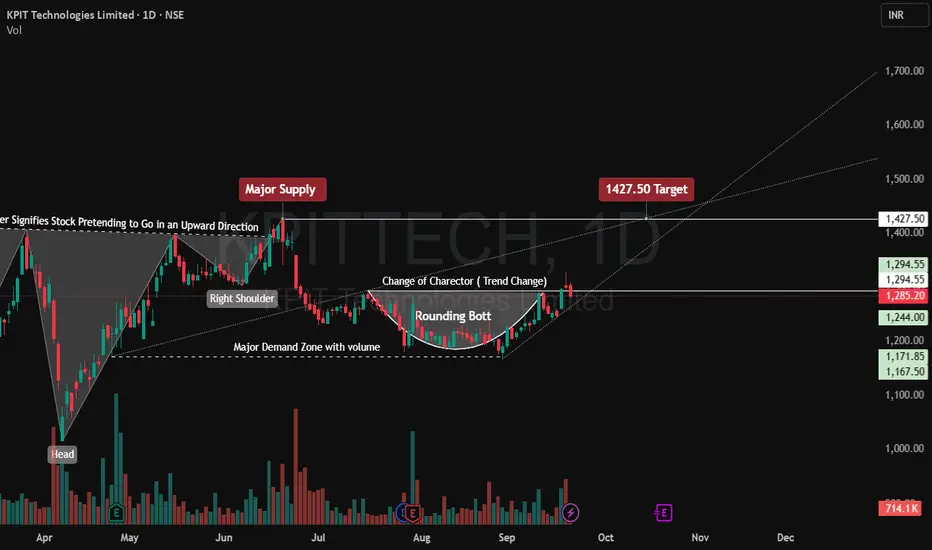

Logical Buy Projection

Trend Context

Trend Context

- Strong trend change confirmation after Rounding Bottom.(Near Term)

- Inverse H&S pattern indicates a bullish reversal structure.(Failed to breakout)

- Volume supports accumulation in the demand zone.

Entry Zone - Around ₹1,280–₹1,300 (CMP, near breakout of rounding bottom neckline).

- Safer entry on retest of ₹1,244–₹1,260 (demand-supported zone).

Targets

Target 1: ₹1,350 (near-term supply retest)

Target 2: ₹1,427.50 (chart projection / neckline breakout target)

Extended Target: ₹1,500+ if momentum sustains (continuation after H&S breakout).

Stop-Loss (SL) - Conservative SL: Below ₹1,167 (demand invalidation).

- Tight SL (for traders): Below ₹1,244 (last support zone).

Summary Projection - Buy Zone: ₹1,280–₹1,300

- Stop-Loss: ₹1,167 (safe) / ₹1,244 (tight)

- Targets: ₹1,350 → ₹1,427.50 → ₹1,500+

Disclaimer:tinyurl.com/59ypbsrh

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.