📈  MU – Preparing for Institutional Flow Reversal?

MU – Preparing for Institutional Flow Reversal?

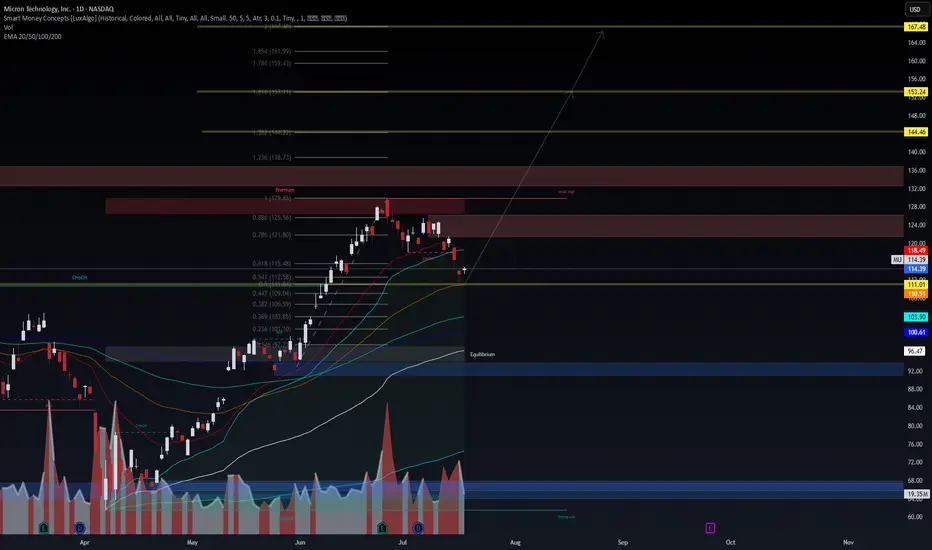

Micron ( MU) is at a crucial confluence zone, holding just above the 0.618 retracement ($115.48) after a CHoCH breakdown. With EMAs (20/50/100/200) aligning under price, the technical setup hints at an early-stage liquidity grab before potential expansion.

MU) is at a crucial confluence zone, holding just above the 0.618 retracement ($115.48) after a CHoCH breakdown. With EMAs (20/50/100/200) aligning under price, the technical setup hints at an early-stage liquidity grab before potential expansion.

🔹 Technical Outlook

Current price: $114.39

CHoCH confirmed near premium zone ($129–$138)

Rejection from 0.886 Fibonacci zone ($125.56)

Holding above major EMAs (Support: $110.91 / $111.01)

Volume spike suggests accumulation at equilibrium ($100–$103)

🔹 VolanX DSS Probability Scenarios

LSTM-GRU model predicts price recovery toward $135–$140 by late August

Short-term risk zones: $108.67 stop loss (weekly), upside target $124.69

1W Neural Forecast: +5.9% upside bias, confidence skewed toward recovery

VaR (99%): -8.68% max drawdown exposure

🔹 Macro & Risk Consideration

Semiconductor cyclicals are catching tailwinds from AI infrastructure demand

Risk: High beta and earnings volatility; monitor inflation & Fed communication

Volatility: 52.4% annualized – risk remains elevated

🔹 Strategic Play (Not Financial Advice)

Entry Zone: $111–$114 (support + VWAP alignment)

SL: $108.67 (below weekly structure)

TP Zones: $124.69, $138.73, $153.24 (Fib levels)

💡 “We don’t trade the price, we trade the narrative. Follow the Smart Money—ride the VolanX Protocol.”

#Micron MU #TradingView #SMC #LSTM #AITrading #SmartMoney #TechStocks #Fibonacci #OptionsFlow #VolanX #WaverVanir #MarketIntel #InstitutionalTrading #ProbabilityBasedTrading

MU #TradingView #SMC #LSTM #AITrading #SmartMoney #TechStocks #Fibonacci #OptionsFlow #VolanX #WaverVanir #MarketIntel #InstitutionalTrading #ProbabilityBasedTrading

Micron (

🔹 Technical Outlook

Current price: $114.39

CHoCH confirmed near premium zone ($129–$138)

Rejection from 0.886 Fibonacci zone ($125.56)

Holding above major EMAs (Support: $110.91 / $111.01)

Volume spike suggests accumulation at equilibrium ($100–$103)

🔹 VolanX DSS Probability Scenarios

LSTM-GRU model predicts price recovery toward $135–$140 by late August

Short-term risk zones: $108.67 stop loss (weekly), upside target $124.69

1W Neural Forecast: +5.9% upside bias, confidence skewed toward recovery

VaR (99%): -8.68% max drawdown exposure

🔹 Macro & Risk Consideration

Semiconductor cyclicals are catching tailwinds from AI infrastructure demand

Risk: High beta and earnings volatility; monitor inflation & Fed communication

Volatility: 52.4% annualized – risk remains elevated

🔹 Strategic Play (Not Financial Advice)

Entry Zone: $111–$114 (support + VWAP alignment)

SL: $108.67 (below weekly structure)

TP Zones: $124.69, $138.73, $153.24 (Fib levels)

💡 “We don’t trade the price, we trade the narrative. Follow the Smart Money—ride the VolanX Protocol.”

#Micron

הערה

Risk is that institute can go for the liquidity grab, if so it will be recorded here. כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.

כתב ויתור

המידע והפרסומים אינם אמורים להיות, ואינם מהווים, עצות פיננסיות, השקעות, מסחר או סוגים אחרים של עצות או המלצות שסופקו או מאושרים על ידי TradingView. קרא עוד בתנאים וההגבלות.