This method am about to explain to you has been tested & battle proofed, it is the same trading method touch at Trading schools academies & is how the pro traders trade/use. It if followed it would yield 65 to 75 probability in your favor on charts with day or smaller timeframes and a 75 to 90 probability on swing trades especially in week timeframe. Am sharing it from the goodness of my heart & selfishly motivated to reach more probability score if more people trade like this.. this will be more of a self fulfilling prophecy..

identify the Longterm trend.

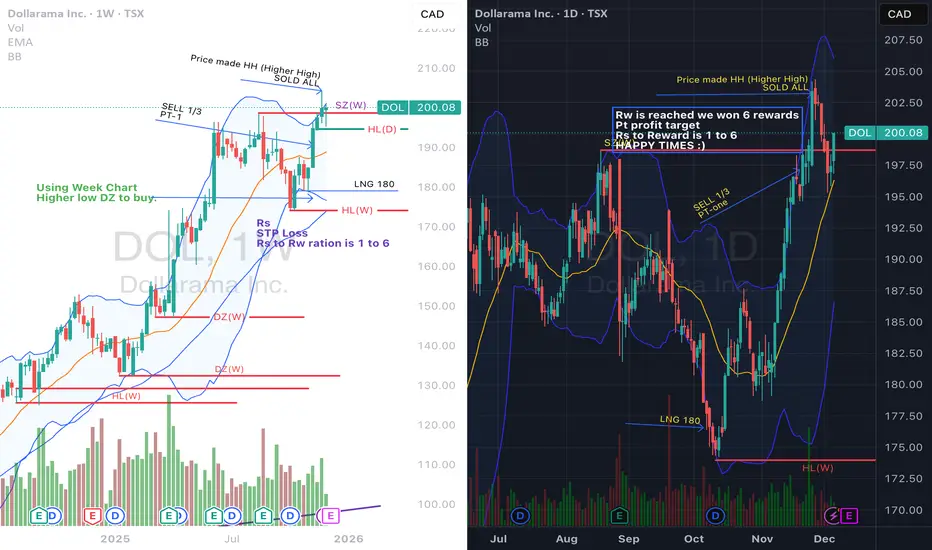

After identifying the longterm trend & identifying the last HL (higher Low) of the uptrend. but a line on that, this is your DZ (demand zone) this is the area you want to buy, you wait like a sniper & once price is there yo buy

Identify your Risk

calculated your risk before you calculated your reward. in other words identify how much you are willing to risk in money $ before you get out, or your stop limit order is triggered. you are out you had a Small Loss, you can handle it. This is your STP Loss price

When to sell & claim profit Rw (Reward, profit)

Identify your Pt (profit Target)s,this part I will save later, and reveal only when we have 1000 Likes - followers

Risk to Reward Ratio

This is important, it deserves its own section. Rs is your (Risk) and Rw is your (Reward). The correct reward ratio is 1 to 6 meaning you are willing to Risk 1 dollar for each 6 dollars you profit. Any trades with lower ratio is more risky & can be taken at trader own discretion. for example a low score of 1 to 3 yields less profit & more aggressive risk habitat.

here is an example

identify the Longterm trend.

After identifying the longterm trend & identifying the last HL (higher Low) of the uptrend. but a line on that, this is your DZ (demand zone) this is the area you want to buy, you wait like a sniper & once price is there yo buy

Identify your Risk

calculated your risk before you calculated your reward. in other words identify how much you are willing to risk in money $ before you get out, or your stop limit order is triggered. you are out you had a Small Loss, you can handle it. This is your STP Loss price

When to sell & claim profit Rw (Reward, profit)

Identify your Pt (profit Target)s,this part I will save later, and reveal only when we have 1000 Likes - followers

Risk to Reward Ratio

This is important, it deserves its own section. Rs is your (Risk) and Rw is your (Reward). The correct reward ratio is 1 to 6 meaning you are willing to Risk 1 dollar for each 6 dollars you profit. Any trades with lower ratio is more risky & can be taken at trader own discretion. for example a low score of 1 to 3 yields less profit & more aggressive risk habitat.

here is an example

עסקה פעילה

This method am about to explain to you has been tested & battle proofed, it is the same trading method taught at Trading school academies & is how the pro traders trade. if followed it would yield 65 to 75 probability in your favor on charts with day or smaller timeframes and a 75 to 90 probability on swing trades especially in week timeframe. Am sharing it from the goodness of my heart & selfishly motivated to reach more probability score if more people trade like this.. this will be more of a self fulfilling prophecy..identify the Longterm trend.

After identifying the longterm trend & identifying the last HL (higher Low) of the uptrend. put a line on that! this is your DZ (demand zone) this is the area you want to buy, your buy order waits, dont chase. time your Entry using a smaller timeframe chart.

Identify your Risk

You should be calculating your risk before calculating your reward. in other words identify how much you are willing to risk (money $) before you get out. This is your STP Loss price-where your stop loss order is triggered. If your STP Loss is triggered, you are out! you had a Small Loss, you can handle it.

When to sell & claim profit Rw (Reward, profit)

Identify your Pt (Profit Target)s, this part I will save for later, and reveal only when we have 1000 Likes - followers

Risk to Reward Ratio

This is important, it deserves its own section. Rs is your (Risk) and Rw is your (Reward). The correct reward ratio is 1 to 6 meaning you are willing to Risk 1 dollar for each 6 dollars of reward-profit. Any trades with lower ratio is more risky & can be taken at the trader's own discretion. for example a low score of 1 to 3 yields less profit & more aggressive risk appetite.

here is an example

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.