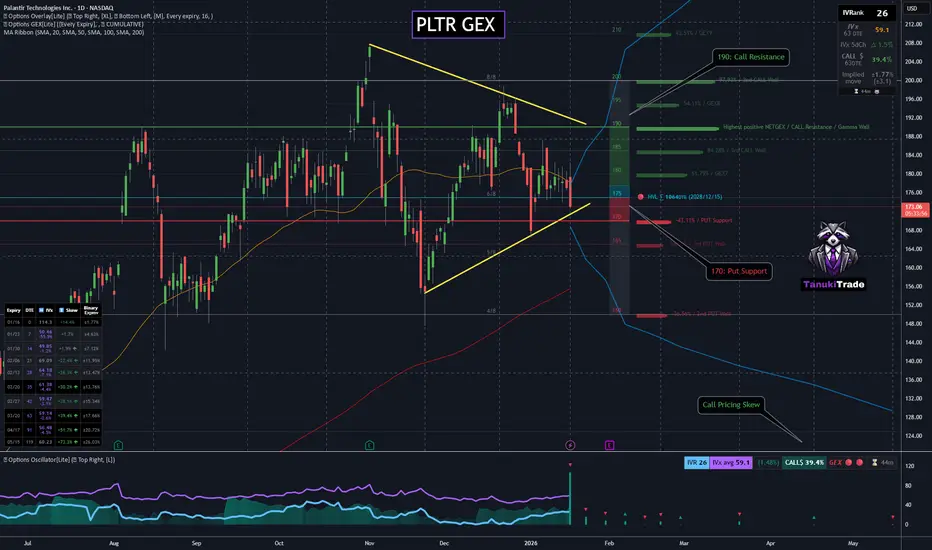

PLTR has entered a tight volatility compression phase, both on price and in the GEX profile, which is now clearly squeezed between well-defined option levels. 🔵

🔶 Current Structure 🔶

This type of GEX compression + price compression rarely persists for long, especially in a high-beta tech name like PLTR. Historically, these regimes resolve via sharp directional expansion, not slow grind.

From a regime perspective, PLTR is currently trading below the HVL, which keeps downside sensitivity elevated. A clean break below 170 would likely trigger 🔴 negative gamma dynamics, opening the door for accelerated downside.

🔶 Options Sentiment 🔶

🔶 Key Structure to Watch 🔶

With price, GEX, and volatility all compressing simultaneously, PLTR is setting up for a near-term breakout, with earnings acting as a potential catalyst. Direction will be determined by which side of the GEX range resolves first.

🔶 Current Structure 🔶

- Call resistance sits at 190

- Put support is defined at 170

- Price has been trading in a narrow range for over a week, confirming balance rather than trend 🔵

This type of GEX compression + price compression rarely persists for long, especially in a high-beta tech name like PLTR. Historically, these regimes resolve via sharp directional expansion, not slow grind.

From a regime perspective, PLTR is currently trading below the HVL, which keeps downside sensitivity elevated. A clean break below 170 would likely trigger 🔴 negative gamma dynamics, opening the door for accelerated downside.

🔶 Options Sentiment 🔶

- Call pricing skew is elevated near 40%, signaling stronger call demand despite range-bound price 🟢

- Implied volatility has been rising steadily over the past 5 sessions, confirming positioning ahead of a catalyst

- Earnings are scheduled for 02/02, adding fuel to an already compressed structure

🔶 Key Structure to Watch 🔶

- 170 – put support / downside trigger 🔴

- 190 – call resistance / upside breakout level 🟢

- HVL – regime pivot 🔵

- Compressed GEX profile – volatility expansion risk 🔵

With price, GEX, and volatility all compressing simultaneously, PLTR is setting up for a near-term breakout, with earnings acting as a potential catalyst. Direction will be determined by which side of the GEX range resolves first.

Boost up your charts with Options PRO!

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.

Boost up your charts with Options PRO!

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

REAL Options metrics for over 200+ liquid US symbols:

✔ 𝗔𝘂𝘁𝗼-𝗨𝗽𝗱𝗮𝘁𝗶𝗻𝗴 𝗚𝗘𝗫 𝗹𝗲𝘃𝗲𝗹𝘀

✔ GEX ✔ IVRank ✔ CALL/PUT skew ✔ Volatility✔ Delta curves

👉 7-day TRIAL 🌐 TanukiTrade.com

פרסומים קשורים

כתב ויתור

המידע והפרסומים אינם מיועדים להיות, ואינם מהווים, ייעוץ או המלצה פיננסית, השקעתית, מסחרית או מכל סוג אחר המסופקת או מאושרת על ידי TradingView. קרא עוד ב־תנאי השימוש.