolerance. You’re in charge of your heist, so protect your loot your way!

🎯 Target: Hit the Jackpot & Escape!

💥 Profit Target: Aim for $248, where a high-voltage resistance wall ⚡️ awaits, potentially paired with overbought conditions and a sneaky trap. Grab your profits and vanish before the market catches on!

Note: Dear Thief OGs, this target is a suggestion. Set your TP based on your goals and risk management. Take the money and run at your own discretion! 😏

👀 Related Pairs to Watch (Correlations & Opportunities)

To boost your heist, keep an eye on these correlated assets:

Key Correlation Insight: AAPL often moves in tandem with tech-heavy indices like QQQ. A bullish QQQ or MSFT can reinforce confidence in this trade setup.

⚡ Why This Setup Rock

Bullish Momentum: DEMA pullback signals a strong continuation pattern.

Layered Entries: Multiple limit orders reduce risk and increase flexibility.

Clear Risk Management: Defined SL and TP keep your heist disciplined.

Market Context: Tech sector strength (check QQQ/MSFT) supports AAPL’s upward move.

⚠️ Risk Disclaimer

Dear Thief OGs, this is not financial advice. The market’s a wild place, and you’re the master of your trades. Set your SL and TP based on your own risk tolerance and strategy. Steal profits wisely! 😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Hashtags: #AAPL #SwingTrading #DayTrading #StockMarket #ThiefStrategy #TechnicalAnalysis #Bullish #TradingView

עסקה פעילה

עסקה סגורה: היעד הושג

AAPL Real-Time Stock Feed (Sept 24, 2025)Current Price: $251.84 USD

Change Today: Down $2.59 (-1.02%) from previous close of $254.43

Open: $255.22

Day's Range: $251.04 - $255.73

Volume: 18.9M shares (below avg of 57.1M)

52-Week Range: $169.21 - $260.10

Market Cap: $3.737T

(Data from NYSE, latest at ~2:30 PM UTC+1; market open 2:30 PM - 9:00 PM UTC+1.)

Fundamental Analysis (Company Health & Value)

Apple is financially strong with high revenue and profits, but trading at a premium price.

Revenue (last 12 months): $408.62B

Net Income (last 12 months): $99.28B

Cash on Hand: $55.37B

Debt Level: 154% of equity (moderate risk)

Earnings Per Share: $6.59

Price-to-Earnings Ratio: 38.22 (high, means stock costs a lot per profit dollar)

Next Earnings Date: Oct 30, 2025

Dividend: $1.04 per share (0.41% yield)

Analyst Target Price (1 year): $242.32 (below current, suggests possible downside)

Health: Solid cash and profits show stability. Value: Overpriced vs targets, but ecosystem strength supports it.

Catalyst & News-Driven Analysis (Price Movers)

Strong iPhone 17 demand: Wait times high, turning stock positive YTD after launch. UBS notes entry-level mixing may limit price gains this quarter.

Carbon neutral push: 14,000-acre California forest buy advances green goals.

Analyst views: Wedbush raised target to $310 (bullish on China rebound); Rosenblatt to $241 (neutral). Some funds cut stakes.

Broader: Underperformed "Magnificent Seven" peers in 2025. No major events today; watch Powell's rate comments for tech impact.

These could lift price on demand news, but limit upside short-term.

Market Sentiment & Macro Environment

Overall Market: Wall Street flat/choppy; S&P/Nasdaq subdued after Fed's Powell tempered rate-cut hopes (no aggressive cuts soon). Tech rebounding but AAPL lags peers.

Beta (volatility vs market): 1.11 (slightly more volatile than average).

Macro: Stable but cautious on rates; tech sentiment improving on AI/iPhone buzz.

Retail & Institutional Traders Sentiment

Retail: Mostly positive. Social chatters posts show excitement on iPhone 17 demand, bullish targets ($260+), and "unstoppable" momentum. Some caution on pullbacks/overextension. High anecdotes of global demand.

Institutional: Owns 67.73% of shares (high confidence). 4,083 buyers last year; inflows steady. Some raises (e.g., Aaron Wealth up 6K shares), but mixed (one fund cut stake). Underexposed vs peers, per analysts.

Investor Mood: Fear & Greed Measure

CNN Fear & Greed Index: In "Greed" zone (investors optimistic, buying dips).

Overall mood: Greed with caution; sentiment improved on stock records.

Overall Score

Bullish (long trend): Strong fundamentals, iPhone demand, and greed mood outweigh today's dip and high valuation. Watch earnings for confirmation.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.